- 11 Dec 2025

- Elara Crowthorne

- 23

mimo.exchange Gas Fee Calculator

mimo.exchange requires Ethereum gas fees for every transaction. With its low trading volume and unstable platform, these fees can eat up most of your trade value. Calculate how much of your transaction would be consumed by gas fees.

When you hear "mimo.exchange," you might think it’s another crypto exchange like Binance or Coinbase - a place to buy Bitcoin, trade altcoins, or stash your Ethereum. But here’s the truth: mimo.exchange isn’t built for everyday traders. It’s a narrow, technical tool tied to a small DeFi project that’s struggling to stay online. If you’re looking for a reliable place to trade crypto, this isn’t it.

What Is Mimo.exchange Really?

Mimo.exchange is a decentralized exchange (DEX) linked to the Mimo DeFi protocol. It doesn’t operate like traditional exchanges. There’s no customer support chat, no mobile app, and no simple buy button. Instead, you need an Ethereum wallet - like MetaMask - and you have to understand wrapped ETH (wETH), gas fees, and how to connect to DeFi protocols. It’s not beginner-friendly. It’s not even mid-level friendly. It’s for people who already live in the DeFi world and specifically want to trade Euro-pegged stablecoins. The platform only supports 27 cryptocurrencies and 29 trading pairs. Compare that to Binance, which offers over 1,500 coins. Or even Kraken, which has 200+. Mimo.exchange’s entire purpose is to facilitate trades around PAR, its Euro-pegged stablecoin. That’s it. If you don’t care about EUR-backed assets, you won’t find anything useful here.Operational Instability Is a Major Problem

In March 2024, ScamAdviser reported that mimo.exchange was returning a 503 Service Unavailable error. That means the site was down - not just slow, but completely unreachable. This wasn’t a one-time glitch. The domain has been around since 2015, yet it still can’t maintain basic uptime. That’s a red flag. Major exchanges like Kraken and Coinbase boast 99.99% uptime. They invest millions in infrastructure. Mimo.exchange? There’s no public record of funding rounds, team hires, or technical upgrades. The fact that it’s still down or unstable over a year later suggests either neglect or lack of resources. If your funds are tied up in a wallet connected to a site that vanishes for hours or days, you’re not trading - you’re gambling.Trading Volume? There Isn’t Any

You can’t find trading volume data for mimo.exchange on CoinGecko, CoinMarketCap, or CryptoQuant. Not a single reliable source tracks it. That’s not because it’s too small to measure - it’s because there’s almost no activity. Top 10 exchanges move over $90 billion daily. Mimo.exchange? Probably less than $1 million. Maybe even less than $100,000. Why does this matter? Low volume means slippage. You try to trade 100 PAR tokens, and the price moves 5% before your order fills. It means you can’t exit your position quickly. It means you’re stuck if the market turns. And it means nobody else is using it - which makes it a lonely, risky place to trade.

The MIMO Token Is in Trouble

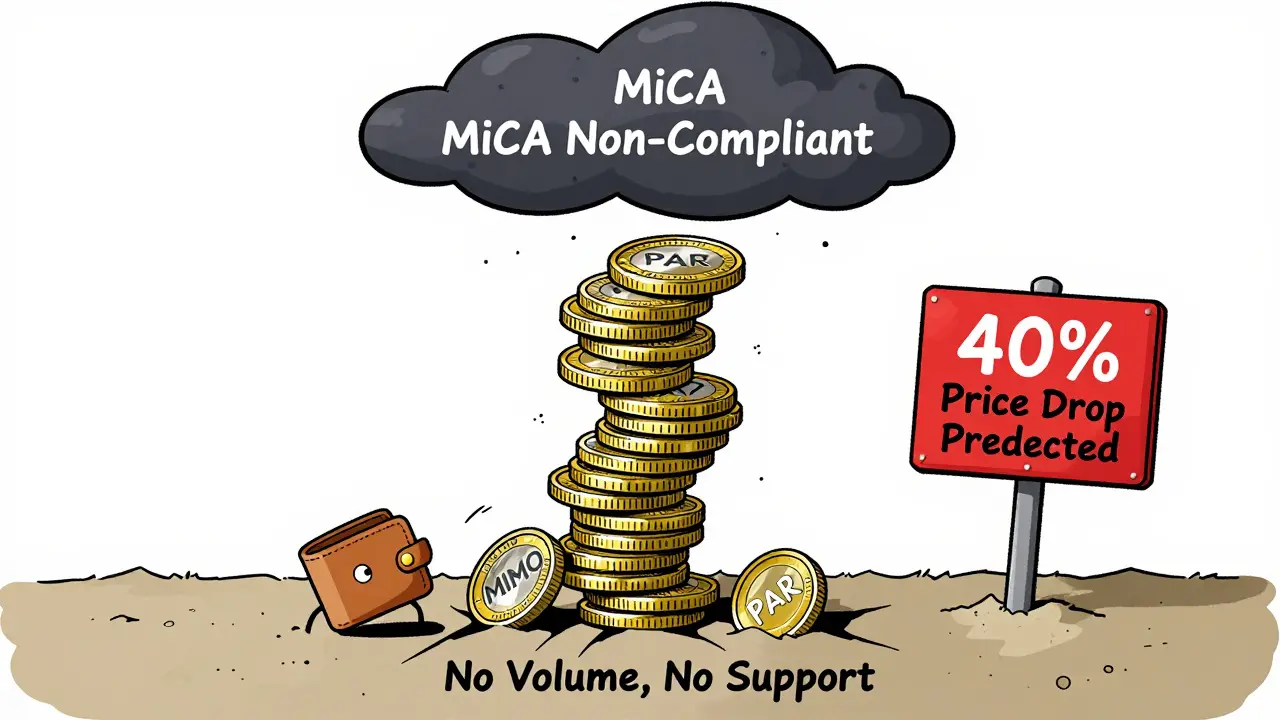

Mimo.exchange is powered by the MIMO token, used for governance in the DeFi protocol. But the market doesn’t believe in it. CoinCodex’s May 2024 analysis predicted a 40.37% price drop for MIMO by December 2025 - from around $0.0039 to $0.0023. That’s a massive loss for anyone holding it. SwapSpace’s more optimistic forecast of $0.0026-$0.0027 still shows a token that’s barely worth a penny. If the token is collapsing, the whole ecosystem weakens. Governance tokens aren’t just digital collectibles - they’re the backbone of decision-making. If holders lose faith, no one votes on upgrades, no one funds development, and the project dies quietly. MIMO’s price trajectory suggests it’s already on that path.Who Is This For? (Spoiler: Almost No One)

There are two types of people who might use mimo.exchange:- DeFi developers who need to test Euro stablecoin flows on Ethereum

- Speculators betting on PAR’s adoption in Europe

No User Reviews. No Community. No Trust.

You won’t find reviews for mimo.exchange on Trustpilot, Reddit, or Sitejabber. Not one verified user comment. Not one detailed experience. That’s not normal. Even obscure exchanges have at least a few Reddit threads or forum posts. The few scattered mentions on Bitcointalk from 2023 describe people getting locked out after depositing test funds. One user wrote: "Site went down after depositing test funds." Another said: "Trouble connecting wallet." That’s not a feature - that’s a failure. Compare that to Swyftx, which has over 1,200 verified reviews on Trustpilot. Or eToro, with 2,500+ Australian reviews. People talk about those platforms because they use them. Nobody’s talking about mimo.exchange because nobody’s using it.Regulatory Risks Are Growing

The EU’s MiCA regulation came into force in June 2024. It requires all crypto platforms operating in Europe to register, follow strict rules on asset custody, and provide transparency. Mimo.exchange has no public evidence of MiCA compliance. No license. No regulatory disclosure. No legal team mentioned anywhere. That’s dangerous. If regulators crack down on unlicensed DeFi platforms, mimo.exchange won’t be the first to shut down - but it’ll be one of the first to disappear without warning. Your funds could vanish overnight with no recourse.Final Verdict: Don’t Use It

Mimo.exchange isn’t a scam in the traditional sense - the domain is old, SSL is valid, and security scanners don’t flag it as malicious. But it’s not functional either. It’s a ghost platform: technically alive, practically dead. Its only real purpose is to serve a tiny niche: trading Euro-pegged stablecoins in a DeFi environment. But even there, better tools exist. The lack of volume, the broken uptime, the collapsing token, and the absence of user trust make it a high-risk, low-reward experiment. If you’re curious? Try it with $5. Not $500. Not $5,000. $5. See if the site loads. See if your wallet connects. See if you can withdraw. Then walk away. For everyone else - save your time. Use a real exchange. There are dozens of them that work, are safe, and actually have users.Is mimo.exchange safe to use?

Mimo.exchange has a 78% trust score from ScamAdviser based on technical factors like SSL and domain age, which means it’s not a known scam site. But safety isn’t just about being hacked - it’s about reliability. The platform has been down multiple times, has no customer support, and lacks user reviews. If you deposit funds and the site disappears, you won’t get them back. It’s not safe for anything more than tiny test transactions.

Can I buy Bitcoin on mimo.exchange?

Technically, yes - but only if Bitcoin is paired with one of the 27 supported coins, like PAR or wETH. You won’t find a simple "Buy Bitcoin" button. You need to connect a wallet, approve transactions, pay Ethereum gas fees, and manually swap. For most people, this is unnecessarily complicated. Use a centralized exchange instead.

Why does mimo.exchange only support Euro stablecoins?

It’s built around the Mimo DeFi protocol, which focuses on creating PAR, a stablecoin pegged to the Euro. This niche targets European users who want to avoid USD-based stablecoins for regulatory or personal reasons. But the Euro stablecoin market is tiny - less than 2% of the total $130 billion stablecoin market. That’s why mimo.exchange has almost no trading volume.

What’s the difference between mimo.exchange and Binance?

Binance is a centralized exchange with 1,500+ coins, 24/7 support, a mobile app, fiat on-ramps, and over $20 billion in daily volume. Mimo.exchange is a decentralized, niche DEX with 27 coins, no support, no app, and near-zero volume. They serve completely different users. Binance is for traders. Mimo.exchange is for DeFi developers testing Euro stablecoin flows.

Should I invest in the MIMO token?

Based on current data, no. CoinCodex predicts a 40% price drop by the end of 2025. The token has no clear utility beyond governance, and governance is useless if no one uses the platform. With mimo.exchange struggling to stay online and no signs of growth, MIMO is a speculative bet with extremely low odds of success.

Is mimo.exchange regulated?

There is no public evidence that mimo.exchange is registered under any financial authority, including the EU’s MiCA regulation. Without regulatory compliance, users have no legal protection. If funds are lost or the platform shuts down, there’s no recourse. In today’s crypto landscape, unregulated platforms are high-risk - especially for anything beyond small test transactions.

23 Comments

Stick to Binance or Kraken. Save your sanity.

It reminds me of the last days of MySpace.

There is poetry in its silence. And tragedy in its persistence.

🙏