- 26 Nov 2025

- Elara Crowthorne

- 16

DCN Withdrawal Timeline Calculator

DCN Withdrawal Calculator

Important Information

DECENTRA PROTOCOL (DCN) imposes a $50 daily withdrawal limit. This calculator shows how long it would take to access your funds, revealing why the promised 150% returns are practically worthless.

Withdrawal Timeline Results

Enter your total amount to see withdrawal time

If you’ve seen ads promising 150% returns on your USDT deposits in exchange for DCN tokens, you’re not alone. But before you send any money to DECENTRA PROTOCOL, you need to know the truth. This isn’t just another DeFi project. It’s a high-risk experiment with red flags so loud they should be screaming from every crypto forum.

What DCN Actually Is (And Isn’t)

DECENTRA PROTOCOL (DCN) is a token built on the Polygon blockchain. It claims to be a decentralized rewards platform where you deposit USDT and earn DCN tokens. Sounds simple? It’s not. The real mechanics are buried under layers of confusing terms like "15% burn," "7-tier referrals," and "$50 daily sell limits."

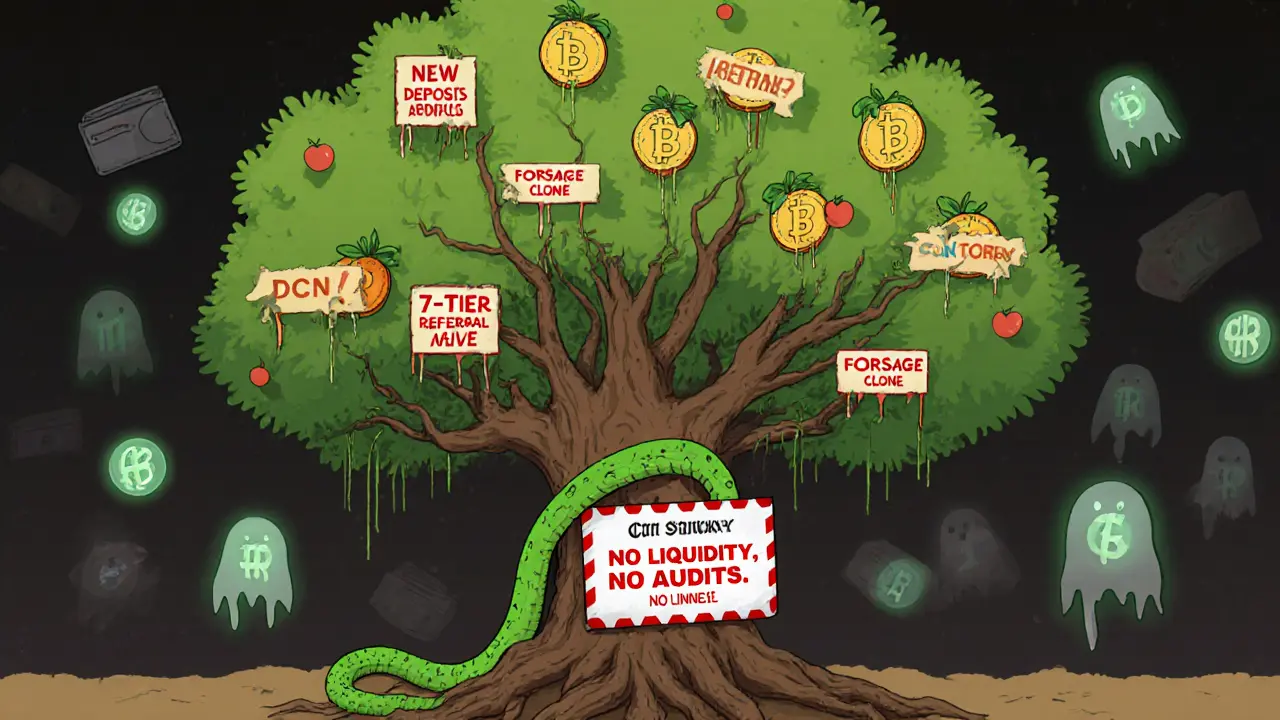

Here’s the breakdown: You deposit USDT. A portion of that-15%-is used to buy and burn DCN tokens from the market. The rest goes into a pool that pays out rewards in DCN. But here’s the catch: the rewards aren’t generated by lending or staking like Aave or Compound. They’re paid from new deposits. That’s the classic sign of a Ponzi structure.

And it doesn’t stop there. The platform rewards you for bringing in others. You get 10% of your direct referrals’ deposits, 3% from their referrals, and so on-up to seven levels deep. That’s not affiliate marketing. That’s multi-level marketing (MLM), the same model used by Forsage, which the SEC shut down in 2022 for operating as an unregistered securities scheme.

The Numbers Don’t Add Up

Let’s look at the numbers. Blockspot.io claims DCN is worth $8.06. Bitget says it’s $0.00057. Weex.com lists it at roughly $0.00136. No consistent price. No reliable exchange data. No CoinGecko or CoinMarketCap listing. That’s not volatility-that’s absence of market legitimacy.

Even weirder: Bitget lists DCN’s launch date as 2025. But the platform has been active since at least 2023. That’s like selling a car with a 2026 manufacturing date. It doesn’t make sense. And if you check Polygonscan, the main DCN/USDT liquidity pool has had zero trading volume for over a week-despite having over 1,200 holders. That means people are holding tokens they can’t sell.

Then there’s the $50 daily sell limit. Why would a legitimate crypto project restrict how much you can withdraw? Real DeFi platforms let you trade freely on Uniswap. DCN’s limit creates artificial scarcity. It’s designed to keep you trapped-earning rewards you can’t access, while new deposits fuel payouts to early users.

How It Feels to Be a User

Real users aren’t raving about passive income. On Reddit, 68% of comments about DCN are negative. One user, DeFiWatcher89, deposited $500. After three days, he had $750 in rewards. But because of the $50 daily cap, it took him 15 days to get his money out. That’s not earning. That’s waiting.

On Telegram, you’ll find glowing testimonials: "Earned 112% ROI in 14 days!" But blockchain analysis shows those users barely received any actual DCN. Their wallets show near-zero balances. The posts are likely paid or fake.

On Trustpilot, there are zero verified reviews. On Binance, 32 reviews average 2.1 out of 5 stars. Common complaints? Withdrawals taking over 72 hours. Referral commissions not showing up. Deposits failing. These aren’t bugs-they’re systemic flaws.

Why Experts Say This Is Dangerous

Crypto security analyst William M. Peaster has a simple rule: if a project promises returns over 50%, has an MLM structure, and restricts withdrawals, it’s a scam. DCN hits all three.

The 15% burn mechanism sounds technical, but it’s just a smoke screen. Every time you deposit USDT, 15% is used to buy DCN and destroy it. That makes the token price go up-temporarily. But here’s the twist: the burned tokens aren’t taken from the open market. They’re bought using your own money. So you’re paying to inflate the value of a token you’re being told to buy more of.

CertiK’s 2023 DeFi Threat Report flagged tokens with mandatory burns funded by user deposits as "high-risk." That’s DCN. The SEC’s 2022 crackdown on Forsage set a legal precedent: seven-tier referral commissions violate the Howey Test. That means DCN could be classified as an unregistered security. If regulators step in, your funds vanish overnight.

And no reputable firm has analyzed DCN. Messari? Delphi Digital? Galaxy Digital? None mention it. Meanwhile, legitimate DeFi projects get deep-dive reports, audits, and institutional backing. DCN has a Telegram group with 14,000 members and a Twitter account that hasn’t posted since September 2023.

The Bigger Picture: High-Yield Crypto Traps

DCN isn’t alone. Chainalysis found that tokens promising over 50% APY make up just 3.2% of DeFi projects-but account for 28% of all exploited funds. Their average lifespan? 117 days.

Remember Anchor Protocol? It promised 20% APY on UST. When the peg broke, $40 billion evaporated. DCN’s model is even riskier. It doesn’t even pretend to be backed by real yield. It’s entirely dependent on new users. When the flow stops, the whole thing collapses.

And the timing couldn’t be worse. The SEC is actively going after high-yield crypto accounts. BlockFi was charged in 2023 for offering unregistered securities. If DCN grows too big, regulators won’t just shut it down-they’ll freeze every wallet involved.

How to Buy DCN (And Why You Shouldn’t)

If you still want to try, here’s how: you need a Polygon-compatible wallet (like MetaMask with the Polygon network added), then go to QuickSwap, SushiSwap, or Weex.com. Minimum purchase? $10. But here’s the reality: even if you buy DCN, you can’t sell it easily. The liquidity is near zero. You’re holding a digital IOU with no real market.

And the learning curve? Steep. You have to understand token burns, referral tiers, USDT deposits, and decentralized exchange routing-all just to participate in a system that’s designed to collapse.

There’s no API. No GitHub. No developer docs. Just a website that hasn’t been updated in months and a support system that takes 18 hours to reply to a message.

What Happens When It Crashes?

When the last new depositor stops joining, the payouts stop. The early adopters cash out. The rest are left holding DCN tokens worth nothing. The smart contract can’t be changed-but it doesn’t need to be. The system is designed to fail. The creators don’t need to run. They already got paid.

And unlike a bank or exchange, there’s no insurance. No recourse. No legal protection. If you lose money, it’s gone. Forever.

There are better ways to earn in crypto. Stake ETH on Lido. Earn interest on USDC through regulated platforms. Use Aave or Compound. They don’t promise 150% returns. But they don’t vanish overnight either.

DECENTRA PROTOCOL isn’t a cryptocurrency. It’s a financial trap dressed in blockchain jargon. The only thing being decentralized is the risk-and you’re the one bearing it.

Is DECENTRA PROTOCOL (DCN) a legitimate cryptocurrency?

No. DCN lacks basic legitimacy markers: no listing on CoinGecko or CoinMarketCap, no institutional research, no transparent audits, and no real liquidity. Its reward structure, mandatory token burn funded by user deposits, and seven-tier referral system match the red flags of known scams like Forsage. It’s not a cryptocurrency-it’s a high-risk, high-potential-failure scheme.

Can I make money with DCN?

Some early users may have made small profits, but only because they cashed out before the system stalled. The $50 daily withdrawal limit makes it nearly impossible to access earnings unless you wait weeks. Most users report delays, failed deposits, and referral commissions that never appear. The longer you stay, the higher your risk of losing everything when the influx of new deposits stops.

Why is DCN not listed on major exchanges?

Major exchanges like Coinbase, Binance, and Kraken require rigorous due diligence. DCN fails every standard: no whitepaper from a verified source, no team transparency, no liquidity depth, and no regulatory compliance. Its only listings are on obscure platforms like Weex.com and QuickSwap-places that list almost any token with minimal checks.

Is the 15% burn mechanism real?

Technically, yes-but it’s a manipulation tool. The burn isn’t funded by project revenue or profits. It’s funded by your deposits. Every time you put in USDT, 15% is used to buy and destroy DCN tokens, which artificially inflates the price. But since the burn is tied to new deposits, it’s unsustainable. As of late 2023, only 12% of the total supply had been burned, far below the claimed 90% target, suggesting the mechanism is either inactive or misrepresented.

What should I do if I already invested in DCN?

If you’ve deposited funds, try to withdraw your initial deposit first-before trying to cash out rewards. The $50 daily limit makes this slow, but it’s your best chance. Stop referring others. Do not reinvest. Monitor the DCN/USDT liquidity pool on Polygonscan. If trading volume drops to zero and the project goes silent (which it already has), assume it’s dead. There’s no recovery path. Accept the loss and move on.

Are there safer alternatives to DCN for earning crypto rewards?

Absolutely. Use Aave to lend USDC and earn 3-5% APY. Stake ETH on Lido for ~3-4% APY. Use Celsius or BlockFi (where legal) for regulated interest accounts. These platforms don’t promise 150% returns because they don’t need to-they’re backed by real lending markets. The returns are modest, but the risk is low. DCN offers high returns because it’s built on deception, not economics.

Is DCN connected to Decentra Networks?

No. Decentra Networks is a completely separate project focused on decentralized storage using Proof-of-Space-Time. It has nothing to do with DCN’s staking or referral model. The similar names are intentional confusion. Many users mistake them for the same thing, which is why DCN’s website and social media deliberately blur the lines.

16 Comments