- 5 Mar 2025

- Elara Crowthorne

- 15

Kenshi (KNS) Investment Risk Calculator

Current Market Data

Price: $0.00169

Market Cap: $1.3 million

24h Volume: $735

Liquidity Depth: Extremely Low

Risk Assessment

Overall Risk Level: High

Reasoning: Low liquidity, small market cap, and minimal trading volume indicate high volatility and potential for significant losses.

Investment Risk Factors

- Market Capitalization Small ($1.3M)

- Daily Trading Volume Very Low ($735)

- Liquidity Pool Depth Near Zero

- Exchange Listings Single DEX

- Public Product Availability Limited

Investment Recommendation

Based on current data, Kenshi (KNS) presents a high-risk investment opportunity due to its micro-cap status, extremely low liquidity, and limited market presence. It may be suitable for speculative traders with a high risk tolerance, but not recommended for conservative investors.

When you hear about Kenshi (KNS) is a cryptocurrency token built on the Ethereum blockchain, you might wonder why it’s barely on anyone’s radar. As of October2025 the token trades around $0.00169USD, with daily volume barely in the three‑digit range. In simple terms, Kenshi crypto is a micro‑cap altcoin that tries to link a distributed computing platform called Timeleap with oracle‑style data services, but the details are hazy and the market is thin.

Current market snapshot

KNS sits near the bottom of CoinGecko’s rankings, priced at $0.001697 with a 24‑hour volume of about $735. The market cap hovers around $1.3million, putting it well below the $10million threshold most analysts use to define a “low‑cap” token. Different aggregators disagree - LiveCoinWatch lists it as #8587, while RevenueBot ranks it at #3718 - a symptom of the sparse data surrounding the coin. Trading activity is concentrated on a single decentralized exchange, which means price swings can be dramatic even on modest trade sizes.

Technical foundations

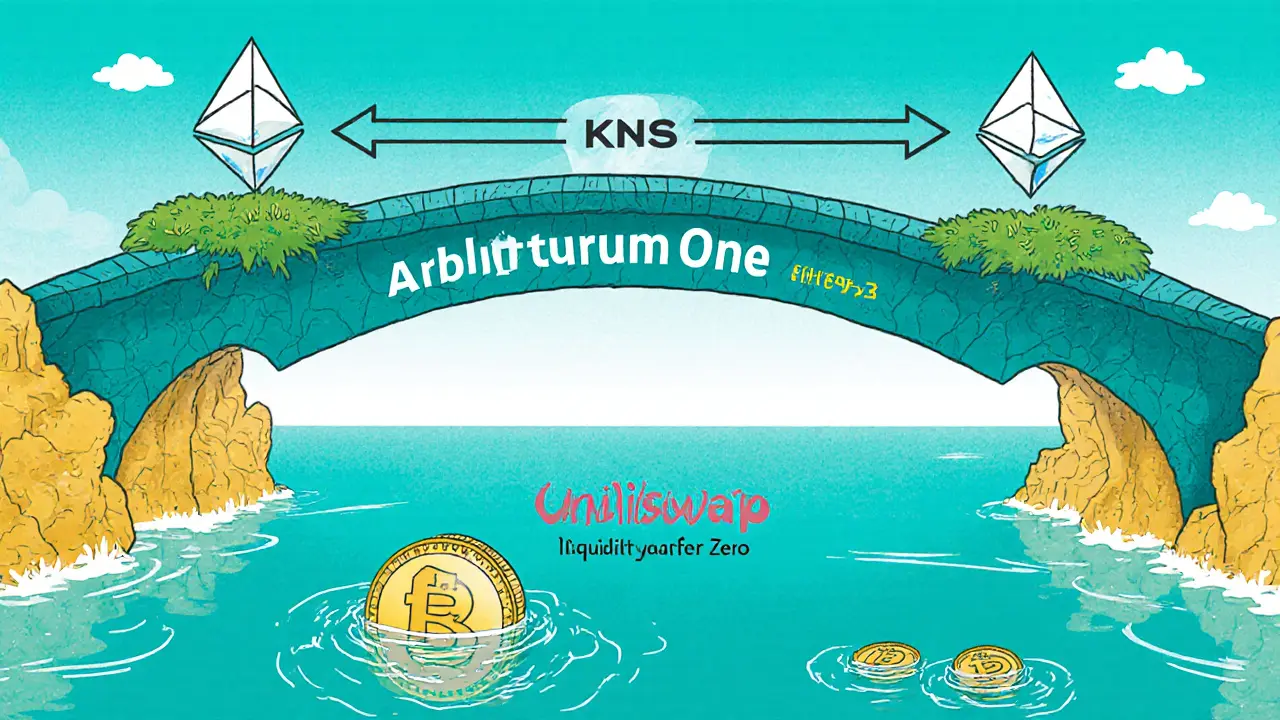

The token lives on the Ethereum blockchain, but it doesn’t stay on the main chain. Instead it runs on Arbitrum One, a layer‑2 scaling solution that batches transactions for lower fees. This design lets KNS trade on Uniswap v3, a decentralized automated market maker (AMM) that supports concentrated liquidity pools. The KNS/ETH pair on Uniswap v3 currently shows a price of roughly $0.00174, but the pool’s liquidity depth is effectively zero, so even small orders can shift the price noticeably.

Intended utility and ecosystem

The only public‑facing product linked to the token is Timeleap, a “Distributed App Engine” that advertises AI‑driven services such as conversational agents, image generation, data analysis, and workflow automation. The website frames these tools as a marketplace where developers can pay for compute time or data verification. In theory, KNS could act as the native payment method for those services, but the whitepaper never spells out a concrete token‑flow or staking model.

Timeleap also labels itself as an Oracle platform, meaning it could supply off‑chain data to smart contracts. That puts it in the same conceptual space as projects like Chainlink, which dominates the oracle market. Another related niche is the Internet of Things, where KNS claims compatibility with IoT devices, a claim it shares with IoTeX. The overlap suggests the team hopes to position KNS as a bridge between decentralized AI compute and real‑world sensor data.

Tokenomics and distribution

KNS is not mineable; there is no proof‑of‑work or proof‑of‑stake reward structure. The initial supply was not pre‑minted in a single dump, but the exact distribution schedule is undocumented. Because the token never appeared on a major exchange, most holders acquired it through the Uniswap pool, meaning early participants likely own a sizable share. No official staking, governance voting, or burn mechanisms have been announced, which limits the token’s utility beyond a possible payment stub.

Risks, liquidity, and price outlook

The biggest red flag is liquidity. With daily volume under $1,000 and a tiny liquidity pool, any attempt to buy a few hundred dollars worth of KNS could move the price by several percent. Price predictions from services like TradingBeasts and WalletInvestor all hover around $0.0017 for the next few years, essentially forecasting a flat or slightly declining trajectory. In a market where micro‑cap tokens can disappear overnight, the lack of transparent roadmaps and community activity adds another layer of uncertainty.

How to acquire or trade KNS safely

If you decide to experiment with KNS, follow these steps to avoid unnecessary slippage:

- Set up a compatible Ethereum wallet (MetaMask, Trust Wallet, etc.) and add the Arbitrum One network. You can find the RPC details on the official Arbitrum documentation.

- Buy a small amount of ETH on the Arbitrum network - you’ll need it to pay gas fees.

- Navigate to the Uniswap v3 interface and paste the KNS contract address:

0x... (placeholder). Verify the address on the Kenshi website before proceeding. - Enter the amount of ETH you want to swap, double‑check the price impact, and confirm the transaction.

- After the swap, add KNS to your wallet’s token list so you can see the balance.

Because the pool’s depth is near zero, consider using a limit order on a service that supports it, or only trade amounts you’re willing to lose.

Comparison with similar projects

| Metric | Kenshi (KNS) | Chainlink (LINK) | IoTeX (IOTX) |

|---|---|---|---|

| Current price (USD) | $0.00169 | $7.42 | $0.018 |

| Market cap (USD) | ≈ $1.3M | ≈ $3.4B | ≈ $250M |

| Primary use‑case | Pay for Timeleap compute & oracle data | Decentralized oracle data feeds | IoT device connectivity & data marketplaces |

| Liquidity source | Uniswap v3 (Arbitrum) - very low | Multiple CEX & DEX - high | Multiple CEX & DEX - moderate |

| Risk level (subjective) | High - micro‑cap, thin volume | Medium - established but price volatile | Medium - niche adoption, growing ecosystem |

What to watch moving forward

Future developments could change the equation. If the Timeleap team releases clear SDK documentation, integrates KNS as a mandatory fee token, or lists the token on a reputable centralized exchange, liquidity would improve and price dynamics could stabilize. Conversely, continued opacity and a stagnant community will likely keep the token in the “watch‑list” category for risk‑averse investors.

Frequently Asked Questions

What is the primary purpose of the Kenshi (KNS) token?

KNS is intended to serve as a payment method for the Timeleap distributed computing platform and to act as an oracle token for feeding off‑chain data to smart contracts, although concrete usage details are still scarce.

Where can I buy or trade KNS?

The token is only available on Uniswap v3 operating on the Arbitrum One network. You’ll need an Ethereum‑compatible wallet set to Arbitrum and some ETH for gas.

Is KNS a mineable cryptocurrency?

No. KNS was launched as a non‑mineable token with its supply allocated through the initial token distribution, not through PoW or PoS mining.

How risky is investing in KNS?

Very risky. The token has tiny daily volume, almost no liquidity, and limited exchange listings, which makes price manipulation and loss of capital more likely.

What are the main competitors to Kenshi?

In the oracle space Chainlink is the dominant player. In the IoT and decentralized compute arena, projects like IoTeX, Golem, and Render Token offer similar services.

15 Comments

Look, the liquidity is practically nonexistent, which means even a small trade can cause massive slippage, so proceed with extreme caution! Remember, diversification is key, and allocating only a tiny fraction of your portfolio to high‑risk micro‑caps like KNS can protect you from catastrophic loss! Stay informed, read the whitepaper, and never invest money you can't afford to lose!!!

When evaluating a token such as Kenshi (KNS), it is essential to start with the fundamentals: the price, market cap, and daily volume give you the first glimpse into how active the market truly is. The current price of $0.00169 sits within a range that is typical for micro‑caps, but the market cap of $1.3 million is well below the threshold that most analysts consider safe. A daily trading volume of only $735 underscores the lack of liquidity, which in turn means that order books are thin and price impact is high. Because the token trades on a single decentralized exchange, there is no price discovery mechanism that can smooth out large trades. The fact that KNS lives on Arbitrum One, a layer‑2 solution, does reduce transaction fees, but it does not magically create depth in the liquidity pool. The token’s utility claim involving the Timeleap platform is still vague, and without concrete adoption metrics, the use‑case remains speculative. Furthermore, the absence of staking, governance, or burn mechanisms limits the incentives for holders to keep the token stable. While the team’s roadmap mentions future integrations, there are no firm milestones or partnership announcements to back up those promises. You should also consider the broader market environment; during bear phases, micro‑cap tokens like KNS tend to suffer the most severe price drops. Historical price data from services such as TradingBeasts shows a near‑flat or slightly declining trajectory, which aligns with the risk assessment of high volatility. If you decide to allocate any capital, it should be a very small portion of a diversified portfolio, and you must be prepared to lose the entire amount. Use limit orders or trade only amounts you are comfortable with losing, as slippage can eat into your position instantly. Keep an eye on the liquidity pool depth; any increase there could be a positive sign, but a sudden drop might signal an impending exit by early investors. Always verify the contract address on the official website to avoid scams, especially when dealing with obscure tokens. In summary, the token presents a high‑risk profile, and only those with a strong appetite for speculation should consider it. Finally, maintain a disciplined approach: set stop‑losses, monitor news, and be ready to exit if the token shows signs of stagnation or abnormal activity.

Oh great, another micro‑cap that’ll probably vanish faster than my internet connection during a storm.

Imagine a world where a token like KNS pretends to be the bridge between AI compute and IoT, yet its liquidity pool is as empty as a desert oasis at midnight; the shadows of hidden whales whisper conspiracies about secret dumps, and the developers hide behind jargon, leaving investors to wander through a maze of unanswered questions, all while the market cap trembles like a candle in a hurricane.

You're voicing a real concern, and it's important to recognize that without transparent tokenomics or a robust community, the promise of bridging AI and IoT remains just a hopeful narrative. For anyone considering KNS, I would recommend focusing on the concrete deliverables from the Timeleap team, such as published SDKs or real‑world integrations, before committing any funds.

Honestly, I think KNS is just another hype coin; if you’re not ready to lose every cent you put in, stay far away.

Esteemed members of this forum, permit me to articulate my observations concerning the Kenshi (KNS) token: the paucity of liquidity, the singular exchange listing, and the nebulous utility proposition collectively engender a substantial risk profile, thereby rendering any speculative investment therein a venture fraught with uncertainty.

i think they r pulling the rug from under us, the govenment and the big crypto corp are in cahoots to sink tokens like this so they can push their own coinss!!!

This token is a textbook example of a high‑risk micro‑cap.

Given the limited trading volume and near‑zero liquidity, any attempt to purchase a meaningful amount of KNS would likely result in significant price slippage.

Well, if you’re gonna talk about US crypto markets, you better stop whining about small tokens and focus on the real stuff that makes America great!!

From a philosophical standpoint, investing in something as uncertain as KNS can be seen as an experiment in embracing risk; it challenges us to confront our comfort zones and examine why we seek value in obscure assets.

Indeed, within the broader cryptoeconomic ecosystem, KNS could be conceptualized as a low‑liquidity node in a decentralized compute graph, and its utility, albeit nascent, might be evaluated through metrics such as transaction throughput, off‑chain data feed latency, and cross‑protocol interoperability.

Reading about KNS makes my heart race!!! The sheer volatility, the whisper of conspiracies, the endless speculation-it's all so intoxicating!!! But remember, dear readers, emotions can cloud judgment, so stay grounded!!!

Behind the façade of Timeleap lies a network of shadowy actors pulling strings, and KNS is merely a pawn in a grander scheme to control decentralized AI services while siphoning unsuspecting investors' money.