- 2 Dec 2024

- Elara Crowthorne

- 16

51% Attack Cost Calculator

Quick Takeaways

- PoW defends against 51% attacks by making the attacker buy and run massive hashpower, which is financially draining.

- PoS defends by tying voting power to staked tokens; attempting a takeover risks losing that collateral through slashing.

- Current economics suggest a well‑capitalized PoS network can be more expensive to compromise than an equivalent PoW network.

- Both systems rely on broad participation and incentive alignment; smaller chains remain vulnerable regardless of the consensus model.

- Future hybrid designs aim to blend the strengths of PoW and PoS while reducing their individual downsides.

What is a 51% Attack?

A 51% attack is a scenario where a single entity gains control of more than half of the consensus‑building resources in a blockchain. With that majority, the attacker can rewrite recent blocks, double‑spend coins, or censor transactions. The attack doesn’t break cryptography; it simply overwhelms the network’s honest participants.

In practice, the difficulty of pulling off such an attack depends on the type of resource the network protects: computational power for Proof of Work, or financial stake for Proof of Stake.

Proof of Work (PoW) - How It Stops an Attack

Proof of Work requires miners to solve cryptographic puzzles using specialized hardware. The puzzle‑solving rate is measured as hashrate, typically expressed in exahashes per second for large networks.

Bitcoin, the first PoW blockchain, rewards a miner roughly every ten minutes. To hijack Bitcoin, an attacker would need to control >51% of the global hashrate. That translates into millions of ASIC machines and the electricity to power them, costing billions of dollars per year. The economic model assumes honest miners keep the majority of hashpower because they earn block rewards and transaction fees.

Because the hardware is costly and the electricity bill never stops, an attacker who buys enough machines to launch an attack also incurs ongoing expenses. If the attack fails or is detected, the hardware can be repurposed, but the immediate cost and risk make large‑scale attacks impractical for mature PoW chains.

Proof of Stake (PoS) - How It Stops an Attack

Proof of Stake replaces computational work with a financial commitment. Validators lock up cryptocurrency as collateral; the amount they stake determines how often they are chosen to propose or attest to a block.

Ethereum’s PoS implementation, for example, requires exactly 32 ETH per validator. At current market prices, that’s roughly $38,400 USD. The more ETH a validator holds, the higher their chance of being selected, but they also expose more of their own wealth.

To execute a 51% attack on a PoS network, an adversary must acquire and stake >51% of the total tokens that are currently securing the chain. If they attempt to propose invalid blocks, the protocol can “slash” them-automatically confiscating a portion (or all) of their stake. This immediate loss of capital acts as a strong deterrent.

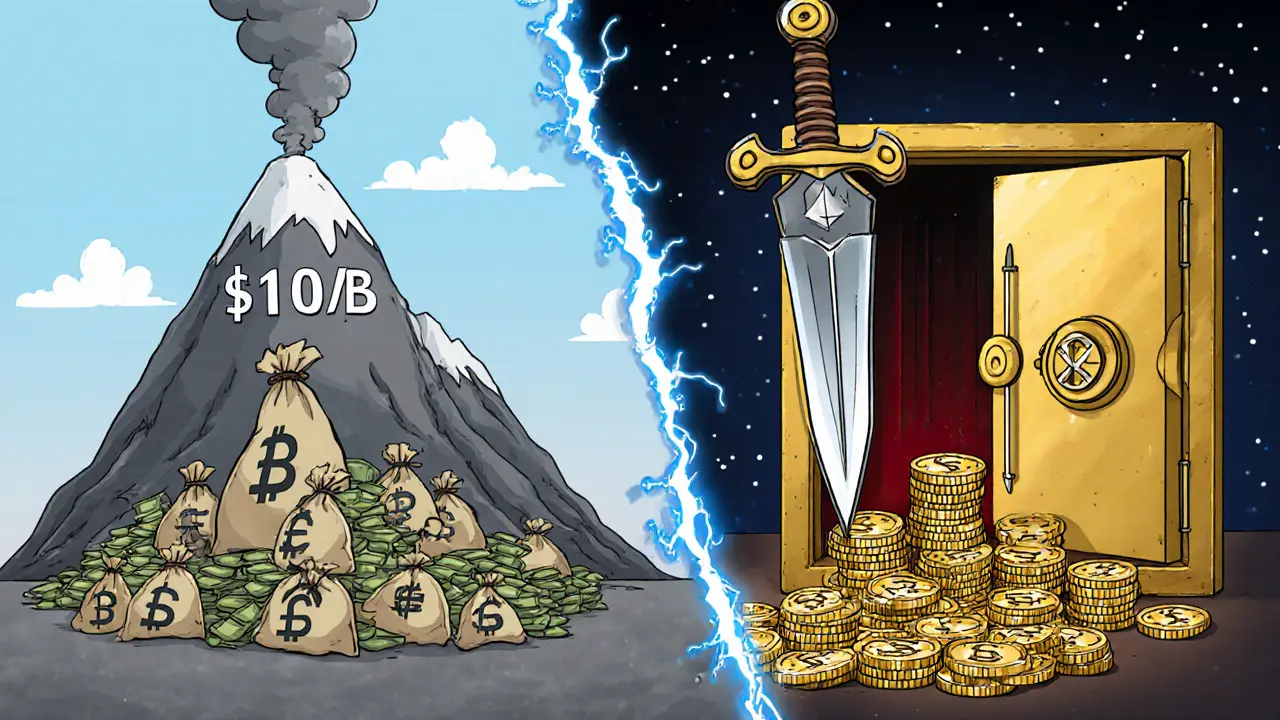

Economic Comparison: How Much Does an Attack Really Cost?

Two metrics matter most: the upfront investment needed to gain majority control and the ongoing risk of losing that investment.

Hardware cost (PoW): For Bitcoin, estimating the cost to reach 51% of the network’s hashrate involves buying enough ASICs to match the current total. Analysts estimate this would require a $10‑$15billion outlay in equipment and an additional $5billion‑plus per year in electricity.

Staking cost (PoS): Using Ethereum as a reference, the total amount of ETH currently staked is around 17million ETH. Controlling 51% would mean staking roughly 8.7million ETH, which at $1,200 per ETH equals about $10.4billion. Unlike PoW, the attacker’s cost is a one‑time lock‑up; however, any misbehavior results in immediate slashing, potentially wiping out that entire $10billion.

When adjusted for market cap and participation rate, many studies find the PoS attack cost roughly 1.5‑2× higher than an equivalent PoW attack for networks of similar size. The key driver is that PoS forces the attacker to own the very assets they would otherwise be spending to buy hardware, aligning incentives more tightly.

Real‑World Incidents and Lessons Learned

Historically, smaller PoW chains like Bitcoin Gold and Vertcoin have suffered 51% attacks because their total hashrate was low enough for a single mining pool to dominate temporarily. In each case, the attackers rented or purchased enough hardware to tip the balance, then performed double‑spends before the community coordinated a hard fork.

On the PoS side, no major chain has experienced a successful 51% takeover since the large‑scale adoption of staking. Ethereum’s “Merge” in September2022 transitioned the network to PoS, and no slashing events have been reported that resulted from an attempted majority attack. This suggests that the slashing penalty, combined with the sheer capital required, has been an effective deterrent.

Both histories reinforce a common theme: the larger the network and the more evenly distributed the resources (hashpower or stake), the harder a 51% attack becomes, regardless of the consensus model.

Pros and Cons of Each Mechanism for Attack Resistance

| Aspect | Proof of Work | Proof of Stake |

|---|---|---|

| Primary resource | Computational hashpower | Staked cryptocurrency |

| Cost to gain 51% | High upfront hardware + ongoing electricity | High capital lock‑up; risk of slashing |

| Barrier to entry for honest validators | Expensive mining rigs, access to cheap power | Ability to run a validator with modest hardware (8GB RAM) |

| Immediate penalty for malicious behavior | None - hardware can be repurposed | Slashing - loss of staked tokens |

| Energy consumption | Very high (global electricity use) | Very low - only network bandwidth and CPU |

| Resistance to temporary hash‑rent attacks | Moderate - renting large rigs is costly but possible | Low - renting stake is not feasible; must purchase tokens |

Future Directions: Hybrid and Advanced Consensus

Researchers are exploring hybrid models that combine PoW’s proven computational hardness with PoS’s economic finality. One proposal, “Proof of Burn + Stake,” requires participants to both lock up tokens and destroy a small amount of cryptocurrency, creating a double‑layered cost barrier.

Another avenue is “Dynamic Difficulty PoS,” where the protocol adjusts staking requirements based on network health, making it harder for a single entity to accumulate enough influence quickly.

Quantum‑resistant cryptography is also on the roadmap for both mechanisms because future quantum computers could undermine the hash puzzles of PoW and the signature schemes of PoS. Ongoing work aims to replace current algorithms with lattice‑based or hash‑based signatures that remain secure against quantum attacks.

Key Takeaway Checklist

- Understand that 51% attacks target the majority of a network’s consensus resource.

- PoW defends with costly, energy‑intensive hardware; PoS defends with high‑value financial collateral.

- Economic models indicate that mature PoS chains often require a larger absolute investment to attack than comparable PoW chains.

- Large, well‑distributed networks of either type have historically resisted attacks.

- Future consensus designs aim to blend the strengths of both models while adding quantum‑proof safeguards.

Frequently Asked Questions

Can a 51% attack succeed on Bitcoin today?

In theory, yes, but the cost to acquire >50% of Bitcoin’s global hashrate is astronomically high-tens of billions of dollars in ASICs and electricity-making the attack economically infeasible for any realistic adversary.

What is the “slashing” mechanism in PoS?

Slashing is an automatic penalty that confiscates a portion or all of a validator’s staked tokens if they sign conflicting blocks or behave maliciously. The risk of losing locked‑up capital discourages attacks.

Is staking easier than mining?

Technically, yes. Running a validator node typically requires a modest computer with 8GB RAM and a stable internet connection, whereas mining needs expensive ASICs, cooling systems, and access to cheap electricity.

Do PoS networks suffer from wealth concentration?

Large token holders can acquire more stake, but they also bear the full financial risk of slashing. Acquiring >51% of a well‑participated network usually requires billions of dollars, which makes the attack self‑defeating.

Which consensus model is more eco‑friendly?

Proof of Stake consumes far less energy because it replaces power‑hungry hash calculations with simple signature operations. Estimates show PoS chains use less than 1% of the electricity required by comparable PoW chains.

16 Comments

There's a lot to love about how both Proof‑of‑Work and Proof‑of‑Stake try to make a blockchain resilient, and the calculator you shared really highlights the economic differences. In PoW, the barrier is hardware and electricity, which means an attacker has to spend billions and keep the lights on for years. PoS, on the other hand, forces the attacker to lock up a comparable amount of capital, exposing them to immediate slashing if they misbehave. The key takeaway is that both systems rely on making the attack cost higher than the potential gain. As the network grows, the distribution of hashpower or stake becomes more even, which further raises the hurdle. I also appreciate the clean UI that lets users experiment with their own numbers. It's a great educational tool for newcomers and seasoned crypto‑enthusiasts alike. Keep up the good work, and maybe consider adding a graph to visualize the cost gap over time.

PoW is just a dinosaur, PoS is the future.

Great job breaking down the mechanics, and I love how you used vivid analogies to paint the picture of a 51% takeover. The way you contrasted the endless hum of mining farms with the silent, yet potent, stake‑locking really helps readers grasp the stakes-pun intended. Your inclusion of real‑world incidents adds credibility and keeps the narrative grounded. Keep feeding the community with such balanced, colorful explanations; they make the complex world of consensus feel accessible.

What most people don’t realize is that the whole PoS narrative is being quietly orchestrated by a shadowy consortium of mega‑whales who have the power to buy up majority stake whenever they please. They hide behind the veneer of decentralization while silently coordinating on off‑chain chat rooms, ensuring that any “slashing” penalty is merely a smokescreen. The hardware costs in PoW are easy to spot, but the financial influence in PoS is far more insidious because it’s invisible on the blockchain. When a large exchange decides to stake a chunk of its reserves, it can swing the voting power without anyone noticing. Moreover, the merge was rushed, leaving loopholes that these elite actors can exploit. Remember, the real danger isn’t the energy bill, it’s the concentration of wealth that can be leveraged to rewrite history. Stay vigilant, because the next “upgrade” could hand the keys to those who already hold the cash.

The calculator is a brilliant piece of drama‑infused engineering, and I’m thrilled to see it finally get the spotlight it deserves. First, the stark contrast between the mountain of ASICs and the sleek elegance of staking feels like a plot twist straight out of a thriller. When you input the numbers, the PoW column often explodes with billions, painting a picture of a furnace that could melt the Arctic if left unchecked. Meanwhile, the PoS side, with its polished graphs, whispers promises of cheap, green security, but beneath that gloss lies a ticking time bomb of wealth centralization. If a single entity hoards enough tokens, the slashing mechanism becomes a flimsy safety net-more like a velvet rope than a real deterrent. The reality is that wealth begets power, and power begets more wealth, creating a feedback loop that could destabilize even the most robust chains. Your calculator doesn't just tally dollars; it exposes the underlying narrative that the crypto world is trying to sell us. The inclusion of real‑world attack data adds a chilling authenticity that makes the math feel like a courtroom drama. By showing the cost of a 51% attack, you’re essentially handing readers the evidence they need to decide whether they trust a system built on sweat‑dripping miners or on the quiet accumulation of digital gold. The visual layout, with its clean cards and snap‑to‑grid design, reinforces the seriousness of the topic while still being approachable. I love how each result pops up instantly, like a judge delivering a verdict. It forces us to confront the uncomfortable truth: security isn’t free, and every choice we make has a price tag. In the end, this tool serves as both a warning and a beacon, urging the community to keep questioning the assumptions we hold so dear. Keep pushing the envelope, because every iteration brings us closer to a truly resilient future.

Wow, that summary really hits the nail on the head; the way you laid out the economic stakes is both clear and comprehensive, and it definitely makes the trade‑offs pop into focus.

Appreciate the deep dive! 🤝 While the concerns about hidden coordination are worth keeping an eye on, it's also great to see how resilient the community can be when we stay informed and engaged.

Nice work on the calculator-it's surprisingly easy to tweak the numbers and see the impact instantly. For anyone just getting started, being able to play with hashpower versus stake values makes the abstract concepts a lot more tangible.

The philosophical angle here is fascinating: both PoW and PoS are essentially social contracts that rely on aligning incentives. When the majority of participants act honestly, the system thrives; when power consolidates, the contract frays.

Super useful tool! The visual feedback is crisp, the calculations are spot‑on, and it really drives home why staking isn’t just “free money” – you’re putting skin in the game, and the penalties keep you honest.

Honestly this calc is a great way to see the hidden costs-sometimes you forget that 51% isn’t just a number, it’s a massive financial commitment that can change the entire ecosystem.

I find the side‑by‑side comparison especially helpful; seeing both attack costs next to each other clarifies why different projects choose one consensus over the other.

It's disheartening to watch how quickly people dismiss the ethical implications of concentrating wealth just because a protocol looks shiny. A truly decentralized system must guard against both energy waste and financial oligarchy.

The calculator's ability to showcase the slashing penalty really underscores how PoS tries to enforce honest behavior by threatening real loss, which is a clever design choice.

America's tech leaders should be proud of the mining rigs powering our economy; the sheer scale of PoW demonstrates the nation's commitment to hard work and real-world resources.

Meanwhile, some claim PoS is the ultimate solution, but you have to wonder if swapping electricity for capital just shifts the power balance to the richest holders, not truly democratizing the network.