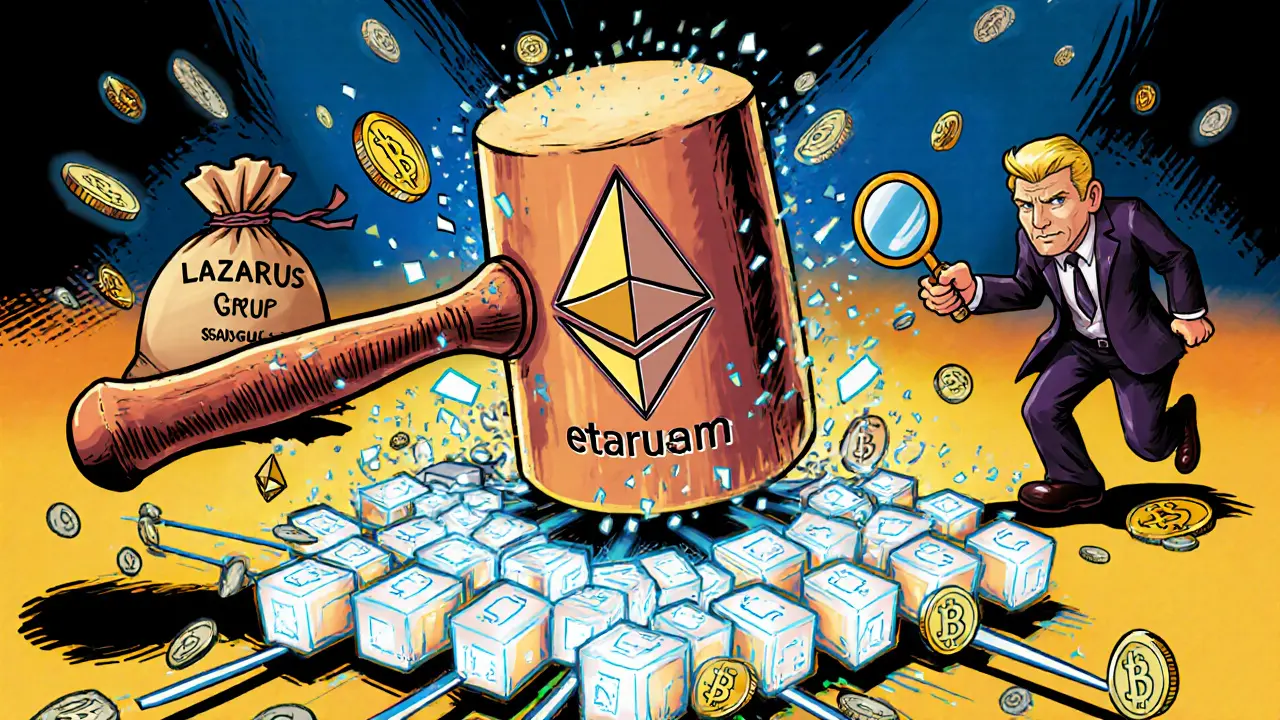

The U.S. sanctioned Tornado Cash in 2022 for laundering billions in crypto, including funds from North Korean hackers. This landmark case raised legal questions about regulating decentralized code-and changed crypto privacy forever.

US Sanctions and Crypto: What You Need to Know About Legal Risks and Compliance

When you hold crypto on a foreign exchange or use a platform outside the US, you might be subject to US sanctions, enforcement actions by the US government that restrict financial activity with certain entities or jurisdictions. Also known as financial restrictions, these rules don’t just target big firms—they apply to individual holders too. If you’re using an exchange like CRXzone or FEX that has no clear legal standing, or if you’ve held assets on a platform that got flagged, you could be at risk—even if you didn’t know the rules.

US sanctions aren’t just about blocking transactions. They trigger FBAR penalties, massive fines for failing to report foreign financial accounts, including crypto wallets and exchanges, to the IRS. If you had over $10,000 in crypto on a non-US platform last year and didn’t file, you could face up to $100,000 in penalties. This isn’t theoretical. People are already getting hit. And it’s not just about reporting. Countries like Nigeria now require all crypto businesses to get a VASP license, a legal authorization from financial regulators to operate as a virtual asset service provider. If you’re running a business or even just trading heavily, you need to know if your platform is compliant—or if you’re unknowingly breaking the law. Meanwhile, China’s full crypto ban and asset seizures show how quickly governments can act. The US may not ban crypto outright, but it’s tightening control through enforcement, not legislation.

What you’ll find below isn’t theory. These are real cases: exchanges that vanished without warning, airdrops that were scams, tokens that died because no one cared—and people who lost money because they didn’t check the legal landscape. Some posts expose platforms with no regulation. Others break down how to avoid FBAR traps or spot a fake VASP license. You’ll see how crypto seizures work, why some tokens are dead on arrival, and what happens when a platform ignores compliance. This isn’t about fear. It’s about clarity. If you’re holding, trading, or building in crypto, you need to know where the lines are. The rules are changing fast. Don’t wait until you’re the one getting called out.