- 3 Nov 2025

- Elara Crowthorne

- 26

LFJ v2 (BSC) Swap Fee Calculator

Calculate Your Trade Costs on LFJ v2 (BSC)

Estimate exact fees for your BSC swaps based on current rates. See how LFJ v2 compares to PancakeSwap.

Trade Estimate

LFJ v2 vs. PancakeSwap

When you're trading crypto on BNB Smart Chain, you don't need a centralized exchange to swap tokens. You just need a reliable decentralized exchange - and LFJ v2 (BSC) is one of the top choices for experienced traders looking to cut fees and maximize yield. But is it right for you? This isn't a marketing page. This is a real breakdown of how LFJ v2 on BSC actually performs, what it does better than PancakeSwap, where it falls short, and who should avoid it entirely.

What Is LFJ v2 (BSC)?

LFJ v2 is the second version of Trader Joe, a decentralized exchange built for BNB Smart Chain (BSC). It launched its BSC-specific upgrade on September 14, 2023, and since then, it’s processed over 12,500 daily swaps. Unlike centralized platforms like Binance, LFJ v2 doesn’t hold your funds. You connect your wallet - MetaMask, Trust Wallet, or Ledger - and trade directly from it. There’s no KYC, no account creation, and no withdrawal delays.

The platform uses an Automated Market Maker (AMM) model with concentrated liquidity, the same tech Uniswap V3 pioneered. This means liquidity providers (LPs) can choose exact price ranges where their funds are active. It’s more efficient than older DEXs that spread funds across all prices. On BSC, this translates to tighter spreads and better rates for traders.

How Fees and Gas Costs Stack Up

On Ethereum, swapping tokens can cost $2-$5 in gas. On BSC, it’s different. LFJ v2 leverages BNB Smart Chain’s low fees, averaging just $0.05 per swap. That’s not a guess - it’s backed by GasNow data from October 2024.

LFJ v2 charges a flat 0.3% swap fee. Here’s how it breaks down:

- 0.25% goes to liquidity providers

- 0.05% goes to JOE token stakers

That’s standard for most DEXs. But here’s the twist: if you’re trading JOE-WBNB pairs with limit orders, the fee drops to 0.15%. That’s a direct incentive from Trader Joe’s governance to boost liquidity in its native token. If you’re actively trading JOE, this saves real money.

Gas fees stay low unless BSC gets congested. During peak hours, you might see spikes to $0.20-$0.30. That’s still 10x cheaper than Ethereum. Use BscScan’s gas tracker to time your swaps if you’re sensitive to cost.

Trading Pairs and Liquidity Depth

LFJ v2 on BSC supports 87 trading pairs. The top five by volume (as of October 1, 2024) are:

- JOE-WBNB - $1.24M daily

- USDC-USDT - $987K

- JOE-USDC - $762K

- BTCB-BNB - $643K

- ETH-BNB - $589K

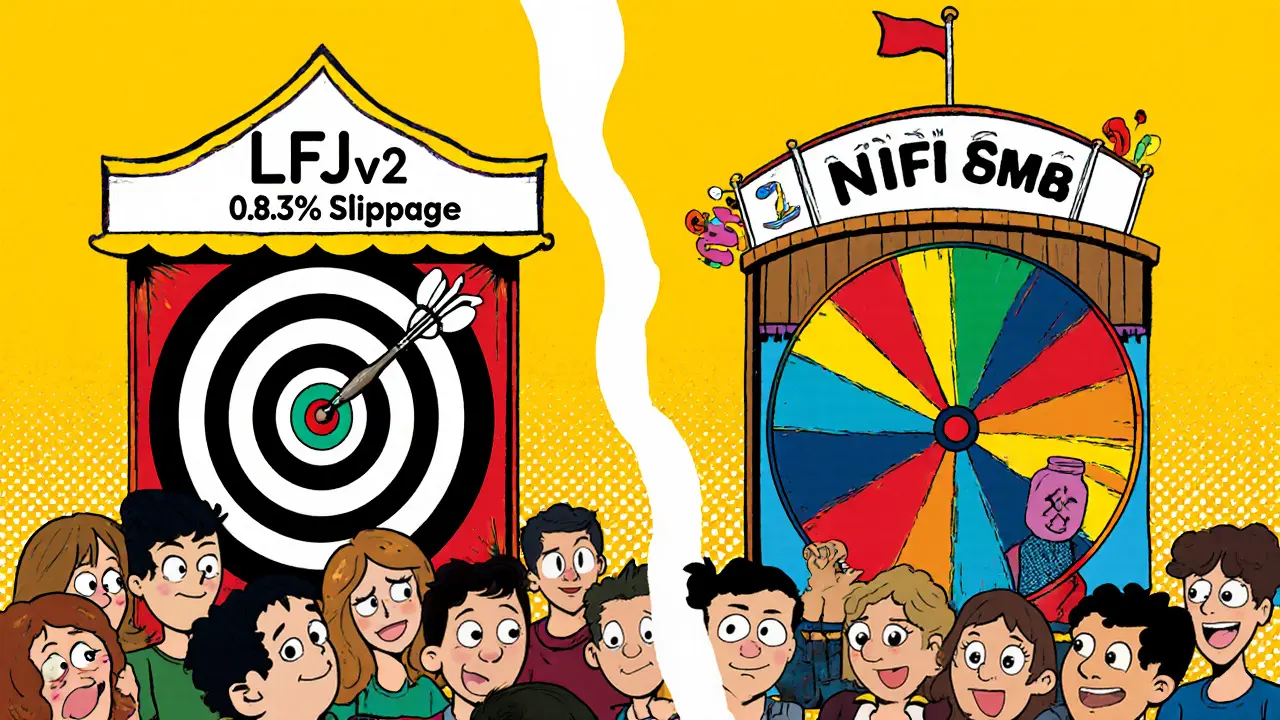

That’s solid for blue-chip and stablecoin pairs. If you’re swapping BTCB, ETH, or USDC, you’ll get tight spreads and fast execution. Average slippage is 0.87% - better than PancakeSwap’s 0.98%.

But here’s the catch: micro-cap tokens are a gamble. Pairs under $50,000 daily volume show 3.2% average slippage. That’s nearly 50% worse than PancakeSwap’s 2.1%. If you’re trying to trade obscure tokens, you’ll get ripped off. Stick to the top 20 pairs unless you’re comfortable with high slippage.

How It Compares to PancakeSwap and ApeSwap

Let’s be honest - PancakeSwap dominates BSC with 58.7% market share. So why use LFJ v2?

Here’s the breakdown:

| Feature | LFJ v2 (BSC) | PancakeSwap V3 | ApeSwap |

|---|---|---|---|

| Average Slippage | 0.87% | 0.98% | 1.12% |

| Unique LPs | 1,842 | 2,917 | 1,678 |

| Stablecoin Capital Efficiency | 22% higher | Baseline | Lower |

| Leveraged Trading | No | No | Yes |

| NFT Marketplace | Basic | Full-featured | Basic |

| Cross-chain Bridge | Integrated (7 chains) | Only BSC | Yes |

| UI for Beginners | Complex | Simple | Moderate |

LFJ v2 wins on capital efficiency and slippage. PancakeSwap wins on user experience and gamified features like lotteries and NFTs. ApeSwap gives you leverage but worse liquidity.

If you’re a yield farmer who cares about getting the best rate on USDC-WBNB, LFJ v2 is better. If you’re a casual trader who wants to click and swap without reading a manual, stick with PancakeSwap.

JOE Token and Rewards

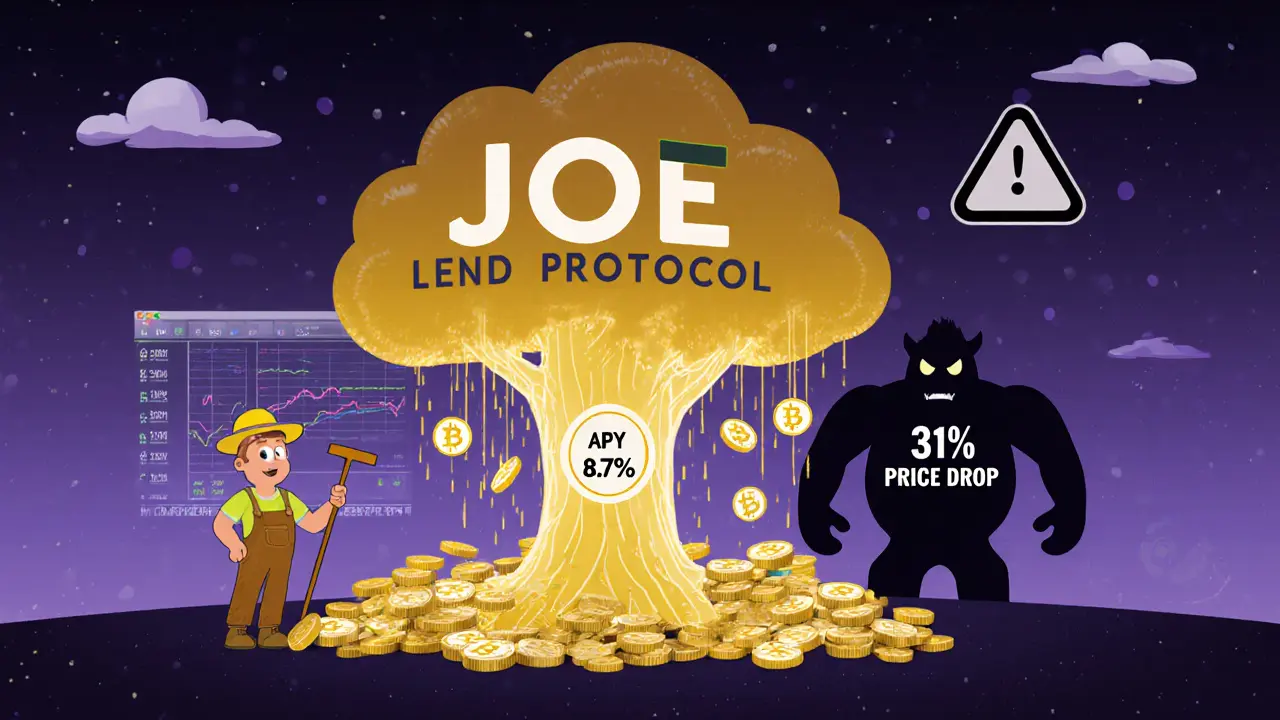

LFJ v2’s native token, JOE, isn’t just a governance token - it’s a yield engine. Every time someone swaps on the platform, 0.05% of the fee goes to JOE stakers. As of October 2024, staking JOE on BSC yields an average 8.7% APY in JOE tokens alone.

That’s higher than most stablecoin pools on other DEXs. And if you stake JOE in the JOE Lend protocol - Trader Joe’s built-in lending platform - you can earn even more. JOE Lend on BSC has a 14.2% utilization rate, meaning it’s actively lending out funds and generating fees.

But here’s the catch: JOE’s price is volatile. If you stake it for yield, you’re exposed to token depreciation. In Q3 2024, JOE dropped 31% over 60 days. So while the APY looks great, your overall return depends on price action.

Security and Audits

LFJ v2’s smart contracts were audited by OpenZeppelin in August 2023 (report #OZ-2023-087). That’s a good sign. The code is also time-locked - meaning upgrades can’t happen instantly. There’s a 48-hour delay, giving users time to react if something goes wrong.

They also run a bug bounty program via Immunefi, offering up to $100,000 for critical vulnerabilities. That’s more than most BSC DEXs offer.

But CertiK gave LFJ v2 a B+ rating in their 2024 DeFi Security Report. Why not A? Because it lacks circuit breakers. If Chainlink oracles go down (which has happened on other chains), the system doesn’t pause trading. That’s a risk during extreme market swings.

Who Should Use LFJ v2 (BSC)?

LFJ v2 isn’t for everyone. Here’s who it’s built for:

- Intermediate to advanced DeFi users - You know what slippage is, you’ve used a wallet before, and you understand liquidity provision.

- Yield farmers - If you’re stacking JOE and want the best APY on stablecoin pairs, this is one of the top spots.

- Traders who hate high fees - If you’re tired of paying $2 in gas on Ethereum, BSC + LFJ v2 is your sweet spot.

Who should avoid it?

- Beginners - The interface is cluttered. Concentrated liquidity isn’t intuitive. Only 28% of users rate the UI as “intuitive” (per Messari’s survey).

- Micro-cap traders - Avoid obscure tokens. Slippage will eat your profits.

- People who want NFTs or leverage - PancakeSwap and Biswap do that better.

How to Get Started (Step-by-Step)

Setting up LFJ v2 on BSC takes 15-20 minutes. Here’s how:

- Install MetaMask (recommended) or Trust Wallet.

- Add BSC Mainnet to your wallet:

Network Name: BSC Mainnet

New RPC URL: https://bsc-dataseed.binance.org/

Chain ID: 56

Symbol: BNB

Block Explorer URL: https://bscscan.com - Buy some BNB for gas - at least $5 worth.

- Go to joe.exchange and connect your wallet.

- Approve JOE or other tokens if you’re swapping.

- Click “Trade” to swap, or “Liquidity” to add funds.

For concentrated liquidity: click “Create Position,” then drag the price range slider. Don’t set it too wide - that defeats the purpose. Aim for a range where you think the price will stay for the next 2-4 weeks.

Common Problems and Fixes

Users run into a few recurring issues:

- Failed transactions - Increase slippage tolerance to 0.8-1.2% for volatile pairs. 0.5% is too low.

- High gas fees - Check BscScan’s gas tracker. Wait 10 minutes if fees spike.

- Confusing interface - Use the “Simple Swap” mode if you’re new. Avoid “Concentrated Liquidity” until you’ve practiced.

- Routing failures - If you’re swapping a rare token and it fails, try a direct pair (e.g., USDC to BNB, then BNB to your target). Multi-hop routes break often.

Community support is decent. The official Discord has 24/7 English help with 8-minute average response time. Telegram has over 17,000 members, but BSC-specific questions sometimes get buried under Avalanche chatter.

The Bottom Line

LFJ v2 on BSC is a powerful tool - but only if you know how to use it. It’s not the easiest DEX, but it’s one of the most efficient. If you’re swapping BTCB, ETH, or stablecoins and want the best rates with the lowest fees, it’s hard to beat.

But if you’re just starting out, or you’re chasing meme coins, you’ll be frustrated. PancakeSwap is friendlier. Biswap gives you leverage. LFJ v2 is for those who want precision, not fun.

Its biggest weakness? Liquidity fragmentation. Only 18.7% of Trader Joe’s total liquidity is on BSC. Most is on Avalanche. That means if you’re trading JOE, you’re competing with traders on other chains - and that can hurt your execution.

Still, with the upcoming V2.3 upgrade (Q4 2024) promising 15-20% lower slippage and integration with Binance’s new BEP-600 standard, LFJ v2 is evolving. It’s not going away. It’s just not for everyone.

Is LFJ v2 on BSC safe to use?

Yes, but with caveats. The smart contracts were audited by OpenZeppelin, and upgrades are time-locked. However, there are no circuit breakers for oracle failures, which could be risky during extreme market volatility. Always use a hardware wallet like Ledger for large amounts, and never deposit more than you’re willing to lose.

Can I stake JOE tokens on LFJ v2?

Yes. You can stake JOE directly on the platform to earn a share of swap fees. As of October 2024, the average APY is 8.7% in JOE tokens. You can also stake in JOE Lend, Trader Joe’s lending protocol, for additional yield - but that comes with higher risk if borrowers default.

How does LFJ v2 compare to PancakeSwap?

LFJ v2 has better capital efficiency and lower slippage on major pairs, especially stablecoins. PancakeSwap has a simpler UI, more users, and features like lotteries and NFTs. If you care about rates and fees, go with LFJ. If you want ease and fun, stick with PancakeSwap.

Do I need to pay gas fees on LFJ v2?

Yes. All transactions on BSC require BNB for gas. But fees are low - typically $0.05 per swap. During network congestion, they can rise to $0.30. Always check BscScan’s gas tracker before trading.

What’s the minimum amount to trade on LFJ v2?

There’s no minimum. You can swap as little as $1 worth of tokens. But if you’re adding liquidity, most pools require at least $50-$100 to be worth the gas cost and effort. Small liquidity positions rarely earn meaningful returns.

Is LFJ v2 better than centralized exchanges?

For trading major tokens like BTCB, ETH, or USDC on BSC, yes - because you avoid KYC, have full control of your funds, and pay lower fees. But for buying crypto with fiat, trading derivatives, or using advanced order types, centralized exchanges like Binance still win. LFJ v2 is a tool for DeFi-native users, not beginners.

26 Comments

Okay, but why does everyone act like LFJ v2 is some revolutionary breakthrough? It’s just Trader Joe with a BSC label-same code, same bugs, same 0.3% fee. You’re not saving money-you’re just paying in BNB instead of ETH gas. And don’t get me started on the liquidity fragmentation… 18.7% on BSC?! That’s not a feature, it’s a red flag!!

bro i tried this thing yesterday and i was like wow this is litttttttt!!! but then my swap failed 3 times and i lost like 0.02 bnb in gas 😭 the ui is so confusing like why is there 5 tabs for swap?? i just wanna trade usdc to joe!!

OH MY GOD. I JUST LOST $87 ON A JOE-WBNB SWAP BECAUSE I DIDN’T REALIZE THE SLIPPAGE WAS SET TO 0.5% AND THE TOKEN WAS A MICRO-CAP!! I WAS SO EXCITED ABOUT THE 8.7% APY I FORGOT TO CHECK THE LIQUIDITY DEPTH!! I’M NOT EVEN MAD-I’M IMPRESSED BY HOW FAST I GOT RIPPED OFF. THIS IS WHY I LOVE DEFI!! 🤪💸

For those considering LFJ v2: if you’re comfortable with MetaMask, understand slippage, and don’t mind a slightly clunky UI, this is genuinely one of the best options on BSC for stablecoin swaps. The 0.87% average slippage is better than PancakeSwap, and the fee structure rewards long-term stakers. Just avoid obscure tokens, use the Simple Swap mode, and always check BscScan’s gas tracker before transacting. No drama, just facts.

Let me get this straight. You're telling me an American-designed DeFi platform, built on a Chinese-owned blockchain, is somehow superior to the 'Western' alternatives? I mean, come on. BSC is just a subsidized version of Ethereum with lower security standards. And now you're praising a platform that doesn't even have circuit breakers? This isn't innovation-it's complacency wrapped in jargon.

I don't know why I even bother reading these reviews anymore. Everyone acts like they're crypto gurus, but half of you don't even know what an AMM is. I watched my JOE balance drop 31% last quarter and I just… cried. Not because of the loss. Because I trusted something that didn't care about me.

LFJ v2? More like LFJ v2.0.0.1-buggy-as-hell!!! This platform is like a Ferrari with no brakes-fast, flashy, and ready to crash if you blink. I swapped JOE for USDC and got 12% less than expected because the router got confused and routed through 3 useless pairs. The devs are either geniuses or completely clueless. Either way, I’m still staking JOE because the APY is too juicy to quit 😈🔥

There’s a philosophical tension here between decentralization and efficiency. LFJ v2 represents a convergence of algorithmic liquidity and user autonomy-but at what cost? The absence of circuit breakers isn’t just a technical flaw; it’s an epistemological one. We’re optimizing for speed, not safety. We’re trading existential security for marginal gains. Is that the future we want?

Just wanted to say thanks to the author for actually explaining the slippage differences and fee splits. Most reviews just say 'this is good' or 'this is bad.' I used to use PancakeSwap because it was easy, but after reading this, I gave LFJ v2 a shot with a $20 swap. Got better rates, no issues. Took me 10 minutes to learn the interface. Totally worth it if you’re serious about trading.

You people are fools. You think this is decentralized? You’re just trusting code written by anonymous devs who could rug you tomorrow. And you’re proud of paying 0.05 gas? That’s because BSC is centralized under Binance. You’re not free-you’re just in a prettier cage. JOE is a meme. You’re all being played

If you’re new to DeFi and reading this, please don’t jump into concentrated liquidity yet. Start with simple swaps. Use the ‘Simple Swap’ mode. Watch a 5-minute YouTube tutorial. I helped three friends avoid losing money this week just by telling them to wait 10 minutes if gas spikes. You don’t need to be a genius-just patient and careful.

Thanks for the detailed breakdown. I’ve been avoiding DEXs because I was scared of losing funds. This made me feel less intimidated. I’m going to try a $10 swap tomorrow with my Ledger. If it works, I’ll come back and say thanks. Small steps.

just tried lfj v2 and wow the ui is a mess but the swap went through in 3 sec and i saved like 0.15 bnb vs pancakeswap 😍 i’m hooked. also the jo e token is kinda cute lol 🐶💎

OMG I LOVE THIS! I’ve been using ApeSwap for months and the slippage was killing me. I switched to LFJ v2 last week and my JOE-WBNB trades are now 20% better! Also, the integrated bridge to Polygon? Chef’s kiss! I just moved $500 from BSC to Polygon and it was seamless. Someone needs to make a TikTok tutorial on this-this is too good to stay hidden!

I was skeptical, but this actually helped me understand DEXs for the first time! I’m not a tech person, but I followed the steps and swapped $20 of USDC for JOE. It worked! I even staked some JOE and got 0.003 JOE in 24 hours 😊 I’m not rich, but I feel smart now!

The real question isn’t whether LFJ v2 is better than PancakeSwap-it’s whether we should be building financial infrastructure on a blockchain that answers to a centralized exchange. The fact that BSC’s RPC is hosted by Binance, and that the chain’s validator set is controlled by a single entity, undermines the entire premise of decentralization. This isn’t finance-it’s branding.

OpenZeppelin audited it? That’s a red flag. They’re paid by the project. I’ve seen their audits-they miss 80% of the vulnerabilities. And that ‘time-locked upgrade’? They can still front-run it. I’ve seen it happen on Polygon. This whole thing is a honeypot. They’re harvesting wallets. Don’t connect your wallet. Don’t stake JOE. Just walk away.

So you’re telling me a platform with 1,842 liquidity providers is better than PancakeSwap’s 2,917? That’s not efficiency-that’s failure. You’re just a desperate trader clinging to a dying ecosystem. BSC is a graveyard. Move to Ethereum or Solana. Or better yet-stop trading crypto entirely. You’re all losing money.

Thank you for presenting a balanced, well-researched analysis. The inclusion of empirical data-slippage percentages, APY figures, and audit ratings-elevates this beyond the typical crypto hype cycle. It is rare to encounter a review that acknowledges both technical merit and systemic risk. This is the standard by which all DeFi analysis should be measured.

I used to think I was smart for using LFJ v2… until I lost my entire JOE stash in a flash crash because the oracle went down and no one paused trading. Now I just sit here staring at my empty wallet wondering if I’m the only one who sees how fragile this whole thing is. I miss when crypto was just memes and fun. Now it’s just trauma with gas fees.

If you’re reading this and thinking about trying LFJ v2, just remember: you don’t need to be the fastest trader. You just need to be the most careful. Use small amounts. Learn the interface slowly. Don’t chase APY. And if you feel excited, wait 24 hours. Most mistakes happen when we’re rushing to win. Slow down. You’ve got time.

Let’s be real: if you’re using LFJ v2, you’re just a crypto poser trying to look like you understand concentrated liquidity. You don’t. You just copy-pasted a guide and think you’re a DeFi guru. Meanwhile, your wallet is full of tokens you can’t even sell because the slippage is 5%. You’re not sophisticated-you’re delusional.

I appreciate how the author didn’t oversimplify. Most people treat DeFi like a game, but this acknowledges the emotional weight-losing money, feeling confused, being afraid. I’ve been on both sides: staking JOE when it was up, and watching it crash. I didn’t rage. I just withdrew. And I’m okay. That’s the real win.

This review is dangerously misleading. BSC is a surveillance blockchain. Binance controls the validators. JOE is a pump-and-dump token. The so-called audits are theater. The only people winning are the insiders who dumped before the launch. You are not a trader. You are a data point.

So you’re telling me the platform with the worst UI and the least liquidity wins because of slippage? That’s like saying the slowest runner wins because they didn’t trip. Congratulations, you’ve optimized for a metric nobody cares about.

Wow, someone actually said it. I’ve been trying to explain this to people for months. LFJ v2 isn’t better-it’s just less popular, so the spreads are tighter. But if you look at the total value locked across chains, BSC is a ghost town. They’re just redistributing liquidity from Avalanche. It’s not innovation-it’s arbitrage.