- 19 Dec 2025

- Elara Crowthorne

- 17

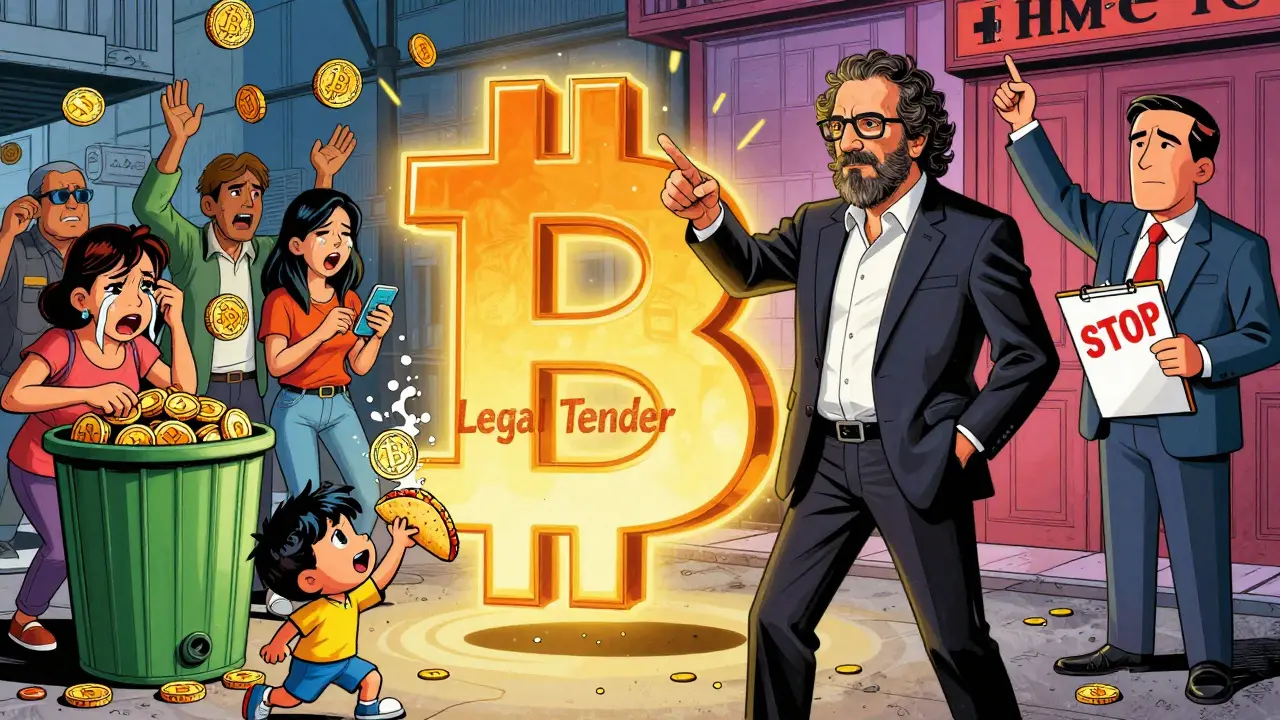

On September 7, 2021, El Salvador did something no country had ever done: it made Bitcoin legal tender alongside the U.S. dollar. President Nayib Bukele called it a revolution. Supporters said it would free Salvadorans from expensive remittance fees, bring unbanked people into the financial system, and attract global investment. But by May 1, 2025, the law changed. Bitcoin was no longer legal tender. The government didn’t just backtrack-it officially ended the experiment.

What Was Supposed to Happen?

The goal was simple on paper. El Salvador has one of the highest remittance rates in Latin America. Families rely on money sent from relatives working in the U.S. Each year, over $7 billion flows into the country. Traditional services like Western Union charge up to 10% in fees. The government claimed Bitcoin could cut those fees to near zero. All you needed was a smartphone and the Chivo wallet-free, government-built, and loaded with $30 in Bitcoin just for signing up. They also promised financial inclusion. About 70% of Salvadorans didn’t have bank accounts. Bitcoin, they said, would let anyone send, save, or spend money without a bank. Businesses would be required to accept it. Taxes could be paid in Bitcoin. The country even bought Bitcoin as a national reserve asset, hoping its value would rise over time. It sounded like a win-win. But real life doesn’t follow policy documents.How It Actually Played Out

By 2024, the numbers told a different story. A survey by the Central Bank of El Salvador found that 92% of Salvadorans never used Bitcoin for daily transactions. Only 1 in 10 businesses accepted it regularly. Even with the $30 sign-up bonus, most people cashed out immediately-often at a loss-because they didn’t trust Bitcoin or didn’t know how to use it. The Chivo wallet became a symbol of the failure. It crashed constantly. Users lost funds. Hackers stole millions. The government admitted the app had security flaws. Many Salvadorans didn’t even have reliable internet or smartphones. Trying to send Bitcoin to pay for a tortilla at a street stall? Impossible if your phone died or the network was down. Merchants hated it. They had to convert Bitcoin to dollars instantly to pay suppliers, employees, and rent. That meant paying fees to third-party processors-defeating the whole point. Some businesses posted signs: "We accept Bitcoin, but we charge extra because it’s risky." Others just ignored the law. The IMF saw the chaos coming. In December 2024, they offered El Salvador a $1.4 billion loan-but only if they scrapped the Bitcoin legal tender law. The conditions were clear: stop forcing businesses to accept Bitcoin. Stop letting people pay taxes in it. Stop buying more Bitcoin. The government agreed.What Changed on May 1, 2025

The new law didn’t ban Bitcoin. It just removed its special status. Now, Bitcoin is just another digital asset-like gold or stocks. Businesses can accept it if they want. They don’t have to. You can’t pay your electricity bill in Bitcoin anymore. The government won’t convert your Bitcoin into pesos or dollars for you. The Chivo wallet’s government funding was cut. Its future is uncertain. Economist Rafael Lemus put it bluntly: "Bitcoin no longer has the strength of legal tender. It should have always been that way, but the government tried to force it into existence, and it didn’t work." The IMF’s March 2025 report confirmed it: Bitcoin did nothing for financial inclusion. The unbanked stayed unbanked. The poor didn’t get richer. The only people who benefited were early Bitcoin investors and speculators who sold their holdings at peak prices.

What About the Bitcoin Reserve?

El Salvador bought Bitcoin when prices were low-around $30,000 per coin in 2021. They held on through the crash in 2022, when Bitcoin dropped below $17,000. Then they bought more in 2023 and 2024, when prices rose again. By early 2025, they held between 6,000 and 6,100 Bitcoin, worth roughly $500 million. But here’s the twist: the government never disclosed exact numbers. Different reports gave conflicting figures. Some claimed they made $287 million in profit. Others said they were still underwater. Transparency was never a priority. The IMF agreement forced El Salvador to stop buying more Bitcoin. A July 2025 report confirmed they hadn’t purchased any since signing the deal. But rumors persist. Some analysts suspect the government is still buying quietly through shell companies.Why Did It Fail?

Three reasons stand out. First, forced adoption backfired. You can’t make people trust something they don’t understand. Bitcoin’s volatility scared ordinary users. One day, your $30 bonus is worth $35. The next, it’s worth $25. Who wants that kind of risk for groceries? Second, the infrastructure didn’t exist. Most Salvadorans don’t have smartphones with reliable internet. They use cash. They trust cash. Changing that overnight was unrealistic. Third, the government didn’t educate. No real workshops. No simple guides in Spanish. No help desks. The Chivo wallet was a black box. If it broke, you were on your own.

What’s Left?

Bitcoin is still legal in El Salvador. You can still buy it. Sell it. Trade it. Use it privately. The country still hosts crypto conferences. The PLANB Forum 2025 drew thousands of international investors. Bukele still tweets about Bitcoin daily. But the dream of Bitcoin as everyday money? Gone. The government’s new strategy is simple: attract crypto businesses. Offer tax breaks. Build a "Bitcoin City" powered by geothermal energy. Let private companies handle adoption. No more mandates. No more Chivo wallet subsidies. No more pretending.What Can Other Countries Learn?

El Salvador didn’t fail because Bitcoin is flawed. It failed because the government thought technology alone could fix deep economic problems. Other countries are watching. Nigeria, Kenya, Argentina-nations with high inflation and weak banking systems-have been tempted to copy El Salvador. But now they see the cost: public distrust, technical chaos, and international backlash. The lesson isn’t that Bitcoin can’t work. It’s that you can’t force a currency on people. Financial inclusion doesn’t come from apps. It comes from trust, education, and stable infrastructure. El Salvador’s experiment was bold. It was historic. And it was wrong. Bitcoin didn’t save El Salvador. But it did teach the world something important: money isn’t just code. It’s culture. It’s habits. It’s trust. And you can’t legislate that.What Happens Next?

El Salvador isn’t abandoning crypto. It’s scaling back. The focus now is on attracting foreign investors, not forcing citizens to use Bitcoin. The country still wants to be seen as a tech hub. But it’s doing it the quiet way now-through incentives, not mandates. The Chivo wallet may fade into obscurity. The Bitcoin reserve will likely be sold off slowly, if at all. The government’s next move? Probably a new law to regulate crypto exchanges and protect investors-without touching the dollar. For now, Salvadorans are back to using cash and dollars. The $30 Bitcoin bonus? Long gone. The dream of a Bitcoin-powered economy? Officially over. But the experiment lives on-as a warning.Was Bitcoin ever really used as money in El Salvador?

Very rarely. By 2024, 92% of Salvadorans didn’t use Bitcoin for daily transactions. Only a small fraction of businesses accepted it regularly. Most people cashed out their $30 Chivo wallet bonus immediately. Bitcoin was never truly integrated into daily life.

Why did the IMF demand El Salvador drop Bitcoin as legal tender?

The IMF saw Bitcoin as a macroeconomic risk. Its volatility threatened financial stability. The lack of transparency in Bitcoin purchases and reserves raised red flags. The government’s forced adoption created chaos in the payment system, and the Chivo wallet’s failures hurt public trust. The IMF wanted El Salvador to stabilize its economy before lending $1.4 billion.

Did Bitcoin help the unbanked population in El Salvador?

No. Multiple studies, including one by the IMF in March 2025, found zero improvement in financial inclusion. People without bank accounts didn’t start using Bitcoin. They kept using cash. The Chivo wallet didn’t replace banks-it replaced nothing.

Is Bitcoin still legal in El Salvador after May 2025?

Yes. Bitcoin is still legal for private transactions. You can buy, sell, or trade it. But businesses no longer have to accept it. You can’t pay taxes or government bills in Bitcoin. It’s treated like any other digital asset-not as money.

How many Bitcoin does El Salvador still hold?

As of early 2025, El Salvador held between 6,000 and 6,100 Bitcoin, worth roughly $500 million. The government never fully disclosed its holdings, leading to confusion. The IMF confirmed no new purchases since December 2024, but some analysts suspect hidden buying continues.

What’s the future of Bitcoin in El Salvador?

The future is voluntary, not mandatory. The government plans to attract crypto businesses with tax incentives and infrastructure projects like Bitcoin City. But there’s no plan to bring Bitcoin back as everyday money. The experiment is over. The legacy is a cautionary tale.

17 Comments

92% didn't use it. Done.

So the government gave people free crypto... and they cashed out like it was a scam? Wow. Groundbreaking.

Man... i just feel bad for the people who tried to use Chivo and lost money 😔 the app was a mess. I mean, imagine trying to pay for lunch and your phone dies? That's not innovation, that's just... bad UX. 🤦♂️

Bitcoin wasn't the failure-it was the hubris. The assumption that code could override centuries of monetary culture is not visionary, it's colonial. You don't legislate trust. You cultivate it. And El Salvador mistook spectacle for substance.

I'm from South Africa and we've had our own struggles with digital finance... but I get it. People need to feel safe before they adopt. No one wants their grocery money to vanish overnight because the price of Bitcoin dipped. 💔

Look, I'm not a tech guy, but I know this: if your system crashes when you try to buy bread, it's broken. Not 'innovative.' Broken. And forcing people to use it? That's not freedom. That's pressure.

Oh please. You think this was about finance? No. This was a vanity project for Bukele. He wanted to be the Bitcoin President. The people? Just props in his digital cult. And now? He's already planning Bitcoin City like it's a theme park for crypto bros. 🤡

Meanwhile, real infrastructure? Roads? Schools? Still crumbling. But hey-look at the selfies with Satoshi!

They didn't fail because Bitcoin is bad. They failed because they treated a nation like a beta test. And the people paid the price.

And now the IMF comes in with a loan and says, 'Stop this nonsense.' And suddenly, the same people who cheered Bukele are silent. Classic.

Next time, try helping people with electricity before you give them crypto.

They didn't fail. They were doomed from day one. You can't force a religion on people and call it economic policy. Bitcoin is not money. It's a belief system. And Salvadorans didn't want to worship at the altar of volatility.

It’s so sad. The people who needed help the most got a glitchy app and a $30 bonus that vanished before they could even understand it. And now? They’re just told to ‘adapt.’ Adapt to what? To being used as lab rats?

I’m crying. Not for the government. For the abuela trying to send money to her grandson. She doesn’t care about blockchain. She just wants her kid to eat.

Kinda reminds me of when my uncle tried to teach me how to use a smartphone. Gave me the latest model, said 'just tap here,' and walked away. Two days later, I was still stuck on the home screen. Same thing here.

Monetary sovereignty isn't achieved through technological fiat. It's achieved through institutional credibility. El Salvador conflated decentralization with legitimacy. A fatal error. The dollar, despite its flaws, is a stable anchor because it's backed by centuries of normative trust-not algorithmic consensus.

It is evident that the underlying issue lies not in the nature of Bitcoin, but in the epistemological framework of the governing elite. The assumption that digital innovation can supplant socio-economic tradition reflects a profound ontological disconnect from the lived reality of the populace.

One must question: is this not a form of neocolonial technocratic imperialism?

Wow. So the average person didn't use it. Shocking. 🤦♂️ You can't expect peasants to understand blockchain. That's like asking a goat to do calculus.

Only the smart ones made money. The rest? They were just noise. And now they're crying because their $30 vanished. Grow up.

I remember when my grandma got her first cell phone. She didn't care about apps or data plans. She just wanted to hear her grandkids' voices. That's what this was. People didn't want Bitcoin. They wanted to be heard. To be seen. To not be treated like a bug in someone's code.

El Salvador is a joke. A third-world country trying to out-tech the U.S.? The IMF had to step in because the U.S. won't let a rogue state undermine the dollar. This was never about finance. It was about power. And the U.S. won.

Actually, you're all missing the point. The real failure was not adopting Bitcoin as legal tender-it was failing to integrate it with a national blockchain-based identity system. Without KYC-compliant digital IDs, adoption was doomed. Also, they should've partnered with Chainlink for oracles and used Lightning Network for microtransactions. Basic stuff. This was amateur hour.