- 11 Sep 2025

- Elara Crowthorne

- 14

Crypto Exchange Safety Checker

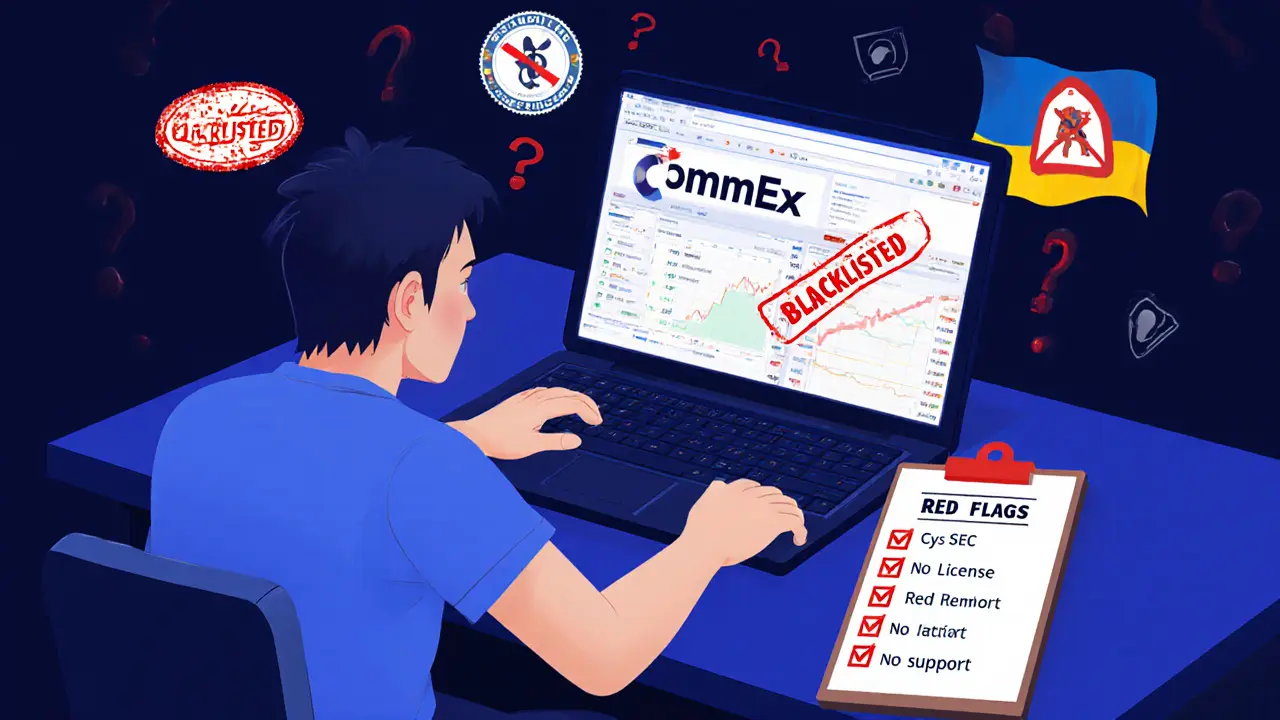

Caution: Avoid exchanges with multiple red flags like blacklisting, revoked licenses, or no customer support.

Safety Assessment Result

When it comes to trading digital assets, choosing a trustworthy platform is non‑negotiable. CommEX crypto exchange review reveals a service riddled with regulatory violations, opaque ownership, and zero customer support - a recipe for lost funds and legal trouble.

Key Takeaways

- CommEX is listed on multiple blacklists, including the Traders Union 2025 blacklist.

- Registered in Seychelles, the exchange offers no verifiable licensing or registration documents.

- Regulators in Cyprus revoked its operating license in 2017 and levied €400,000 in penalties.

- Customer service is virtually nonexistent; users cannot reach the platform via phone or email.

- Safer alternatives such as MEXC and Coinbase provide transparent fees, regulatory compliance, and robust support.

What is CommEX?

CommEX is a cryptocurrency exchange that operates anonymously from the offshore jurisdiction of Seychelles. It mirrors the look of larger platforms but offers no public registration papers, making it difficult to verify its legal standing.

Regulatory History and Blacklist Status

The CySEC (Cyprus Securities and Exchange Commission) revoked CommEX’s license in April 2017 and fined the entity €400,000. The penalties targeted both the platform and key individuals such as AbdelRahmanAlimari, who faced separate sanctions. This enforcement predates the 2024‑2025 crypto boom, indicating long‑standing compliance failures.

Since then, the exchange has appeared on the Traders Union blacklist, a widely respected watchdog that advises traders to avoid listed entities due to high fraud risk.

Operational Red Flags

CommEX’s technical footprint looks suspiciously similar to Binance, suggesting either copied UI elements or a shared back‑end. However, unlike Binance’s transparent corporate structure, CommEX provides no legal identifiers, no phone support, and no email address. Fee schedules change based on an opaque “client status” system, which Traders Union flags as potentially unfair and discriminatory.

User Experience and Support Gaps

Major review sites-Trustpilot, Reddit’s r/cryptocurrency, and specialized forums-show virtually no genuine user feedback for CommEX. In contrast, reputable platforms boast millions of verified reviews. The lack of public sentiment hints at either a tiny user base or an active effort to suppress scrutiny.

Withdrawal requests often stall, and users report being unable to contact the exchange through any standard channel. The combination of anonymous registration and unresponsive support creates a perfect storm for asset loss.

Comparison with Legitimate Exchanges

| Feature | CommEX | MEXC | Coinbase |

|---|---|---|---|

| Regulatory Status | Blacklisted; no license | Licensed in multiple jurisdictions (e.g., Malta, Singapore) | Registered in the U.S.; SEC‑registered |

| Fee Structure | Variable, client‑status dependent, undisclosed | Maker 0.02%-0.20%; Taker 0.04%-0.20% | 0%-0.60% depending on volume |

| Customer Support | No phone or email, no live chat | 24/7 live chat, email tickets | Phone, chat, email, extensive help center |

| User Base (2025) | Unverified, likely under 10,000 | Over 40million users in 170+ countries | Over 80million registered accounts |

| Security Measures | Opaque, no public audits | Cold storage, 2FA, regular security audits | Cold storage, insurance fund, 2FA, SOC2 compliance |

Expert Opinions and Risk Assessment

Financial analysts across multiple platforms consistently warn against using CommEX. The consensus is that the exchange’s anonymity, regulatory breaches, and poor support elevate the risk of total loss. In contrast, platforms like MEXC and Coinbase are highlighted for their compliance records, transparent operations, and active security programs.

Safer Alternatives

If you’re looking for a reliable place to trade, consider these options:

- MEXC - offers a wide range of altcoins, strong security, and clear fee tiers.

- Coinbase - best for beginners, regulated in the U.S., and provides insurance on custodial assets.

- Other region‑specific regulated exchanges that publish audit reports and maintain responsive support.

How to Protect Yourself from Fraudulent Exchanges

- Verify the exchange’s licensing status on the regulator’s official website.

- Check independent review sites for genuine user feedback.

- Look for transparent fee schedules and clear withdrawal policies.

- Prefer platforms that offer two‑factor authentication and cold‑storage solutions.

- Avoid exchanges that hide ownership details or operate from high‑risk offshore jurisdictions.

Final Verdict

Based on regulatory history, operational opacity, and the lack of verifiable user experience, CommEX should be avoided. The exchange fails to meet basic industry standards for security, compliance, and customer service. Traders seeking safety and reliability are better served by established, regulated venues.

Frequently Asked Questions

Is CommEX a licensed cryptocurrency exchange?

No. CommEX operates out of Seychelles without any public license, and it has been blacklisted by Traders Union for violating financial regulations.

Can I withdraw funds from CommEX?

Withdrawals are often delayed or blocked, and users have reported no way to contact support to resolve issues.

What are the main red flags of CommEX?

Key red flags include: blacklist status, revoked CySEC license, anonymous ownership, lack of customer service, and no verifiable security audits.

Which exchanges are recommended as safe alternatives?

Regulated platforms such as MEXC, Coinbase, Kraken, and Binance (when used with the official website/app) provide transparency, security, and reliable support.

How can I verify if an exchange is legitimate?

Check the regulator’s database for a valid license, read independent reviews, confirm the exchange’s physical address, and look for public security audits.

14 Comments

Take a moment to reflect on the red flags highlighted in the review, and remember that vigilance is your best defense, especially when dealing with offshore platforms! The lack of a proper license, the missing customer support channels, and the opaque ownership structure all point to a high‑risk environment, so proceed with caution! If you’re already holding assets on CommEX, consider moving them to a regulated exchange as soon as possible, and keep a close eye on any withdrawal requests! Always verify regulatory status on official websites, and never rely solely on marketing hype-your funds deserve the highest level of protection!

Reading through the detailed breakdown of CommEX, I can’t help but feel a deep sense of concern for anyone who might still be using the platform, because the combination of regulatory violations and zero support creates a perfect storm for users; the first red flag-its blacklisting by reputable watchdogs-should already trigger alarm bells for prudent traders. Moreover, the revoked CySEC license in 2017, coupled with a €400,000 fine, demonstrates a history of non‑compliance that is difficult to overlook. The anonymity of its ownership, hidden behind an offshore registration in Seychelles, strips away any transparency that investors typically rely on to gauge trustworthiness. When you add the fact that the exchange lacks any publicly documented security audits, you’re left with a service that offers little more than a façade of legitimacy. User experiences shared on forums consistently mention delayed withdrawals, which is a classic symptom of liquidity issues or outright fraud. The absence of a phone number or email support channel means that when problems arise, users are essentially left to fend for themselves, a situation no responsible platform would permit. In contrast, exchanges like MEXC and Coinbase provide 24/7 live chat, clear fee structures, and documented compliance with financial regulators. By moving your assets to one of these reputable alternatives, you not only protect your capital but also gain access to better trading tools and educational resources. It’s also worth noting that many regulated exchanges hold a portion of user funds in cold storage, further reducing the risk of hacks. If you’re new to crypto, starting with a platform that offers insurance on custodial holdings can provide an extra layer of safety. The psychological toll of dealing with an unresponsive exchange can be significant, leading to stress and lost confidence in the broader market. Taking proactive steps now-such as withdrawing your holdings and conducting thorough due diligence-will help you avoid potential financial loss. Remember that the crypto space is still evolving, and vigilance is the most valuable skill you can develop. If you ever feel uncertain, reaching out to community forums or trusted friends for advice can provide additional perspectives. Ultimately, the decision to avoid CommEX and choose a regulated, transparent venue aligns with best practices for protecting your investments and maintaining peace of mind. Stay informed, stay safe, and keep your crypto journey on a solid foundation.

Oh great, another “expert” warning us about a platform that already screams danger.

The shadows that cloak CommEX are not merely regulatory oversights; they are the murmurs of a deeper, almost theatrical conspiracy, where unseen hands pull strings from the murky sands of Seychelles. One can almost picture a clandestine cadre, cloaked in midnight, trading on the backs of unsuspecting investors, while the façade mimics the polished UI of a reputable exchange. Their “client‑status” fee model reads like a secret society’s dues-exclusive, opaque, and ripe for abuse. The lack of audits is not just negligence; it is a deliberate veil, a theatrical curtain that hides the inevitable collapse waiting in the wings. In such a grim opera, only the vigilant audience can spot the cracks before the final act descends.

Let’s break down why moving to a regulated exchange matters in plain terms: first, licensing means the platform has passed government checks that protect your money; second, transparent fee schedules prevent hidden costs that can eat your profits; third, robust security, like cold storage and two‑factor authentication, safeguards against hacks. When you compare this to CommEX, the differences are stark-no license, hidden fees, and no clear security protocols. Switching to a platform such as Coinbase or MEXC gives you access to these safeguards immediately. It also offers reliable customer support that can help you resolve withdrawal issues in real time, which is essential for peace of mind. In short, the choice is clear: prioritize safety and compliance over a mysterious, unchecked service.

Honestly, I don’t see why anyone would still trust CommEX-it feels like a scam that never got the memo to shut down. The lack of support is just lazy; the owners probably don’t even care about their users. If you’re looking for a legit place to trade, just skip this junk and go for something reputable.

Esteemed members of the community, I submit for your consideration a treatise on the perils inherent in engaging with an exchange bereft of licensure and transparency. The gravitas of operating under the auspices of an offshore jurisdiction, devoid of regulatory oversight, cannot be overstated. Moreover, the complete absence of accessible customer service channels constitutes a dereliction of fiduciary duty, thereby imperiling the assets of all participants. It is incumbent upon us, as custodians of our own financial sovereignty, to eschew such enterprises and to align ourselves with institutions that embody the highest standards of compliance and security. In summation, the prudent course of action is unequivocal: eschew CommEX and seek refuge within the bounds of regulated markets.

Yo, i totally get the formal vibe, but lets look deeper-maybe the whole regs thing is just a front, you know? There's talk that big banks push these “licensed” platforms to keep us in their pocket while the dark ones like CommEX run the real game. I've seen weird IP logs that jump around, like they're hiding something big. This whole “regulatory” story could be a smokescreen, man.

Our nation’s investors deserve platforms that respect our laws; CommEX fails on every front, so we must avoid it. Choose regulated services that uphold our financial sovereignty.

The review outlines several compliance failures, and those details are sufficient to classify CommEX as high risk. Accordingly, I recommend withdrawing any holdings and selecting a licensed exchange.

Yo bro, cant believe people still think that shady exchng like this is okay-totally against our proud crypto vibes. We should stick to platforms that pump our economy, not leech off it.

From a broader perspective, the crypto ecosystem thrives when trust is cultivated, not when anonymity breeds suspicion. Exchanging value on a platform without clear governance undermines that trust, which is why many gravitate toward transparent services. By choosing regulated venues, we contribute to a healthier market that benefits all participants. It’s a simple act of stewardship for the collective good. In that sense, moving away from CommEX aligns with a philosophy of responsible participation.

When performing a due‑diligence audit, one should prioritize KYC/AML compliance matrices, assess the exchange’s SLAs for latency and uptime, and scrutinize the custodial architecture-specifically, hot‑wallet exposure versus cold‑storage ratios. CommEX scores poorly across these vectors, indicating a systemic risk profile that diverges from industry best practices. Leveraging platforms with robust API rate limits and transparent fee tiering enhances both operational efficiency and risk mitigation. Therefore, integrating a regulated exchange into your portfolio not only optimizes throughput but also aligns with governance frameworks. Adopt this approach to future‑proof your crypto strategy.

It’s heartbreaking to see so many people potentially losing their hard‑earned savings!!! This kind of reckless platform should be avoided at all costs!!!