- 2 Jan 2026

- Elara Crowthorne

- 18

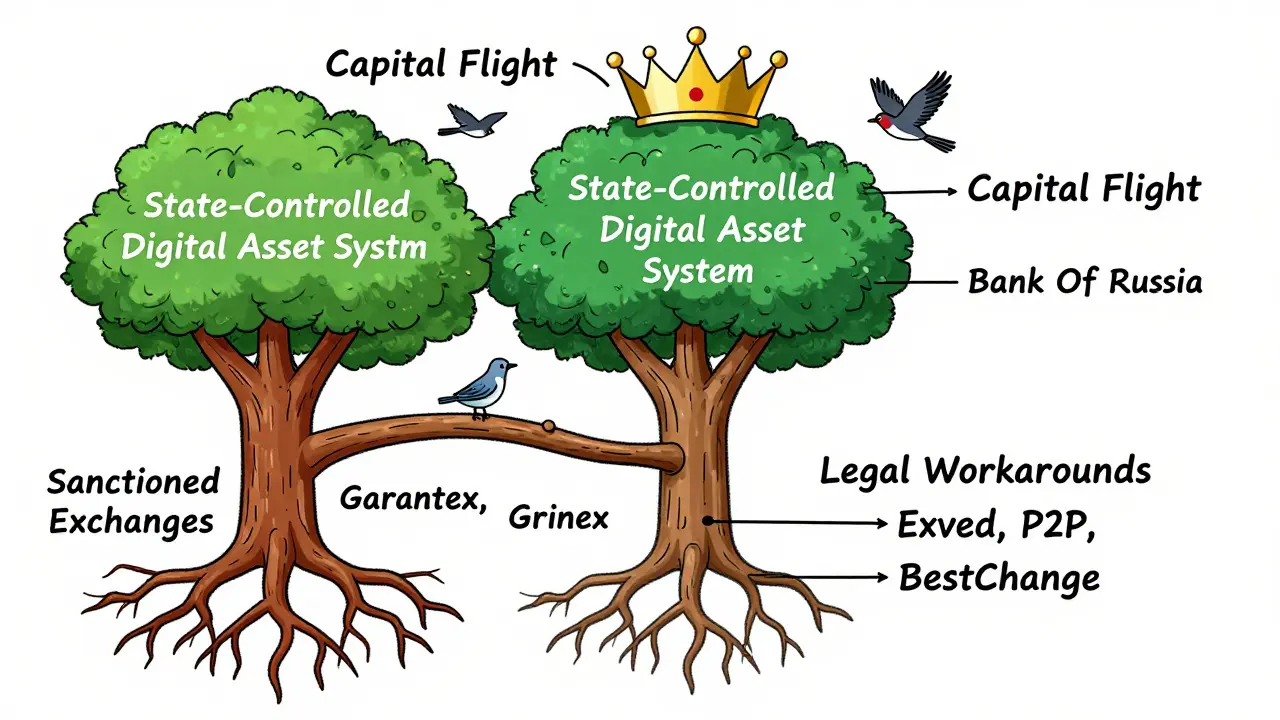

When you hear that Russia has banned cryptocurrency exchanges, it sounds simple-like a wall went up and all crypto trading stopped. But the truth is messier, smarter, and more strategic than that. Russia didn’t shut down crypto. It reshaped it. Some platforms were crushed. Others were forced to change. And a few were quietly rebuilt under new names, with new owners, and new rules. If you’re trying to understand what’s actually blocked in Russia today, you need to look past headlines and into the legal gray zones, the sanctioned entities, and the government’s quiet push for control.

Garantex: The Exchange That Died-And Came Back as a Network

Garantex was once Russia’s biggest crypto exchange. By 2022, it was handling billions in transactions, mostly from users trying to move money out of Russia amid Western sanctions. That’s exactly why the U.S. Treasury slapped it with sanctions that year. But Garantex didn’t just vanish. It adapted.

In March 2025, U.S. Secret Service agents, working with German and Finnish police, seized Garantex’s domain, froze over $26 million in crypto, and arrested key figures. The exchange officially shut down. But behind the scenes, its infrastructure didn’t die. It split. Sergey Mendeleev, the architect behind Garantex’s backend, launched Exved-a new payment service based in Moscow’s International Business Center. Exved doesn’t call itself an exchange. It markets itself as “the first exchange for importers and exporters.” That’s not a coincidence. It’s a loophole. Russia allows international trade in crypto. So Exved operates legally under that rule, while quietly moving funds for former Garantex users.

Transparency International Russia found evidence that Garantex’s old network still runs in at least eight countries: UAE, Brazil, Kyrgyzstan, Spain, Thailand, Georgia, Hong Kong, and Russia. The money flows differently now-through P2P channels, shell companies, and offshore wallets-but the system is alive. And it’s still using Russian infrastructure.

Grinex: The Successor Built to Replace Garantex

While Garantex was being dismantled, its former employees quietly built Grinex. It wasn’t just another exchange. It was a direct replacement. The same codebase. The same user base. The same purpose: helping users bypass sanctions.

In late 2024, the U.S. Office of Foreign Assets Control (OFAC) added Grinex to its sanctions list. By March 2025, the Department of Justice unsealed indictments against two top Garantex executives: Aleksandr Mira Serda and Aleksej Besciokov. Besciokov was arrested in India. Mira Serda remains at large. The U.S. State Department is offering up to $5 million for information leading to his capture.

Grinex isn’t just a rogue platform. It’s a sanctioned criminal enterprise under U.S. law. But inside Russia, it’s still operational-hidden behind encrypted apps, Telegram bots, and local payment processors. Russian banks can’t touch it directly, but users still find ways. The government doesn’t need to ban Grinex. It just needs to pretend it doesn’t see it.

What About Binance, Coinbase, and Kraken?

You’ll see headlines saying Binance is banned in Russia. That’s misleading. Binance isn’t officially blocked by Russian law. But it’s effectively dead there.

Here’s why: Russian banks are forbidden from processing payments to or from any foreign crypto exchange. No Visa, no Mastercard, no bank transfers. That means even if you could access Binance’s website, you couldn’t deposit rubles or withdraw rubles. The same goes for Coinbase and Kraken. They’re not on Roskomnadzor’s blocked list. They just can’t function.

Plus, these platforms refuse to comply with Russia’s KYC demands. They won’t collect Russian ID documents. They won’t report transactions to Russian tax authorities. So they don’t get licensed. And without a license, they can’t legally operate-even if the law doesn’t say “ban.”

The result? Russians who want to trade on Binance use VPNs and P2P platforms. But those trades are risky. No buyer protection. No recourse if you get scammed. And if the Bank of Russia flags your account for suspicious activity, you could lose access to your own bank account.

BestChange: The One That Got Unbanned

Not all platforms got crushed. BestChange, a major crypto aggregation site that compares exchange rates across dozens of platforms, was blocked in 2023. Why? Because it listed foreign payment systems and currencies like the Kazakhstani tenge-something Russian regulators saw as a backdoor for capital flight.

But in early 2025, BestChange changed. It removed all foreign currency listings. It stopped showing ruble-to-foreign-crypto conversion rates. It partnered with legal advisors to rewrite its compliance protocols. And then, quietly, Roskomnadzor lifted the ban.

This is the real story of Russia’s crypto policy: it’s not about banning crypto. It’s about controlling it. If you play by their rules-no foreign currency exposure, no anonymous users, no bypassing sanctions-you can operate. BestChange proved it. Garantex didn’t. That’s the difference.

Russia’s Real Crypto Strategy: State Control, Not Prohibition

Russia isn’t trying to stop crypto. It’s trying to own it.

In July 2020, Russia passed its first crypto law: you can hold crypto, but you can’t use it to pay for coffee or rent. That was the first step-containment. Then, in summer 2024, they flipped the script. They legalized crypto payments for international trade. Suddenly, Russian exporters could receive crypto from Turkey, India, or China. And Russian importers could pay for goods in Bitcoin or Ethereum.

That’s not a loophole. It’s a strategy. It lets Russia trade with countries that still accept crypto, while keeping its citizens locked out of the global market. The Bank of Russia now requires all crypto transactions to go through licensed Russian intermediaries. No direct P2P. No offshore wallets. Everything must be reported.

And in October 2025, Deputy Finance Minister Ivan Chebeskov announced a new experimental framework: Russia is building its own state-controlled crypto infrastructure. Think of it like a digital ruble-but for crypto. It won’t be decentralized. It won’t be anonymous. It will be monitored, taxed, and tracked. This is Russia’s answer to China’s digital yuan: a sovereign, state-backed digital asset system.

Who’s Really Banned? The Real List

Let’s cut through the noise. Here’s who is actually banned-or effectively blocked-in Russia as of early 2026:

- Garantex: Officially sanctioned and dismantled. Still operates underground via Exved and other fronts.

- Grinex: Sanctioned by the U.S. and targeted by law enforcement. Still active in Russia via encrypted channels.

- Any exchange without Russian KYC compliance: Binance, Coinbase, Kraken, KuCoin, Bybit-none can process rubles. No license. No access.

- Platforms listing foreign currencies: BestChange was banned for this-until it changed. Now it’s allowed.

Here’s who’s still operating legally:

- Exved: Officially registered as a payment service. Handles crypto for international trade.

- Local P2P platforms: Like LocalBitcoins Russia, Paxful Russia, and Telegram-based traders. No license, but tolerated if they don’t attract attention.

- State-aligned crypto services: The new experimental infrastructure will soon roll out. It won’t be called “crypto.” It’ll be called “digital financial instruments.”

Why This Matters Outside Russia

This isn’t just about Russia. It’s a blueprint for how authoritarian regimes handle crypto.

China banned crypto trading but built its own digital currency. Iran uses crypto to bypass sanctions but cracks down on citizens who trade it. Venezuela created its own crypto to evade U.S. sanctions. Russia is doing the same-but with more sophistication.

The lesson? Governments don’t ban crypto because they fear it. They ban it because they want to control it. And if you can’t control it, you let it die quietly-while building something you can.

If you’re outside Russia and wondering whether to use a Russian exchange, don’t. Even if it says it’s “legal,” it’s likely tied to sanctioned entities. If you’re inside Russia and trying to trade, know this: the safest option isn’t Binance. It’s waiting. The state is building its own system. When it launches, you’ll be forced onto it. Until then, you’re playing a game with no rules-and no safety net.

Are Binance and Coinbase banned in Russia?

No, they’re not officially banned by Russian law. But they can’t operate there. Russian banks can’t process payments to them, and they don’t comply with Russia’s KYC rules. So even if you access their websites, you can’t deposit or withdraw rubles. They’re effectively unusable for Russian residents.

Is crypto legal in Russia?

Yes, but with heavy restrictions. You can own and trade crypto, but you can’t use it to pay for goods or services inside Russia. Since 2024, crypto can be used for international trade, which is why platforms like Exved are legal. All transactions must be reported, and only licensed intermediaries can handle them.

What happened to Garantex?

Garantex was shut down in March 2025 after a U.S.-led international operation seized its domain and froze $26 million in crypto. Its founders were indicted, and key figures arrested. But its infrastructure lives on through Exved and other shadow networks that continue operating inside Russia under new names and legal loopholes.

Can I use a VPN to access banned exchanges in Russia?

Technically yes, but it’s risky. Using a VPN to access Binance or Kraken won’t get you arrested, but your bank may flag your account for suspicious activity. Russian banks monitor crypto-related transactions closely. If they see you’re sending money abroad via crypto, they could freeze your account or report you to tax authorities.

Is there a Russian crypto exchange I can trust?

There’s no exchange you can fully trust. Even legal ones like Exved are tied to sanctioned networks. The only safe option is to wait for Russia’s state-controlled digital asset system, which is being developed with the Bank of Russia. Until then, all platforms carry high risk-legal, financial, and personal.

Why did BestChange get unbanned?

BestChange was blocked because it listed foreign currencies like the Kazakhstani tenge, which Russian regulators saw as a way to move money out of the country. After removing those listings and aligning with Bank of Russia’s compliance rules, Roskomnadzor lifted the ban in early 2025. It shows Russia doesn’t ban platforms-it demands compliance.

18 Comments

This is such a nuanced breakdown-I’ve been following Russia’s crypto moves for years and this nails it. They’re not banning crypto, they’re weaponizing it.

Exactly. Russia’s playing 4D chess while the West still thinks it’s checkers.

One must acknowledge the strategic brilliance of Russia’s approach-though one might also decry the moral bankruptcy of institutionalizing financial opacity under the guise of ‘international trade compliance.’ The state’s redefinition of ‘legal’ as ‘state-approved’ is not innovation-it is authoritarian rebranding. The fact that Exved operates under a trade loophole while facilitating sanctions evasion is not clever-it is corrosive to global financial integrity. One wonders if the Bank of Russia’s ‘digital financial instruments’ will be the next iteration of the Soviet ruble-centralized, surveilled, and devoid of individual sovereignty.

Andrew, you’re overcomplicating it. Russia isn’t trying to be moral. It’s trying to survive sanctions. This isn’t evil-it’s realpolitik. The West banned them from the system. They built their own.

BestChange getting unbanned is the most telling part. They didn't shut it down. They told it to change. And it did. That's control, not censorship.

That’s the real lesson. Compliance beats resistance every time in authoritarian systems

garantex still alive? no way

bro you think they’re dumb? they’re smarter than you think. they’re using crypto to keep the economy from collapsing while pretending to hate it. genius.

It's fascinating how the legal architecture mirrors the geopolitical one. Sanctions are not walls-they are invitations to redesign. Russia didn't break the rules; it rewrote the rulebook using the same language. The world must now decide: do we treat this as evasion or evolution?

So Binance is ‘dead’ but Exved is ‘legal’? 😂 Russia’s crypto policy is just a game of musical chairs with sanctions.

Let’s not pretend this is about economics. This is about power. The state doesn’t fear decentralized money-it fears the loss of control over narratives, identities, and the very flow of human value. When a government can track every digital ruble, every transaction, every whisper of dissent encoded in blockchain metadata, then it doesn’t need tanks. It needs algorithms. And Russia? They’re building the perfect surveillance ledger. The digital yuan is child’s play compared to what’s coming. We’re not watching a financial revolution. We’re watching the birth of a new kind of prison-one where you can’t even cry out without it being taxed.

Exved calling itself a payment service for importers/exporters? That’s like calling a dragon a very enthusiastic pet. It’s legal on paper, but everyone knows it’s the old Garantex ghost haunting the system. Russia’s playing the long game-let the West scream about sanctions while their underground crypto network keeps the lights on. Smart. Dirty. Effective.

The hypocrisy is staggering. The U.S. sanctions Garantex for circumventing sanctions, yet still allows American citizens to use VPNs to access Binance. The entire framework is a performative theater of enforcement. The real goal is not compliance-it is dominance. And Russia is winning by refusing to play by rules designed to exclude them.

Exved is a front. Grinex is a shell. The Bank of Russia’s ‘digital financial instruments’ are a state-run Ponzi scheme wrapped in blockchain jargon. This isn’t innovation-it’s institutionalized fraud dressed in compliance suits. The fact that people still think this is ‘smart’ is terrifying. You don’t build a sovereign crypto system to empower citizens-you build it to monitor, tax, and punish them. And you call it progress. Pathetic.

Let’s be honest-Russia’s entire crypto strategy is just a sophisticated form of financial black marketeering with a government stamp. They didn’t outsmart the West. They just found a way to keep the same criminal infrastructure running under a different name. Exved? More like Ex-Garantex. Grinex? Grin-and-bear-it-exchange. And now they want us to believe this is ‘state control’ and not ‘state-sponsored laundering’? Please. The only thing being controlled here is the narrative. The money? Still flowing. The people? Still getting screwed.

so like… if you’re in russia and you wanna trade crypto, you just use a p2p telegram bot and hope your bank doesn’t freeze your account? that’s the whole system? 😅

why is everyone acting like this is some deep geopolitical masterstroke? it’s just a bunch of hackers and oligarchs using crypto to dodge sanctions. the ‘state control’ thing is just PR. if the government actually controlled it, they’d shut down the p2p bots. they don’t. they just let it run because they’re getting a cut.

What’s truly remarkable isn’t Russia’s ingenuity-it’s how quickly the global financial system has normalized this. We’ve gone from ‘crypto is the future’ to ‘crypto is a sanctioned shadow economy’ without a single institution asking: why are we still letting this happen? The Bank of Russia isn’t building a digital currency-it’s building a firewall around its own corruption. And the West? We’re just watching, pretending we’re shocked. We’re complicit. We enabled this by refusing to create real alternatives to SWIFT. Now we’re shocked that they built their own?