- 29 Oct 2025

- Elara Crowthorne

- 24

Crypto Payment Calculator

Calculate Your Savings

Based on current rates (RUB 90 = 1 USDT)

USDT Equivalent: 0 USDT

Traditional Transfer Fee: 0 RUB

Crypto Transfer Fee: 0.05% RUB

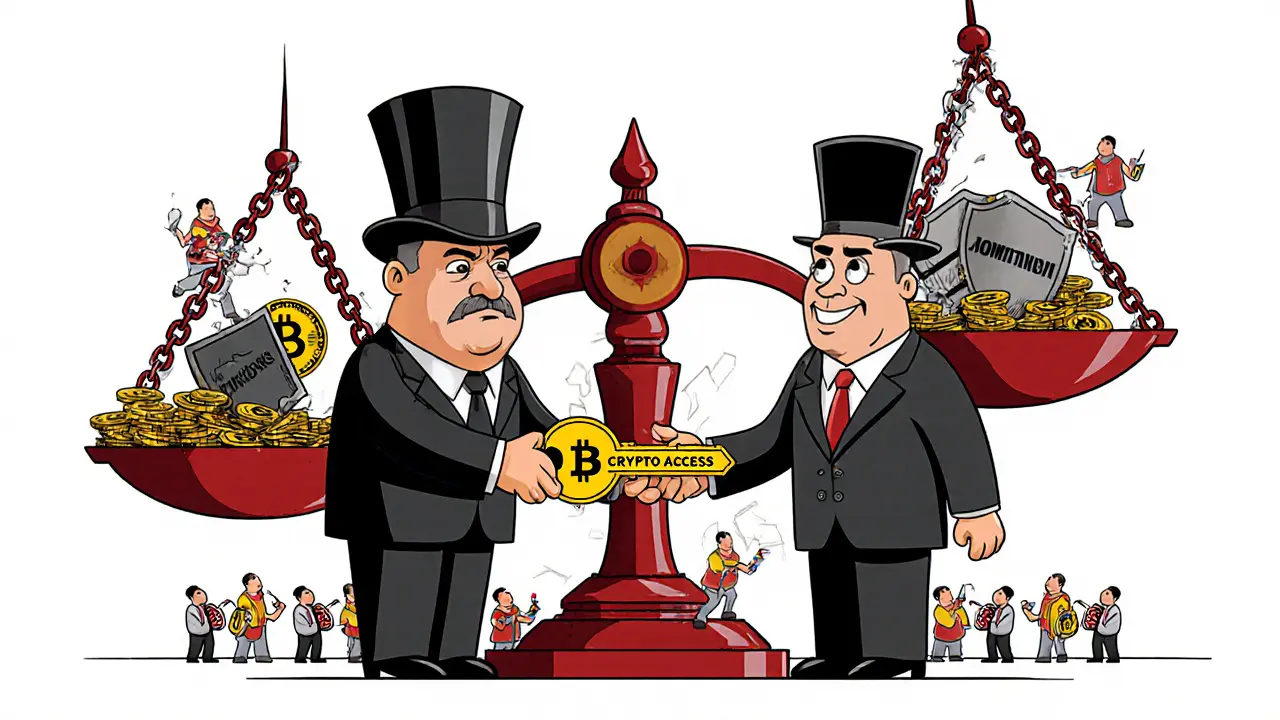

More than 20 million Russians - about one in seven adults - now hold or use cryptocurrency. That’s not a fringe trend. It’s a survival strategy. While Western sanctions cut off access to Visa, Mastercard, and SWIFT, Russians turned to Bitcoin, Ethereum, and USDT to buy goods abroad, pay freelancers, and protect savings from inflation. The government didn’t encourage this. It tried to stop it. But the people kept going. And now, even the Central Bank is admitting: crypto isn’t going away.

Why Russians Started Using Crypto

After February 2022, Russian banks lost access to global payment networks. International transfers froze. Importers couldn’t pay suppliers. Freelancers couldn’t get paid. Families couldn’t send money home. In just a few months, crypto became the only reliable way to move value across borders. People didn’t start using crypto because it was cool. They used it because they had no choice. A small software developer in Novosibirsk started using USDT to pay for cloud hosting in the U.S. A family in Yekaterinburg used Bitcoin to buy medicine from Turkey. A factory owner in Kazan switched to crypto to pay Chinese suppliers after his bank blocked all foreign payments. These weren’t speculators. They were ordinary people doing what they needed to survive. Chainalysis data shows Russia ranks #8 globally for retail crypto value received. That means Russians are receiving more cryptocurrency from abroad than almost any other country. The main drivers? Cross-border payments and value preservation. Inflation hit 8.3% in 2024. The ruble dropped 15% against the dollar in 2023. Crypto became a digital safe.What Crypto Russians Actually Use

Not all crypto is equal here. Bitcoin dominates - making up 62.1% of all holdings. It’s trusted, simple, and widely accepted in peer-to-peer trades. Ethereum comes second at 22%, mostly used for DeFi and tokenized assets. But the real workhorse? USDT and USDC. Stablecoins make up nearly 16% of the market. Why stablecoins? Because they’re stable. When the ruble swings, USDT holds its value. When banks freeze accounts, USDT can be sent in minutes. A survey by FinProm Analytics found 78% of Russian crypto users hold at least one stablecoin. Many keep two wallets: one for Bitcoin (long-term savings), one for USDT (daily transactions). Bitcoin’s adoption rate in Russia is the second-highest in the world - 16% of crypto users own it. Only the U.S. is higher. That’s not because Russians are tech elites. It’s because Bitcoin is the most recognizable, the most liquid, and the easiest to trade without a bank.The Legal Gray Zone

Here’s the twist: Russia doesn’t let you use crypto to buy coffee or pay your rent. The 2021 law on Digital Financial Assets says crypto can be owned, but not used as payment. That means you can hold Bitcoin. You can trade it. You can send it abroad. But you can’t use it to pay for a laptop, a flight, or a meal. This contradiction is everywhere. A Russian business can receive crypto from overseas - and then immediately convert it to rubles. But if they try to accept crypto directly from a local customer? That’s illegal. So while 20 million people use crypto, less than 0.5% of businesses accept it as payment. The result? A thriving underground economy. People trade crypto on peer-to-peer platforms like BitPrepay and EXMO. They use Telegram groups to find buyers and sellers. They meet in cafes to exchange cash for USDT. It’s informal, risky, and completely unregulated.

How Russians Trade Crypto Today

There are no big, regulated exchanges like Binance or Coinbase in Russia. Garantex - once the largest local platform - was sanctioned by the U.S. in 2022. Since then, Russian users have turned to domestic alternatives. But even these are unstable. Accounts get frozen. Withdrawals delayed. Regulations change overnight. Most users rely on P2P networks. They post offers on local forums or Telegram channels. Someone in Moscow sells 0.5 BTC for rubles. Someone in Vladivostok buys it. The trade happens via bank transfer, cash deposit, or even mobile payment apps. No middleman. No KYC. No oversight. This system is fast. A trade can take 10 minutes. It’s cheap - fees are 0.1% to 0.5%. Compare that to a traditional wire transfer: 3-5 business days and 3-5% in fees. But it’s dangerous. There’s no recourse if someone disappears with your money. In April 2025, a survey of 1,200 users found 28% had experienced fraud or account freezes during regulatory crackdowns. One user lost 250,000 rubles after his exchange account was locked for three weeks - right before a price surge.The Government’s Changing Stance

For years, the Bank of Russia called crypto a threat. It banned banks from handling it. It warned users about fraud. But by 2025, the numbers were too big to ignore. In October 2025, Deputy Finance Minister Ivan Chebeskov said: “We can’t resist what 20 million people are already doing. We need to manage it.” That’s a major shift. The same government that called crypto “illegal” is now planning to let banks handle crypto transactions - under strict rules. The Central Bank announced it will soon allow banks to offer crypto custody and trading services. But only if they hold high capital reserves and follow strict reporting rules. A nationwide survey of crypto holdings is scheduled for early 2026. This isn’t legalization. It’s control. The goal? Bring crypto into the formal system - so the state can tax it, monitor it, and stop it from being used to evade sanctions. But for users, it’s a lifeline. If banks start offering crypto services, it could mean safer wallets, clearer rules, and easier access.

24 Comments

Wow, this is wild 😍 I had no idea Russians were using crypto like this! USDT for medicine? Bitcoin for cloud hosting? That’s next-level survival mode. So many people think crypto is just for gamblers or tech bros - but here, it’s literally keeping families alive. Love this.

They didn’t choose crypto. Crypto chose them. The system failed. So they built a new one with nothing but keys and trust. Who needs banks when you have a private key and a Telegram group? The state doesn’t control money anymore - it just watches. And that terrifies them.

Let’s be real - the government’s ‘regulation’ is just panic. They can’t stop 20 million people. They can’t even shut down P2P trades because half the country’s using them. And now they want to tax it? Good luck collecting from people who trade cash for USDT in parking lots. This isn’t a financial revolution - it’s a rebellion with wallets.

This gives me hope 🙌 People are figuring it out even when the system tries to crush them. Crypto isn’t about getting rich - it’s about staying free. More power to the Russians doing this right.

While the narrative is compelling, we must consider the ethical implications of decentralized financial systems operating outside legal frameworks. The absence of consumer protections, coupled with the potential for illicit activity, raises serious concerns - even if the intent is survival. Regulation, however imperfect, exists to prevent systemic harm. Is autonomy worth the risk of unregulated financial chaos?

20 million users? That’s 1% of the population. You’re overstating this. Also, USDT is just a Ponzi. Everyone knows it’s backed by nothing. Why are you treating this like a miracle?

Sanctions? What sanctions? The real story is that the West is scared. Russia’s crypto use is proof that dollar hegemony is crumbling. This is all part of a plan - the IMF, the Fed, the Bilderberg Group - they never wanted people to have financial sovereignty. Now they’re panicking. They’ll come for your keys next.

bro this is so cool like literally imagine sending usdt to your cousin in ukraine while your bank is frozen 😭 you dont need a visa you just need a phone and a brain. i wish more people in the us understood this. crypto is freedom.

Can you provide a source for the 8.3% inflation rate in 2024? The official Russian statistics have been widely disputed. Also, the Chainalysis data you referenced - was it adjusted for wash trading or exchange volume distortions? The methodology matters here.

ok but like… why not just use rubles? i mean… its not that hard? also why is everyone so obsessed with bitcoin? its just a number on a screen lol 🤷♀️

This is just an excuse to evade sanctions. People are breaking the law and you’re celebrating it. There’s no moral high ground here.

This is beautiful. People adapting, helping each other, using tech to survive. I hope more countries learn from this. Not to copy the crypto - but to see how communities rise when institutions fail. We need more of this in the world.

Wait… so if crypto is so great, why are people losing 250k rubles in scams? Sounds like the government is right to be scared. This isn’t freedom - it’s chaos. And chaos gets people killed.

Why are you praising a country that’s bombing its neighbors? Crypto or not, Russia is a rogue state. Don’t romanticize their suffering. It’s not heroic - it’s tragic.

How quaint. Ordinary people using crypto? How… proletarian. I suppose we should all be moved by the plight of the Russian engineer who trades USDT for coffee. Meanwhile, I’m holding BTC in a multisig vault in Zug. The real revolution is in the architecture - not in the parking lot trades.

This is so fascinating. I never thought about how financial systems collapse and people just… rebuild. It’s like nature finding a way through concrete.

People think crypto is just wallets and apps but its the mindset. You learn to check your keys. You learn to verify every trade. You learn to not trust anyone. That’s the real skill. Not trading. Surviving. The rest is just noise.

This is a profound case study in financial resilience. In Nigeria, we face similar challenges - currency devaluation, banking restrictions, and capital controls. The parallels are striking. What Russia demonstrates is not merely adoption, but the emergence of a new social contract - one where trust is decentralized, and agency is reclaimed. The world must pay attention.

It’s not autonomy. It’s desperation. And desperation doesn’t make something right.

Let’s be honest - this isn’t about survival. It’s about circumventing sanctions to fund war machines. The fact that you’re framing this as ‘ordinary people just trying to buy medicine’ is disingenuous. The money flowing into crypto isn’t going to hospitals - it’s going to defense contractors, oligarchs, and shell companies in Dubai. You’re romanticizing a regime’s financial lifeline. That’s not empathy. That’s complicity.

Chainalysis data is unreliable. They don’t verify wallet ownership. A single exchange can inflate numbers by 300%. Also, ‘USDT as stablecoin’? Tether’s reserves are a black box. You’re citing a propaganda piece as fact.

people are amazing 😎 when the system fails you don’t wait for permission you just build a new one. usdt in the park, btc in the closet, no bank needed. this is the future. not crypto as a stock - crypto as a right.

It’s easy to judge from the outside. But if your bank froze your kid’s insulin payment, would you care about the legal technicalities? This isn’t about politics - it’s about people refusing to starve because of bureaucracy. That’s not illegal. That’s human.

20 million users? That’s 14% of the adult population. But what’s the average holding? $50? $100? This isn’t wealth creation - it’s panic hoarding. And the fraud rate? 28%? That’s a disaster. This isn’t innovation. It’s a financial dumpster fire.