- 17 Feb 2025

- Elara Crowthorne

- 14

Wrapped Bitcoin (WBTC) Calculator

WBTC Value Calculator

WBTC Value Summary

Total Value: $0.00

Equivalent Bitcoin: 0.00 BTC

DeFi Yield Estimator

Projected Annual Yield

Estimated Annual Return: $0.00

Monthly Return: $0.00

Weekly Return: $0.00

How WBTC Works

Wrapped Bitcoin (WBTC) is an ERC-20 token on Ethereum that mirrors Bitcoin 1:1. It allows Bitcoin holders to participate in DeFi without leaving the Ethereum ecosystem.

Each WBTC token is fully collateralized by real Bitcoin held by regulated custodians like BitGo and BiT Global. This hybrid model provides institutional-grade compliance while maintaining Ethereum's transaction speed.

WBTC can be used for lending, liquidity provision, yield farming, and payments in DeFi applications. The token maintains a 1:1 peg with Bitcoin through regular audits and transparent reserves.

Key Takeaways

- Wrapped Bitcoin (WBTC) is an ERC‑20 token that mirrors Bitcoin 1:1 on Ethereum.

- It lets Bitcoin holders tap into lending, DEXs, and yield farms without leaving the Ethereum ecosystem.

- The token is fully collateralized by real Bitcoin held by regulated custodians.

- Centralized custody offers security and compliance, but it also introduces trust risks.

- Getting started requires a Bitcoin wallet, an authorized merchant, and an Ethereum wallet like MetaMask.

What is Wrapped Bitcoin?

When you hear the term Wrapped Bitcoin, think of a digital receipt that represents one Bitcoin on a different blockchain. In technical terms, Wrapped Bitcoin (WBTC) is an ERC‑20 token on Ethereum that is fully backed by an equivalent amount of Bitcoin held in trusted custody.

Because it follows the ERC‑20 standard, WBTC can be moved instantly, swapped on any decentralized exchange, and used as collateral on lending platforms - something you can’t do with native Bitcoin alone.

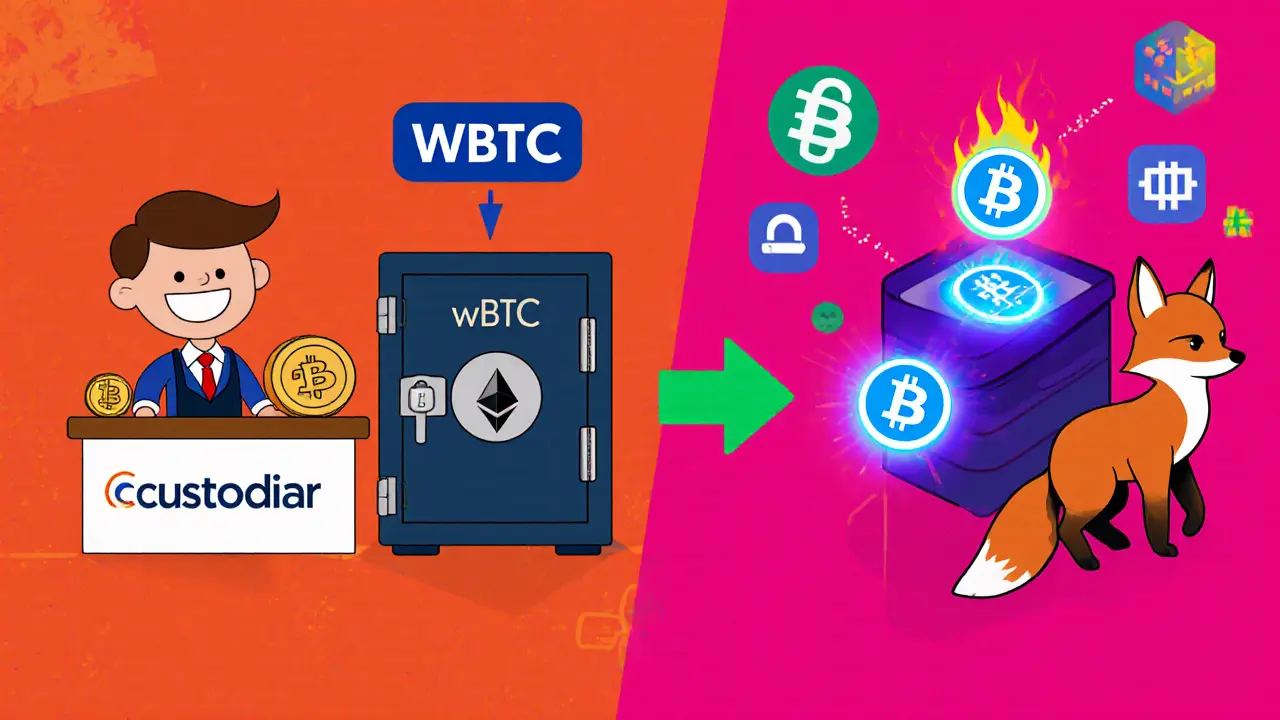

How WBTC Works: The Wrapping Cycle

The process has two sides: minting (wrapping) and burning (unwrapping). Here’s a quick rundown:

- Bitcoin the original cryptocurrency stored on its own blockchain is sent to an authorized merchant a regulated entity that handles user onboarding and compliance.

- The merchant verifies the transaction and forwards the Bitcoin to a custodian a regulated vault that actually holds the Bitcoin (e.g., BitGo or BiT Global).

- Once the custodians confirm receipt, they mint the same amount of WBTC on Ethereum and send it to the user’s Ethereum address.

- To go back, the user initiates a burn transaction on Ethereum, sending WBTC to a designated contract.

- The contract notifies the custodian.

- The custodian releases the equivalent Bitcoin to the user’s Bitcoin address.

The entire cycle is secured by multi‑signature wallets and the oversight of the wBTC DAO the decentralized governance body that manages protocol upgrades and custodian onboarding.

Governance and Custody Model

Unlike fully trustless bridges, WBTC relies on a hybrid model that balances security, compliance, and speed.

Three roles keep the system running:

- Custodians - entities like BitGo a regulated digital asset custodian and BiT Global the newer shared‑custody partner added in 2024 that actually hold the Bitcoin reserves.

- Merchants - exchanges, wallets, or platforms that onboard users, perform KYC/AML checks, and interact with custodians.

- wBTC DAO - a multi‑sig governance group composed of projects like Kyber Network a liquidity protocol that helped launch WBTC and Compound a DeFi lending market that integrated WBTC early on. The DAO votes on new custodians, fee structures, and protocol upgrades.

This structure gives WBTC institutional‑grade compliance while still offering the speed of Ethereum transactions.

Using WBTC in DeFi

Once you have WBTC in an Ethereum wallet (MetaMask, Trust Wallet, etc.), the token behaves like any other ERC‑20 asset. Here are the most common actions:

- Lending & borrowing - Deposit WBTC on platforms such as Aave a money market protocol that supports WBTC as collateral or Compound another lending platform where WBTC earns interest.

- Liquidity provision - Pair WBTC with ETH or stablecoins on DEXs like Uniswap the leading automated market maker. Earn a share of trading fees while staying exposed to Bitcoin’s price.

- Yield farming - Lock WBTC in incentive programs that reward additional tokens (e.g., CRV, STETH) for supplying liquidity.

- Payments and settlements - Some services accept WBTC as a fast, low‑fee payment method compared to moving actual Bitcoin.

All of these use‑cases keep your exposure to Bitcoin but let you earn returns that pure Bitcoin can’t generate.

Pros and Cons Compared to Other Bitcoin Bridges

| Feature | WBTC | renBTC | tBTC |

|---|---|---|---|

| Custody model | Regulated custodians (BitGo, BiT Global) | Hybrid (renVM+ custodians) | Trustless threshold signatures |

| Compliance | KYC/AML via merchants | No built‑in KYC | Minimal compliance |

| Liquidity & integration | Widely integrated across DeFi | Growing but fewer pools | Limited DEX support |

| Decentralization | Centralized custodians (partial decentralization) | More decentralized than WBTC | Fully decentralized |

| Speed of mint/burn | Minutes (merchant processing) | Fast, but depends on renVM | Fast, on‑chain only |

WBTC wins on ease of use and ecosystem reach, while alternatives score higher on pure decentralization. Choose based on what matters most to you - regulatory comfort or trustless design.

Risks and Considerations

- Custodial risk - You trust custodians to hold the Bitcoin 1:1. Any breach or legal seizure could affect the peg.

- Centralization criticism - Bitcoin purists argue that any third‑party custody defeats Bitcoin’s trustless ethos.

- Ethereum gas fees - Wrapping or moving WBTC requires ETH for gas. During network congestion, fees can exceed $30, eroding small‑scale profits.

- KYC/AML obligations - Merchants must verify identity, which may deter privacy‑focused users.

- Peg stability - Historically WBTC has maintained a 1:1 ratio, but extreme market stress could cause temporary deviations.

Understanding these trade‑offs helps you decide if WBTC fits your risk tolerance.

Getting Started: Step‑by‑Step Guide

- Acquire Bitcoin on an exchange or via a peer‑to‑peer purchase.

- Choose an authorized merchant (e.g., Binance, Coinbase, Kraken) that supports WBTC conversion.

- Complete the required KYC/AML verification on the merchant platform.

- Send the exact amount of Bitcoin to the address provided by the merchant.

- Once the merchant confirms receipt, they will mint the matching WBTC and send it to your Ethereum wallet address.

- Connect your wallet (MetaMask, Trust Wallet, etc.) to a DeFi app of choice - Aave for lending, Uniswap for swapping, or Curve for stablecoin pairing.

- When you’re ready to convert back, initiate a burn transaction in the same merchant’s interface and wait for the Bitcoin to be released.

Typical turnaround time ranges from a few minutes (low network load) to a couple of hours (high congestion or manual review).

Future Outlook for WBTC

The August2024 shift to shared custody with BiT Global shows the protocol’s push toward decentralization without sacrificing security. The wBTC DAO is actively scouting additional custodians and even discussing expansion to other EVM‑compatible chains like Polygon or Arbitrum. If these plans materialize, you could see WBTC moving faster and cheaper while still holding the same Bitcoin backing.

Competing bridges are experimenting with threshold signatures and zero‑knowledge proofs, which could eventually out‑compete the custodial model on trustlessness. However, WBTC’s first‑mover advantage, deep integration with major DeFi platforms, and institutional backing keep it a go‑to option for most users today.

Regulators are also paying close attention. As more jurisdictions formalize rules around tokenized assets, custodians may need to obtain additional licenses, potentially increasing compliance costs but also boosting user confidence.

Frequently Asked Questions

How does WBTC maintain a 1:1 peg with Bitcoin?

Every WBTC token is minted only after a custodian receives an equal amount of Bitcoin. The custodian holds the Bitcoin in cold storage, and the protocol’s multi‑signature wallet can only issue or burn tokens when the underlying Bitcoin moves. Audits and public proofs of reserve are published regularly, ensuring the peg stays intact.

Can I use WBTC on non‑Ethereum chains?

Yes. Since WBTC follows the ERC‑20 standard, it works on any EVM‑compatible network (Polygon, Optimism, Arbitrum, etc.). You’ll need to bridge the token from Ethereum to the target chain using a trusted bridge service.

What fees are involved when wrapping or unwrapping?

Wrapping incurs a small protocol fee (usually around 0.1% of the amount) plus the Ethereum gas fee needed to mint the ERC‑20 token. Unwrapping burns the WBTC and triggers a Bitcoin transaction, which also has a miner fee on the Bitcoin network. Both steps require paying the respective chain’s transaction costs.

Is WBTC safe for long‑term storage?

For long‑term holding, most users keep the underlying Bitcoin in a hardware wallet instead of WBTC, because the former avoids smart‑contract risk and gas fees. WBTC is best suited for active DeFi participation where the benefits outweigh the custodial and gas‑related risks.

How does the governance of WBTC work?

The wBTC DAO, composed of key DeFi projects and custodians, controls a multi‑signature wallet that can add or remove custodians, set fees, and approve protocol upgrades. Proposals are voted on by DAO members, ensuring that changes require consensus among major stakeholders.

14 Comments

Hey folks, great to see interest in Wrapped Bitcoin! WBTC lets you bring Bitcoin's value onto Ethereum, opening doors to DeFi without moving the actual BTC. Think of it as a bridge that keeps the 1:1 peg while you enjoy faster transactions and smart contract capabilities.

Whoa, WBTC is basically the superhero cape for Bitcoin in the DeFi universe-swooping in to save the day with instant swaps and liquidity pools! If you’ve ever felt stuck with Bitcoin’s slow chain, this is the turbo‑boost you’ve been craving.

Absolutely, the bridge concept is solid; it maintains custody integrity, and the audits provide transparency. However, always remember the custodial risk-your BTC is held by third‑parties, which introduces a trust layer that pure on‑chain assets lack.

Totally feel you! 🚀 WBTC really does give Bitcoin the speed it’s been missing, and the yield farms are just 🔥. Plus, the community vibes are awesome when you see folks swapping assets in seconds. 😎

For anyone new, WBTC is an ERC‑20 token that mirrors Bitcoin 1 to 1, backed by custodians. You can deposit it into protocols like Aave or Uniswap to earn interest or provide liquidity.

When you first encounter Wrapped Bitcoin, it can feel like stepping through a portal into a parallel financial universe.

The token’s existence rests on a simple premise: every WBTC minted is locked away as real Bitcoin with a trusted custodian.

This lock‑and‑mint mechanism creates a bridge that is both robust and transparent, thanks to regular attestations.

In practice, the bridge empowers Bitcoin holders to participate in DeFi protocols without relinquishing ownership of the underlying asset.

You can lend WBTC on platforms like Compound, earning interest that would otherwise be inaccessible to raw BTC.

Liquidity pools on Uniswap and SushiSwap accept WBTC, allowing traders to swap between ETH and BTC‑denominated assets instantly.

The speed of ERC‑20 transactions means your trades settle in seconds, a stark contrast to Bitcoin’s ten‑minute block times.

Moreover, the smart contract layer enables complex strategies such as yield farming, staking, and even synthetic derivatives.

These possibilities open a new horizon for arbitrageurs who can capture price differences across chains in real time.

However, the reliance on custodians introduces a centralized element that some purists find unsettling.

Audits and proof‑of‑reserves are designed to mitigate this risk, but the trust model remains a point of debate.

From a regulatory perspective, WBTC’s custodial nature can simplify compliance, making it attractive for institutions.

Yet, this same feature can expose users to legal jurisdiction issues if custodians face regulatory actions.

In essence, Wrapped Bitcoin is a tool-a bridge that expands Bitcoin’s utility while inheriting both the strengths and the vulnerabilities of Ethereum.

As the ecosystem evolves, expect more seamless integrations and possibly decentralized minting mechanisms that could further reduce custodial risk.

WBTC is basically Bitcoin on steroids.

Yo, that line about WBTC bein' on steroids is littttt-like, who needs plain old BTC when you can have that turbo magic?!!

I understand the excitement around WBTC, especially for those wanting to keep their Bitcoin exposure while exploring newer protocols.

While the enthusiasm is commendable, we must not overlook the ethical implications of entrusting our assets to centralized custodians, which could erode the very principle of financial sovereignty that Bitcoin stands for.

Conversely, one could argue that custodial arrangements, when subjected to rigorous third‑party audits, provide a level of security and regulatory clarity that pure decentralized solutions currently lack.

In short, to use WBTC, simply acquire it on a reputable exchange, then connect your wallet to DeFi platforms.

And hey, did you know some big players might be quietly stockpiling WBTC to influence market dynamics? It’s like a hidden layer of control that most users never see.

That’s an interesting point-staying aware of the bigger picture helps us make smarter decisions in the ever‑moving DeFi space.