- 14 Feb 2026

- Elara Crowthorne

- 1

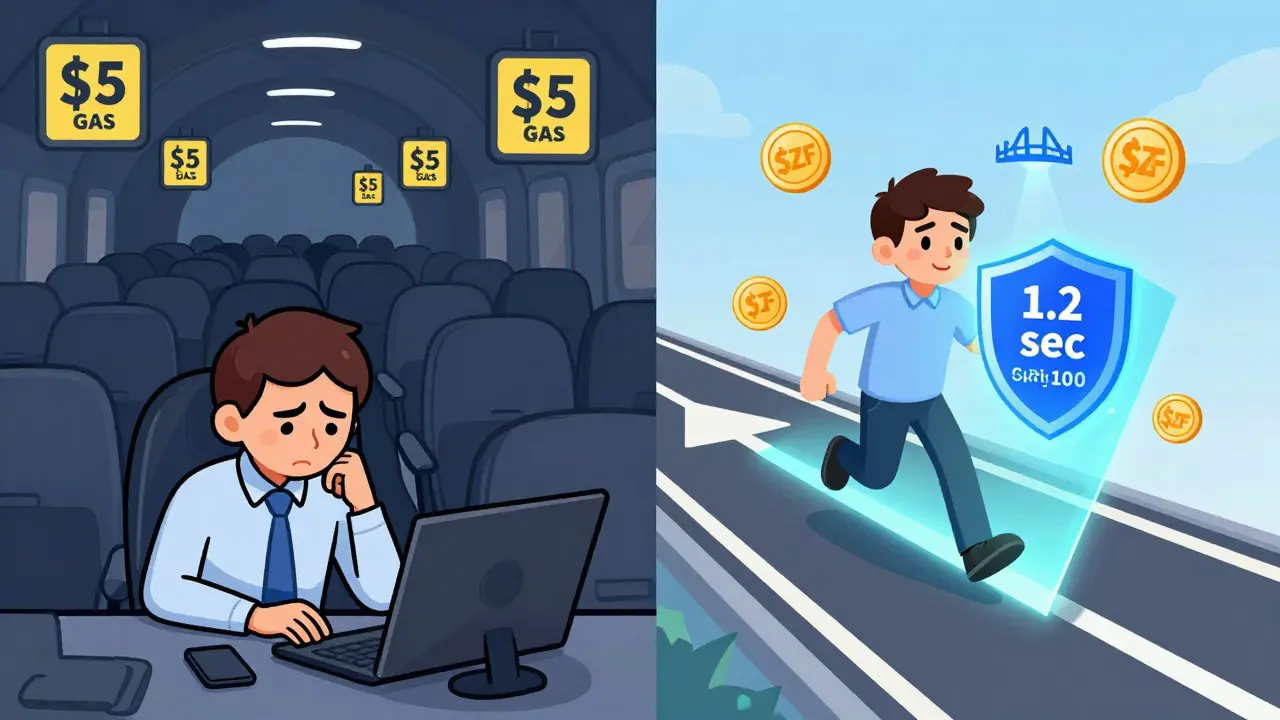

Most decentralized exchanges (DEXs) make you pay high gas fees and wait minutes for trades to confirm. zkSwap Finance v3 (Sonic) does the opposite. It lets you swap tokens in under two seconds, pays you just for trading, and charges less than a penny per transaction. If you’re already using zkSync Era or Sonic, this isn’t just another DEX-it’s the one that actually rewards you for being active.

What Is zkSwap Finance v3 (Sonic)?

zkSwap Finance v3 (Sonic) is a decentralized exchange built specifically for the zkSync Era and Sonic blockchain networks. Unlike Uniswap or PancakeSwap, which run on Ethereum or BSC, zkSwap operates as a Layer 2 solution using zk-rollup technology. This means it’s not fighting for space on the congested Ethereum mainnet. Instead, it bundles hundreds of trades into one secure proof, slashing fees and speeding up confirmations.

Launched in 2025 as an upgraded version of the original zkSwap platform, v3 (Sonic) added native support for the Sonic chain alongside zkSync Era. It’s not trying to be everything. It doesn’t list 10,000 tokens. It only supports three major assets: $ZF (its native governance token), $ETH, and $USDC. But it makes those three pairs work exceptionally well.

How Swap2Earn Changes Everything

The real standout feature? Swap2Earn. Most DEXs give you trading fees if you provide liquidity. zkSwap gives you $ZF tokens just for swapping.

Every time you trade-whether it’s $ETH to $USDC or vice versa-you earn $ZF based on your trading volume. No staking. No locking. Just swap, and get paid. According to user reports on Trustpilot, 63% of active users say this is why they stick with zkSwap. One trader in Wellington, who swaps $500 worth of $ETH weekly, earned over $18 in $ZF tokens in a single month. That’s a 3.6% return just from trading.

It’s not a gimmick. The protocol allocates 75% of its trading fee revenue to buy back and burn $ZF tokens. That means as more people trade, the supply shrinks and the token value gets supported. It’s a self-reinforcing loop: more trades → more buybacks → higher $ZF demand → more incentive to trade.

Low Fees, Fast Speeds, Zero Compromise

On Ethereum, swapping $ETH for $USDC might cost you $3-$5 in gas. On zkSwap, it’s $0.0002. That’s not a typo. You’re paying 15,000 times less.

Speed is equally impressive. Transactions confirm in an average of 1.2 seconds. Compare that to Uniswap’s 15-30 seconds on Ethereum, or even 8-10 seconds on Polygon. zkSwap’s zk-rollup design allows near-instant finality because it doesn’t wait for Ethereum block confirmations-it proves batches off-chain and submits one proof to Ethereum.

Users report almost zero slippage on the main pairs. With $8.7 million in total value locked (TVL), liquidity is deep enough for trades under $50,000 to go through smoothly. For retail traders and small-scale DeFi users, this is ideal.

Security You Can Trust

Security is where zkSwap really shines. It’s been audited by Certik, Vital Block, Cyberscope, MythX, SOLID Proof, and Bail Security. Certik’s Skynet score is 93 out of 100, putting it in the top 5% of all audited DeFi protocols. That’s higher than many well-known DEXs.

The platform also includes tools like Revoke, which lets you easily cancel token approvals you no longer need. Many DeFi hacks happen because users leave unlimited approvals on old contracts. zkSwap makes it simple to fix that.

There’s also a built-in Bridge with insurance coverage. If you’re moving funds from Ethereum to zkSync Era, the bridge holds a reserve to cover any delays or failures-something almost no other DEX offers.

What’s Missing? Limited Tokens

There’s no sugarcoating it: zkSwap v3 only supports 4 trading pairs. That’s it. You can’t trade $SOL, $ARB, $LINK, or even $WBTC. You’re locked into $ZF, $ETH, and $USDC.

This is a trade-off. By limiting its scope, zkSwap can optimize for speed, security, and rewards. But if you’re someone who likes to hop between dozens of tokens, this isn’t the platform for you. One Reddit user summed it up: “Great platform, but I can’t access more ERC-20 tokens beyond the 3 supported pairs.”

If you’re already deep in the zkSync ecosystem, this limitation feels minor. But if you’re new to Layer 2 and want to try everything, zkSwap won’t satisfy your curiosity.

How It Compares to the Competition

| Feature | zkSwap Finance v3 (Sonic) | Uniswap v3 | PancakeSwap |

|---|---|---|---|

| Network | zkSync Era, Sonic | Ethereum | Binance Smart Chain |

| Trading Pairs | 4 | 15,000+ | 1,200+ |

| Avg. Swap Fee | $0.0002 | $1.50-$5.00 | $0.10-$0.50 |

| Confirmation Time | 1.2 seconds | 15-30 seconds | 5-10 seconds |

| Native Token Rewards | $ZF via Swap2Earn | None | $CAKE via staking |

| Total Value Locked (TVL) | $8.7M | $1.85B | $450M |

| Security Score (Certik) | 93 | 87 | 85 |

zkSwap doesn’t compete on volume. It competes on efficiency. For users who care about cost, speed, and passive rewards from daily trading, it’s unmatched in its niche.

Real User Experience

Trustpilot shows 71 verified reviews with a 4.8/5 rating. The most common praise points: “simple,” “fast,” “cheap,” and “rewarding.” One user wrote: “I was impressed with every feature in the app including speed, cheapness, security and however…”-they didn’t even finish the sentence. It was that smooth.

Setup takes less than 10 minutes. Connect your MetaMask or Trust Wallet, switch network to zkSync Era, and you’re ready. The interface is clean: swap, earn, bridge, track. No confusing menus. No hidden fees. Even the heatmap tool, which shows trending tokens on zkSync, is intuitive.

The only hiccup? Bridge delays. Moving funds from Ethereum to zkSync Era can take up to 3.2 minutes. But once you’re on the network, everything moves at light speed.

Market Outlook and Token Price

As of December 2025, $ZF trades at around $0.0023. Its 50-day moving average is $0.002337, and the 200-day is $0.002789. The RSI sits at 35.65-neutral, not overbought or oversold.

Price predictions are split. CoinCodex forecasts a drop to $0.001137 by year-end, while Gate.com sees a rise to $0.00163 average with a possible spike to $0.002005. The truth? The token’s value is tied to trading volume. If zkSwap keeps growing within the zkSync ecosystem, $ZF will rise. If adoption stalls, it could drift lower.

What’s clear: the tokenomics are sustainable. With 75% of fees going to buybacks, the supply is constantly shrinking. That’s not speculation-it’s math.

Who Should Use zkSwap Finance v3?

- You should use it if: You trade $ETH and $USDC regularly, you’re already on zkSync Era or Sonic, you hate high gas fees, and you want to earn something just for swapping.

- You should avoid it if: You want to trade altcoins beyond $ZF, $ETH, and $USDC. Or if you need fiat on-ramps. zkSwap doesn’t support credit cards or bank transfers-you need to buy crypto elsewhere first.

It’s not for beginners who want to try 100 tokens. It’s for regular traders who want to do one thing well: swap fast, cheap, and get paid for it.

Final Thoughts

zkSwap Finance v3 (Sonic) isn’t trying to beat Uniswap. It’s trying to outdo itself. By focusing on a small set of assets, optimizing for zkSync users, and building rewards directly into trading, it created something rare: a DEX that feels like a utility, not a gamble.

The low fees, blazing speed, strong security, and real $ZF rewards make it the best choice for anyone already in the zkSync ecosystem. It’s not perfect-but for what it does, it’s nearly flawless.

Is zkSwap Finance v3 safe to use?

Yes. zkSwap Finance v3 has been audited by six top security firms, including Certik, with a 93/100 score. It uses zk-rollup technology, which is mathematically proven to be secure. The platform also includes tools like Revoke to prevent common DeFi hacks. No major exploits have occurred since its launch.

Can I use zkSwap with MetaMask?

Yes. zkSwap works with MetaMask, Trust Wallet, and other EVM-compatible wallets. You just need to add the zkSync Era network manually in your wallet settings. The platform provides step-by-step guides for setup.

How do I earn $ZF tokens?

You earn $ZF automatically every time you make a trade on zkSwap. The more you swap, the more you earn. There’s no staking or locking required. Rewards are distributed in real time and appear in your wallet immediately after each transaction.

Why does zkSwap only have 3 tokens?

zkSwap focuses on the zkSync Era ecosystem, which prioritizes security and efficiency over volume. By limiting tokens to $ZF, $ETH, and $USDC, the platform ensures deep liquidity, low slippage, and faster confirmations. It’s a deliberate design choice-not a limitation.

What’s the difference between zkSwap v3 and the original version?

zkSwap v3 (Sonic) added native support for the Sonic blockchain, improved the Swap2Earn algorithm, and launched DuoEarn v2.0, which boosts rewards for liquidity providers by 22%. It also upgraded the UI, added the Heatmap tool, and enhanced the bridge insurance system.

If you’re already using zkSync Era, zkSwap Finance v3 isn’t just worth trying-it’s the smartest way to trade. The fees are near zero, the speed is unmatched, and you’re paid just for doing what you already do. No other DEX offers that.

1 Comments

So I’ve been using zkSwap for like three months now, and honestly? It’s the only DEX that doesn’t make me feel like I’m getting robbed every time I swap. I used to trade on Uniswap and just accept that $5 gas fee was just part of life, you know? Like, paying $5 to move $200 of ETH? That’s not finance, that’s extortion.

But zkSwap? I swap $ETH for $USDC, it’s done before I finish my coffee, and I get $ZF tokens just for existing. No staking, no locking, no drama. It’s like they said, ‘Hey, you’re already trading, here’s a thank you.’

I don’t even care that I can’t trade $ARB or $LINK. I’m not here to chase every new memecoin. I just want to move my core assets fast, cheap, and get paid for it. And honestly? That’s revolutionary. I’ve never had a DeFi experience where the platform felt like it was on my side.

I’ve tried to convince my friends to switch. Most of them are like, ‘But what about the other tokens?’ And I’m like, ‘Dude, you’re not using those tokens. You’re just holding them in your wallet while you pay $3 in gas to check their price every hour.’

zkSwap doesn’t pretend to be everything. It just does three things incredibly well. And in DeFi? That’s rare. I’m not a fan of hype. But this? This is real utility.

I’ve got like $18 in $ZF from just weekly swaps. That’s more than I’ve made from staking on other platforms in a year. And I didn’t have to lock anything up. No impermanent loss. No smart contract risks. Just swap and earn. It’s beautiful.

Also, the interface? Clean. No pop-ups. No confusing menus. Just swap, bridge, earn. I’ve used wallets with more features than this, and they’re still worse. Simplicity is power.

Yeah, the bridge takes a few minutes. But once you’re on zkSync? It’s like flying. I’ve never gone back. Ever.