- 13 Oct 2025

- Elara Crowthorne

- 13

Multi-Jurisdictional Compliance Checker

Check Your Compliance Risk

Enter your business type and user locations to see which regulations apply to you.

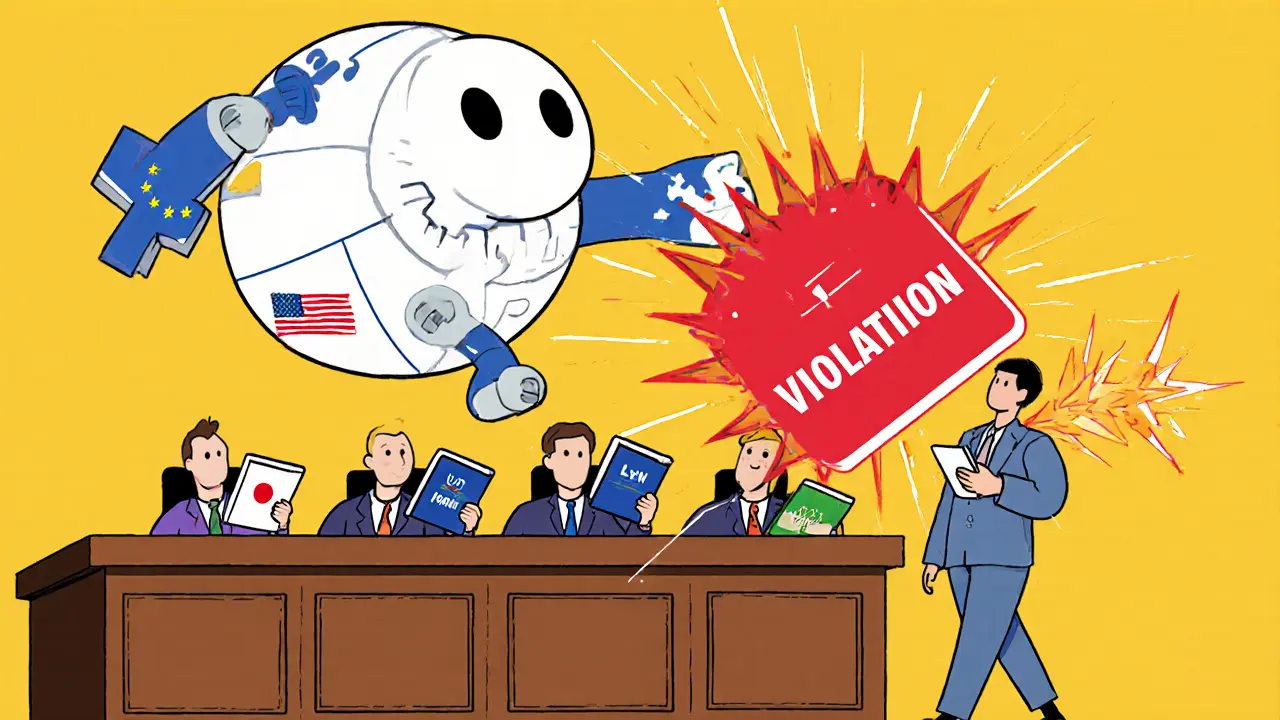

Running a blockchain project across borders isn’t just about tech-it’s about law. Every country, state, or region you touch has its own rules. One day you’re fine in Germany; the next, you’re violating a law in California because your smart contract collected data from a user who happened to be visiting. This isn’t theoretical. In 2023, the U.S. alone saw 707,834 regulatory changes. And that’s just one country.

Why Blockchain Makes Multi-Jurisdictional Compliance Harder

Blockchain is designed to be global. Transactions don’t care about borders. But laws do. A decentralized finance (DeFi) protocol hosted in Singapore but used by people in the EU, Brazil, and Japan must follow GDPR, Brazil’s LGPD, and U.S. state-level privacy laws-all at once. There’s no central server to shut down. No single entity to blame. That’s the point of blockchain. But regulators don’t care about decentralization when someone’s money is at risk.Take data privacy. Under GDPR, if your wallet app stores a user’s IP address or transaction history, you’re a data controller-even if you’re a DAO with no CEO. You must allow users to delete their data. But in the U.S., only California, Virginia, and Colorado have similar rules. The rest? Nothing. So do you build one system for everyone? Or six different ones? Either way, you’re spending time and money you don’t have.

The Real Cost of Getting It Wrong

Wells Fargo paid $3 billion in 2020 for opening fake accounts. That’s not blockchain-but it’s the same problem: inconsistent compliance across jurisdictions. In crypto, the stakes are just as high. In 2024, the SEC fined a U.S.-based NFT platform $15 million for selling unregistered securities to EU residents. The platform didn’t even know it was targeting them. Their analytics tool flagged U.S. traffic only. But someone in Amsterdam used a VPN. Boom-violation.GDPR fines can hit 4% of global annual turnover. For a mid-sized crypto firm doing $50 million in revenue, that’s $2 million. And that’s just one regulator. Add in the CFTC, FinCEN, FATF, and local financial authorities, and you’re looking at overlapping penalties. One violation can trigger investigations in three countries at once.

Five Jurisdictions That Are Watching You Closely

If you’re running a blockchain business, you can’t ignore these five regulatory hotspots:

- European Union: GDPR applies to anyone handling EU citizen data-even if you’re based in Nigeria. MiCA (Markets in Crypto-Assets Regulation) now requires licensing for token issuers and exchanges operating in the EU.

- United States: No federal crypto law, but 50 states have their own rules. New York’s BitLicense, California’s CCPA, and Texas’s crypto money transmitter laws all apply differently. The SEC treats most tokens as securities unless proven otherwise.

- Japan: Requires full registration with the Financial Services Agency. Must hold customer funds in segregated accounts. No anonymous wallets allowed.

- Singapore: No outright ban, but MAS (Monetary Authority of Singapore) requires strict KYC, AML checks, and licensing for exchanges. Even tokenized assets are regulated.

- Nigeria: Central Bank banned banks from servicing crypto firms in 2021. Enforcement is patchy, but if you’re collecting Naira or processing local payments, you’re at risk of asset freezes.

That’s five legal systems. And you’re not done. If your users are in Canada, Australia, or Brazil, you add more layers. A single user in Spain might trigger GDPR, Spain’s Data Protection Act, and the regional laws of Catalonia-all at the same time.

How to Build a Real Compliance System (Not a Paper One)

You can’t hire a lawyer in every country. But you can build a system that adapts.

- Map your users: Don’t guess. Use geolocation and IP checks to know where your users are. Track not just where they live, but where they’re currently accessing your platform. A tourist in Nevada using your app from New York? You need to follow both states’ laws.

- Use a centralized compliance register: Build a living document that tracks every regulation that applies to your business. Include: data privacy laws, tax rules, licensing requirements, and AML obligations. Update it monthly. Regology found companies miss 60% of changes because they check quarterly.

- Automate what you can: AI-powered RegTech tools now scan 200+ jurisdictions for new rules. Some platforms flag when a user from a restricted country tries to sign up. Others auto-update privacy policies based on location.

- Don’t reuse templates: One employee handbook for all countries? That’s how you get sued. California’s ABC test for contractors is different from Germany’s Werkvertrag rules. Your terms of service must reflect local labor, consumer, and contract laws.

- Test your system: Hire a local lawyer in one jurisdiction every six months to audit your setup. Even if you’re not physically there, they can check if your app complies with local disclosure rules or data retention periods.

What Most Crypto Teams Get Wrong

Here are the top mistakes we see over and over:

- "We’re decentralized, so we’re not responsible": Regulators don’t care. If your token is traded in the EU, you’re accountable-even if you’re a DAO with 10,000 members.

- "We only target the U.S.": A user from France uses your app. Now you’re under GDPR. No exceptions.

- "We’ll handle compliance later": The first fine is usually the last one. Many crypto startups get shut down before they hit $1M in revenue because they ignored one local rule.

- "Our smart contract is code, so it’s neutral": Code can violate laws. A DeFi protocol that auto-sends tokens to users in sanctioned countries? That’s illegal, no matter how "decentralized" it sounds.

The Future: AI, Not Lawyers

The volume of changes is too high for humans alone. In 2025, the best crypto firms use AI tools that:

- Scan legal databases in real time

- Auto-generate jurisdiction-specific privacy notices

- Block access from high-risk regions before a transaction occurs

- Alert legal teams when a new regulation impacts their token structure

These tools don’t replace lawyers-they make them more effective. A single compliance officer can now monitor 50 jurisdictions instead of 3. That’s the difference between surviving and shutting down.

Final Reality Check

You don’t need to be perfect. But you need to be proactive. If you’re building a blockchain product and thinking, "We’ll figure out the legal stuff later," you’re already behind. The regulators aren’t waiting. They’re watching. And they’re getting smarter.

Start small. Map your user locations. Pick one high-risk jurisdiction-like the EU or California-and audit your app against its rules. Do it now. Not next quarter. Not after your next funding round. Right now.

The blockchain world is global. The laws aren’t. If you want to build something that lasts, you have to play by the rules-even when they’re messy, contradictory, and constantly changing.

Does GDPR apply to blockchain projects outside the EU?

Yes. GDPR applies to any organization that processes personal data of individuals in the EU-even if the company is based in Canada, Nigeria, or Texas. If your wallet, exchange, or DeFi app collects names, emails, IP addresses, or transaction histories from EU users, you’re subject to GDPR. That means you must allow data deletion, provide transparency about data use, and report breaches within 72 hours.

Can a DAO be held legally responsible for non-compliance?

Yes. While DAOs have no traditional CEO or board, regulators treat them as legal entities when they operate services that impact users. The SEC, EU authorities, and others have already taken action against DAOs for unregistered securities offerings, money transmission, and data privacy violations. If your DAO collects fees, issues tokens, or provides services to users, you’re not immune-you’re just harder to find.

Do I need a license to run a crypto exchange across borders?

It depends. In the EU, you need a MiCA license. In the U.S., you need a BitLicense in New York and money transmitter licenses in most other states. In Japan, you need approval from the Financial Services Agency. In Singapore, MAS requires licensing for all exchanges. There’s no global crypto license. You must register in every jurisdiction where you have users or conduct business-even if it’s just one person.

What happens if I ignore local privacy laws?

You risk fines, platform bans, and criminal charges. In California, violating CCPA can lead to $7,500 per intentional violation. In the EU, GDPR fines can reach 4% of global revenue. Some countries, like China and Russia, block access entirely. Others, like Brazil and South Korea, require local data storage. Ignoring these rules doesn’t make you innovative-it makes you a target.

How often do crypto regulations change?

Constantly. In the U.S. alone, there were over 700,000 regulatory changes in 2023. Some jurisdictions update rules monthly. A new tax rule in Germany, a data retention law in India, or a token classification shift in Australia can appear overnight. Companies using manual tracking miss 60% of changes. Automated compliance tools are no longer optional-they’re survival.

13 Comments

This whole post is just fearmongering with fancy charts. Blockchain is supposed to be free from borders, and now you want us to hire lawyers in every country? LOL. If I’m running a DAO and someone in Finland uses my app, I’m not responsible for their local laws. That’s not innovation, that’s surrender.

While I appreciate the attempt to outline the regulatory landscape, the underlying assumption-that compliance must be achieved through centralized control mechanisms-is fundamentally flawed. The entire premise of blockchain is decentralization, yet this article prescribes a bureaucratic architecture that mirrors traditional finance. If you’re building a system that requires jurisdiction-specific code forks for every regional law, you’re not building a blockchain-you’re building a glorified SaaS platform with a blockchain-shaped sticker on it. The real innovation lies in self-sovereign identity, zero-knowledge proofs, and on-chain compliance predicates-not in geo-fencing users like they’re naughty toddlers.

Moreover, the notion that ‘regulators don’t care about decentralization’ is a self-fulfilling prophecy. If you treat users as liabilities to be filtered rather than participants to be empowered, you invite the very centralization you claim to oppose. The EU doesn’t ban Bitcoin because it’s decentralized-it bans it because you let it be used for money laundering. Fix the abuse, not the architecture.

And let’s not forget: if a user in Spain accesses your platform via a VPN from Canada, do you really need to comply with Catalonia’s regional data laws? Or are you just over-engineering compliance to justify your $300k/year legal budget? The cost of over-compliance is just as dangerous as under-compliance.

I’ve worked with several crypto startups and this is honestly one of the clearest breakdowns I’ve seen. The part about mapping user locations in real time? Game changer. We used to just assume everyone was in the US and got hit with a GDPR fine before we even had 100 users. Now we use a simple IP + consent flow and it’s saved us thousands.

Also, the point about not reusing templates? So true. I once saw a team copy-paste their ToS from a US-based fintech and then get sued in Brazil because they didn’t include the mandatory consumer rights clause. Rookie mistake.

Biggest issue nobody talks about: what happens when two jurisdictions contradict each other? Like, GDPR says delete data, but Japan’s Financial Services Agency says you must keep transaction logs for 7 years. Do you pick one and risk the other suing you? Or do you just stop serving both markets? That’s the real trap.

I’ve seen teams just give up and block the EU entirely. But then they lose 40% of their user base. It’s not a tech problem-it’s a political one. We need global standards, not more patchwork laws.

700k regulatory changes in one year? Source? Also why are you using Wells Fargo as an example? That’s not crypto that’s corporate fraud. This whole thing feels like a lawyer’s LinkedIn post.

What if the law itself is the problem? We’re building systems to escape centralized control, and now we’re being told to bend them to every nation’s whims. That’s not compliance-that’s capitulation. The future isn’t in obeying 50 different rulebooks. It’s in creating a new legal layer on-chain. Smart contracts that auto-comply based on user identity, not location. That’s the real innovation.

Stop asking how to follow the rules. Start asking how to change them.

I’m just shocked anyone still thinks blockchain can be legal. It’s like trying to make a wildfire obey traffic laws. The whole premise is inherently anarchic. If you’re serious about this, you should be building offshore. Or better yet-don’t build at all.

Love this breakdown. Seriously. The AI tools part? Lifesaver. We started using RegTech last year and our compliance team cut their workload by 70%. No more midnight panic emails when a new law drops. Just a Slack alert and a checkbox. Keep it real like this.

Let’s be honest: the real reason people ignore compliance is because they’re scared of the cost. But here’s the truth-getting fined once costs more than building it right from day one. I’ve seen three startups die because they thought ‘we’ll fix it later.’ The regulators don’t care about your roadmap. They care about your balance sheet.

One thing people forget: even if you’re a DAO, if you have a treasury and you’re paying people, you’re a business. And businesses pay taxes. And taxes have rules. No amount of ‘we’re decentralized’ changes that. Just file the damn forms.

India is not mentioned here but we have strict crypto tax rules now. Even small transactions are tracked. If you’re targeting Indian users, you must report to the tax authority. Simple as that.

The most profound insight here isn’t about technology-it’s about humility. We entered this space believing we could disrupt the old world. But the old world doesn’t disappear because we build new tools. It evolves. And it demands accountability. The most revolutionary act in crypto today isn’t coding a new consensus mechanism-it’s accepting the moral weight of jurisdictional responsibility. We don’t need to be perfect. We need to be accountable. And that starts with listening-not just to code, but to the laws that protect real people.

im just so tired of this. why does every single crypto project have to be a legal nightmare? i just wanna send money to my friend in germany without filling out 12 forms. its exhausting.