- 21 Nov 2025

- Elara Crowthorne

- 21

SINGLE Token Liquidity Impact Calculator

Current Market Conditions

As of October 2025:

Critical Liquidity SINGLE/USDC pair: $510 liquidity

Price Range $0.000174 - $0.000239

Trading Volume $18,000 24h

Note: Selling large amounts will significantly impact price due to low liquidity.

Single Finance (SINGLE) isn’t a household name like Bitcoin or Ethereum, but if you’re digging into smaller DeFi projects on the Cronos blockchain, you’ve probably seen it pop up. Launched in 2022, SINGLE is a cryptocurrency built to let users earn yield and vote on protocol changes-all within the Cronos ecosystem. But here’s the thing: as of October 2025, it’s not thriving. It’s surviving. And that’s where things get messy.

What SINGLE actually does

SINGLE is designed as a dual-purpose token: yield farming and governance. That means if you hold it, you’re supposed to be able to stake it to earn more tokens over time, and also vote on upgrades or changes to the Single Finance platform. Sounds simple, right? But unlike big DeFi names like Aave or Curve, there’s almost no public documentation on how the farming works, what APYs you can expect, or how voting actually plays out.

The project lives on Cronos, which is Crypto.com’s blockchain. That’s not a bad thing-Cronos is faster and cheaper than Ethereum, and it’s EVM-compatible, so tools built for Ethereum can run on it. But being on Cronos also means you’re stuck in a smaller pond. Most of the trading happens on VVS Finance and Gate.io, two exchanges that cater mostly to Cronos users. If you’re not already in that ecosystem, getting SINGLE isn’t straightforward.

The numbers don’t lie: a token in decline

As of October 2025, the total supply of SINGLE is 998,829,918 tokens. But here’s the odd part: the circulating supply is listed as zero on most trackers. That doesn’t mean all the tokens vanished-it means they’re locked up. Maybe in staking contracts, maybe in team wallets, maybe in vesting schedules. No one’s saying.

Price-wise, SINGLE is hovering between $0.000174 and $0.000239. That’s less than a tenth of a cent. For comparison, a single Bitcoin satoshi is worth about $0.0005. SINGLE trades at roughly a third of that. The 24-hour volume? Around $18,000. That’s less than what a single large whale might move on Ethereum-based tokens in five minutes.

The numbers are worse over longer periods. In the last 30 days, SINGLE lost 12.93%. In 60 days? 37.2%. In 90 days? A brutal 56.08%. That’s not market noise. That’s a steady, unrelenting drop. Even on the best days, the price barely moves. On CoinMarketCap, it’s $0.000176. On Binance, $0.000175. On CoinGecko, $0.000184. These aren’t glitches-they’re signs of a token with almost no buying pressure.

Where you can trade SINGLE (and why it matters)

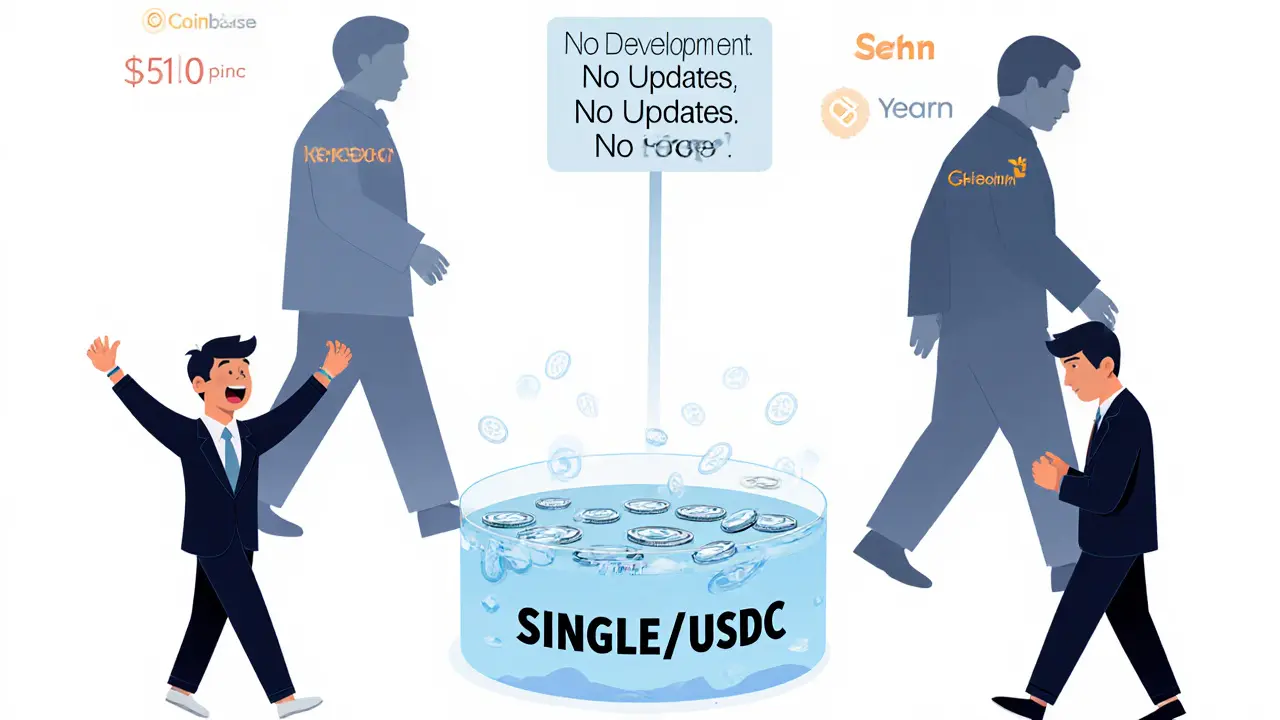

You won’t find SINGLE on Coinbase, Kraken, or even KuCoin. It’s only listed on a handful of exchanges, and the two biggest are Gate.io (centralized) and VVS Finance (decentralized). The most active trading pair is SINGLE/USDT on Gate.io. On VVS Finance, you’ll see SINGLE/USDC and SINGLE/VVS. But here’s the kicker: the liquidity on these pairs is tiny.

On VVS Finance, the SINGLE/USDC pair has only $510 in liquidity within a 2% price range. That’s less than the cost of a good pair of sneakers. The SINGLE/VVS pair? Just $179. That means if you tried to sell even 100,000 SINGLE tokens, you’d likely crash the price. There’s no depth. No safety net. If you buy in, you’re betting the entire market will suddenly wake up-and that’s a huge risk.

Is SINGLE a scam? Probably not. But is it worth it?

It’s not a scam. It’s listed on CoinMarketCap, CoinGecko, Binance, and other serious trackers. It has a live blockchain, real transactions, and active trading. That rules out rug pulls or fake projects. But being real doesn’t mean it’s valuable.

Most successful DeFi tokens have three things: strong tokenomics, active development, and real user demand. SINGLE has none of those in clear evidence. There’s no public roadmap. No GitHub commits. No Twitter updates from the team. No Discord chatter. No YouTube explainers. The project feels like a ghost town-there’s a building, but no one’s inside.

And in DeFi, that’s deadly. Yield farming is a race to the bottom. New protocols pop up every week offering better rewards, better security, and better transparency. SINGLE offers none of that. It’s stuck in 2022 while the rest of the ecosystem moved on.

Who’s still holding SINGLE?

If you’re wondering who’s still trading it, the answer is mostly speculators and Cronos ecosystem insiders. Some might be holding because they believe in the long-term potential of Crypto.com’s blockchain. Others might be buying on dips, hoping for a rebound. A few might be stuck-bought high, now waiting to break even.

But here’s what’s missing: institutional interest. No venture capital firms have publicly backed it. No DeFi aggregators like Yearn or Zapper list it as a top farm. No yield optimizer includes it in their portfolios. That’s not an accident. It’s a signal.

What’s the future for SINGLE?

The only real hope for SINGLE is if Crypto.com decides to push it forward. If they integrate it into their wallet, add staking rewards in their app, or use it as a governance token for a new product-that could spark demand. But there’s zero evidence they’re doing that. No announcements. No leaks. No hiring. No updates.

Without that kind of backing, SINGLE is just another forgotten DeFi token. It has a blockchain address, a market cap of effectively $0, and a price that keeps sliding. It’s not dead-but it’s not alive either. It’s in limbo.

If you’re thinking of buying SINGLE, ask yourself: Are you betting on the token, or on someone else buying it later? Because right now, there’s no fundamental reason to hold it. No yield data. No governance activity. No development. Just a price chart going down.

DeFi is full of tokens that faded away. SINGLE is one of them. The question isn’t whether it’ll recover. It’s whether you’re willing to risk money on something that hasn’t moved in months-and might never move again.

21 Comments

SINGLE is just a ghost token with no activity and no reason to exist

Zero circulating supply means the project is either dead or hiding something

Either way it's not worth your time

Been watching SINGLE for months and honestly its just a zombie token

Low volume, no dev updates, no team presence

Its like someone left a crypto project running in a basement and forgot to turn off the lights

People still trade it hoping for a miracle but the math says no

Even the liquidity pools are joke sized

510 in USDC pair? Thats less than my coffee budget

If you're thinking of buying this you're not investing you're gambling on a ghost

And dont get me started on the price chart

Its not declining its just slowly evaporating

DeFi moves fast and SINGLE got left behind in 2022

No roadmap no GitHub no Discord no nothing

Its not a scam its just dead weight

There are hundreds of better yield farms out there with real teams

Why waste gas on this?

Save your ETH and your sanity

Typical American crypto graveyard

Weak blockchain weak community weak token

Britain has better dead projects than this

Anyone still holding this is either delusional or waiting for Crypto.com to rescue it

Good luck with that

This is what happens when you build on a blockchain nobody cares about

Cronos is a dead end

And SINGLE is its corpse

Bro why even talk about this

Its like discussing the weather on Mars

No one cares

Wait till you find out the team is just a bunch of ex-Crypto.com interns

They dumped the rest of the supply into VVS

This is a pump and dump with a fancy website

And CoinMarketCap is complicit

They list everything

Its all rigged

They want you to think its real so you buy the bottom

Then they vanish

Same script every time

There's something haunting about a token that still has a price but no buyers

It's not dead

It's waiting

Waiting for someone to believe again

But belief needs proof

And SINGLE has none

Maybe its not about the token

Maybe its about the hope we still cling to

Even when the charts scream otherwise

That's the real tragedy

It is astonishing that anyone would consider this a viable investment opportunity

The lack of transparency is not merely concerning

It is professionally negligent

There is no justification for the continued existence of this token in any rational financial ecosystem

The liquidity figures are an embarrassment

The price action is statistically meaningless

And the absence of any developer activity suggests either incompetence or malice

One must ask why this token remains listed on reputable aggregators

The answer is likely commercial opportunism disguised as neutrality

Investors are being systematically misled

This is not DeFi

This is a graveyard with a ticker symbol

Man this is the saddest crypto I've seen in months 😔

Like watching a dog wait by the door for someone who left years ago

Someone's still holding onto this

And I just wanna hug them

But also tell them to sell

And go find something real

There's still time

SINGLE is not a token

It's a monument to bad decisions

A digital tombstone for every investor who thought 'maybe this time'

The price chart isn't moving

It's gasping

And the liquidity pools? Pfft

That's not a pool

That's a puddle after a drought

And the team? Silent

Like a ghost haunting a house they already sold

This isn't DeFi

This is crypto funeral music

Look

I know you want to believe

I know you think this is the one

The underdog

The hidden gem

But here's the truth

It's not

It's a zombie

And you're feeding it your last coins

Walk away

Now

Before it takes everything

It's funny how a token can be alive on paper but dead in practice

SINGLE is like a temple with no worshippers

The architecture is still there

The altar still stands

But no one prays anymore

And the priests? Gone

Some cultures bury their dead with ceremony

Here we just leave them on CoinMarketCap

Waiting for someone to notice they're not breathing

There's a quiet dignity in how quietly SINGLE is dying

No drama

No announcement

No panic

Just a slow fade

Like an old radio losing signal

One day you hear it

The next day you don't

And you wonder if you ever really heard it at all

That's the real horror

Not the crash

But the silence that follows

The structural deficiencies of SINGLE are not merely economic

They are epistemological

The absence of verifiable data renders any valuation framework inapplicable

Furthermore

The lack of on-chain governance activity negates the purported utility of the token

It is a symbolic artifact without functional agency

Its continued listing on centralized exchanges constitutes a failure of due diligence

One must question the integrity of platforms that facilitate trading in assets with zero circulating supply

This is not innovation

This is necro-finance

Let me be clear

This is not a call to action

This is a call to awareness

SINGLE is not a failure of technology

It is a failure of leadership

And those who still hold it

Are not fools

They are loyal

But loyalty without evidence is a burden

Let go

Not because the token is worthless

But because you deserve better

You are worth more than this silence

Hey

I know it's hard to let go

But sometimes the kindest thing you can do is walk away

You're not losing

You're choosing peace

And that's worth more than any token

Of course this is still listed

It's American

Everything gets a second chance here

Even when it deserves zero

That's why we're losing to the world

Someone in the team must still be watching the price

Every day

Just waiting for it to go up

And every day

It doesn't

And they still don't say anything

That's the real horror story

Yeah whatever