Paritex is a beginner-friendly crypto exchange based in Turkey with fair trading fees but high withdrawal costs. It's simple to use but lacks payment options and advanced features. Best for Turkish newcomers, not global traders.

Crypto Regulations and Exchanges in November 2025: Compliance, Scams, and Real Platforms

When it comes to crypto regulations, the legal rules that govern how cryptocurrencies are traded, taxed, and reported, especially in the U.S. and key global markets. Also known as crypto compliance, it's no longer optional—it's the line between staying in business and facing fines or jail. In November 2025, regulators didn’t just tighten rules—they made them unavoidable. From FinCEN’s updated reporting requirements to Nigeria’s strict VASP licensing, if you’re running or using a crypto service, you’re now under the microscope.

One major theme this month was FinCEN registration, the mandatory U.S. federal process that all crypto exchanges must complete to legally operate. Also known as MSB registration, it’s not paperwork—it’s a firewall against money laundering. Missing it means your exchange gets shut down, and your users lose access overnight. Meanwhile, VASP licensing, the legal requirement for crypto businesses in Nigeria to register with the SEC. Also known as crypto business permits, it’s forcing local platforms to clean up or disappear. These aren’t just rules—they’re survival checks. And it’s not just about legality. Scams exploded in November, with fake airdrops like AFEN Marketplace and Yum Yum exchange tricking users into handing over private keys. Meanwhile, dead tokens like ArbitrageCT and Fire Lotto were exposed as relics, not investments. The market didn’t just move—it filtered out the noise.

On the exchange side, November gave us a clear split: platforms built for real users and those built to disappear. Crypto exchange reviews showed that beginners need simple, regulated tools like Global Blockchain Exchange or Paritex—no fancy features, just safety and clarity. But traders looking for altcoins found narrow options like Rfinex or Bitwyre Indonesia, both offering low fees but high risk. And if you’re in a restricted country? Compliance-first trading isn’t a buzzword—it’s your only way out. You can’t rely on banks. You can’t trust unregulated platforms. You need self-custody, clear rules, and zero illusions.

What you’ll find below isn’t just a list of articles. It’s a map. A map of who’s licensed, who’s banned, who’s lying, and who’s actually building something that lasts. Whether you’re checking if your exchange is safe, wondering if that new token is a scam, or trying to stay legal in your country—every post here cuts through the hype. No fluff. Just facts you can use before you send your next transaction.

- 29 Nov 2025

- Elara Crowthorne

- 14

FinCEN Registration Requirements for Crypto Exchanges: What You Need to Know in 2025

FinCEN registration is mandatory for U.S. crypto exchanges. Learn the 2025 compliance rules, state licensing requirements, AML obligations, and real costs to avoid shutdowns or criminal charges.

- 28 Nov 2025

- Elara Crowthorne

- 21

Bitwyre Indonesia Crypto Exchange Review: What You Need to Know Before March 2025 Launch

Bitwyre Indonesia launches March 14, 2025 as an OTC-focused crypto exchange targeting professional traders. Learn how it compares to Indodax and Tokocrypto, its fees, security, referral program, and whether it's right for you.

- 27 Nov 2025

- Elara Crowthorne

- 19

Compliance-First Crypto Trading in Restricted Countries: How to Stay Legal

Learn how to trade crypto legally in restricted countries by following a compliance-first approach-understanding local bans, using self-custody wallets, avoiding banking traps, and staying ahead of regulations.

- 26 Nov 2025

- Elara Crowthorne

- 16

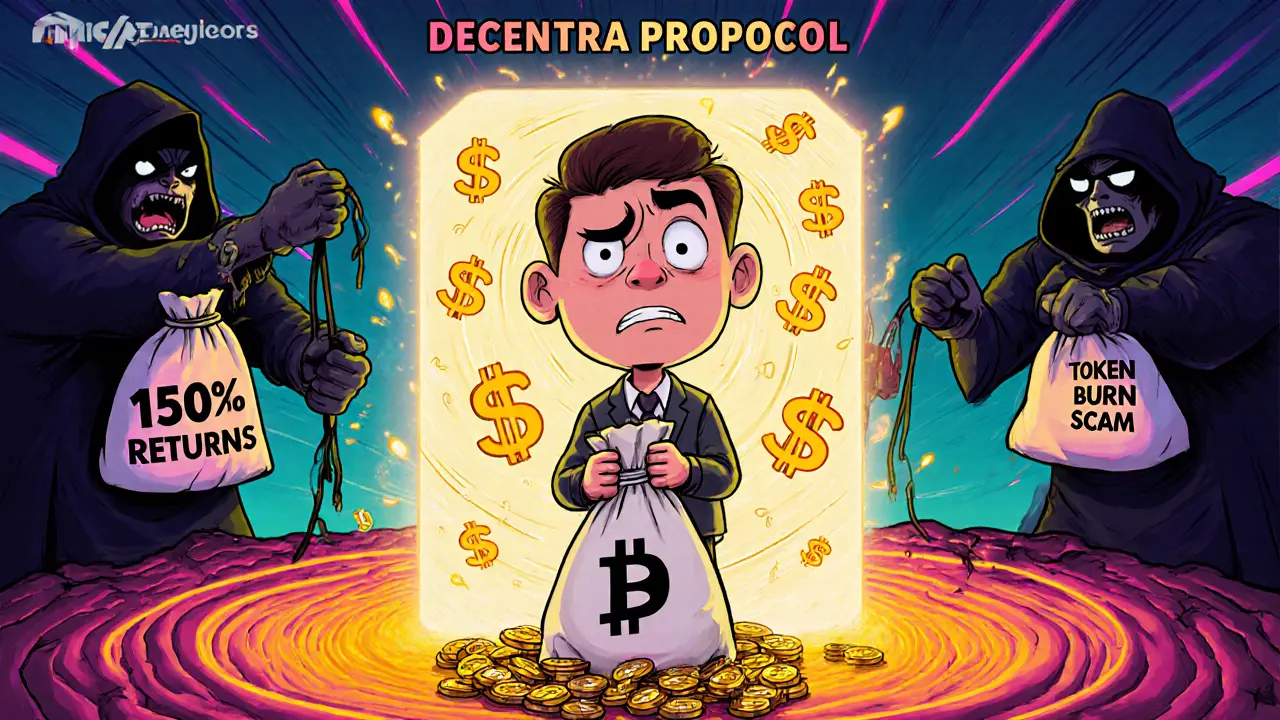

What is DECENTRA PROTOCOL (DCN) Crypto Coin? The Truth Behind the High-Risk Reward Scheme

DECENTRA PROTOCOL (DCN) promises high returns through staking and referrals, but its structure, lack of liquidity, and MLM model point to a high-risk scam. Learn why experts warn against it and what safer alternatives exist.

Global Blockchain Exchange is a secure, user-friendly crypto platform ideal for beginners holding Bitcoin and Ethereum. With strong regulatory compliance and seamless wallet-exchange integration, it’s safe but lacks altcoins and advanced tools traders need.

- 24 Nov 2025

- Elara Crowthorne

- 20

CRXzone Crypto Exchange Review: Is It Safe or Just Another Risky Platform?

CRXzone crypto exchange lacks regulation, security transparency, and user reviews. With no licensing, hidden fees, and no customer support, it's a high-risk platform best avoided in favor of proven alternatives like Kraken or Bybit.

- 23 Nov 2025

- Elara Crowthorne

- 22

VASP Licensing in Nigeria: Requirements and Process for Crypto Businesses

Nigeria now requires all crypto businesses to obtain a VASP license from the SEC. Learn the capital, documentation, and compliance requirements to legally operate in the country.

The U.S. sanctioned Tornado Cash in 2022 for laundering billions in crypto, including funds from North Korean hackers. This landmark case raised legal questions about regulating decentralized code-and changed crypto privacy forever.

- 21 Nov 2025

- Elara Crowthorne

- 21

What is Single Finance (SINGLE) crypto coin? Token basics, market status, and DeFi role in 2025

Single Finance (SINGLE) is a Cronos-based DeFi token for yield farming and governance, but as of 2025, it's in steep decline with near-zero trading volume and no visible development. Is it worth holding?

- 21 Nov 2025

- Elara Crowthorne

- 13

What is Single Finance (SINGLE) Crypto Coin? Token Details, Market Status, and DeFi Role in 2025

Single Finance (SINGLE) is a low-volume DeFi token on the Cronos blockchain focused on yield farming and governance. As of 2025, its price is falling, liquidity is thin, and user adoption is minimal-making it a high-risk, low-reward asset.

- 20 Nov 2025

- Elara Crowthorne

- 16

What is ArbitrageCT (ARCT) Crypto Coin? The Full Story Behind a Dead Token

ArbitrageCT (ARCT) was launched in 2017 as an automated crypto arbitrage tool, but today it has zero trading volume, no community, and no updates. It's a dead token - not a scam, but a complete failure.