- 27 Oct 2025

- Elara Crowthorne

- 18

Kazakhstan Crypto Mining Profit Calculator

Important: As of 2025, Kazakhstan requires mining operations to:

- Pay a 15% tax on mining profits

- Sell 75% of mined crypto on AIFC-approved exchanges

- Register equipment with the National Association of Blockchain Industry

- Buy electricity through state-run platform (max 1 MWh per transaction)

Estimated Profitability (2025 Regulations)

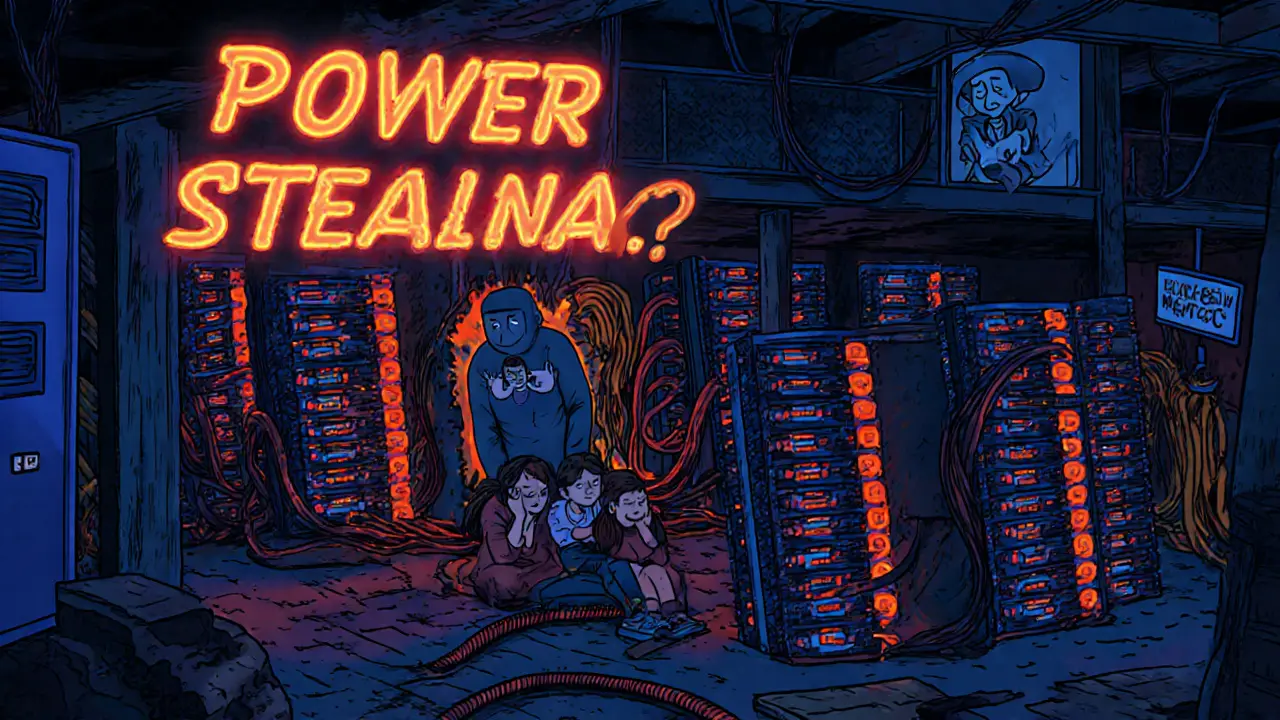

After 15% TaxBy 2021, Kazakhstan was the world’s top Bitcoin mining country. Cheap power, cold winters, and lax rules made it a magnet for miners from China, Russia, and beyond. Then came the blackout. In early 2022, homes in Almaty went dark for days. Hospitals ran on generators. Schools shut down. The cause? Illegal crypto mining farms sucking up power meant for millions of citizens.

The government didn’t just tighten rules - it rewrote them. What followed wasn’t a ban. It was a full-scale overhaul. Today, mining in Kazakhstan is legal - but only if you play by strict, high-stakes rules. If you’re thinking about setting up a mining operation there in 2025, here’s what you need to know.

How Kazakhstan Went From Mining Hub to Regulatory Enforcer

Kazakhstan’s crypto boom started quietly. Miners moved in after China cracked down in 2021. They brought racks of ASICs, hooked them up to local power plants, and started hashing. Within two years, the country accounted for over 18% of the global Bitcoin network. It looked like a win-win: jobs, tax revenue, and a modern tech sector.

But the grid couldn’t keep up. By 2022, mining farms were using more electricity than entire cities. In the city of Semey, residents reported lights flickering at 7 p.m. every night - the exact time miners cranked up their rigs after off-peak rates kicked in. The Ministry of Energy estimated that illegal operations were stealing over 1.2 billion kWh annually - enough to power 1.5 million homes.

The breaking point came in August 2025, when authorities raided a massive underground mining complex in East Kazakhstan Oblast. The operation was running on diverted power from a state utility. It consumed 50 megawatt-hours per day - equivalent to the daily usage of 60,000 people. The miners had bribed grid employees for two years. When police shut it down, they found luxury cars, high-end apartments, and $16 million in cash stashed in storage units.

What’s Legal Now? The 2025 Rules

Kazakhstan didn’t outlaw mining. It made it a licensed business - and turned it into a revenue stream. As of 2025, here’s how it works:

- You need a license from the Astana Financial Services Authority (AFSA) to operate legally.

- All mining equipment must be registered with the National Association of Blockchain and Data Center Industry. Over 415,000 machines are currently registered.

- You can only buy electricity through the state-run platform managed by the Ministry of Energy. Each transaction is capped at one megawatt-hour - no bulk purchases.

- You must sell 75% of your mined cryptocurrency on AIFC-approved exchanges. This was raised from 50% in 2024 to increase transparency and tax collection.

- You pay a 15% tax on mining profits. That’s higher than in most neighboring countries.

- You must comply with AML and KYC rules enforced by the Financial Monitoring Agency (FMA). Suspicious transactions trigger automatic audits.

Failure to comply means fines, equipment seizure, or criminal charges. In 2024 alone, authorities shut down 36 unlicensed exchanges and confiscated over 4,000 mining rigs. They also seized 17 luxury apartments in Nur-Sultan and 23 high-end vehicles bought with unreported crypto profits.

Who’s Getting the Power? The 70/30 Energy Deal

Here’s the twist: the government isn’t trying to kill mining. It wants to control it - and use it to fix the grid.

In late 2024, Energy Minister’s representative Tuleushin proposed a radical plan: a 70/30 energy partnership. Foreign investors would fund the construction of new thermal power plants. In return, 70% of the generated electricity would feed the national grid. The remaining 30% would go to licensed miners.

This isn’t just theory. Two pilot projects are already underway in the Atyrau region. One combines gas-fired generation with solar arrays. The other uses waste heat from a nearby oil refinery to power mining rigs. The goal? Make miners part of the solution, not the problem.

It’s working. In 2025, Kazakhstan’s grid stability improved by 22% compared to 2023. Miners now help balance demand during low-usage hours - turning what was once a burden into a smart energy buffer.

How Miners Are Adapting - and Where They’re Leaving

Not everyone stayed. Thousands of small-time miners packed up and moved to Georgia, Uzbekistan, or even Texas. The ones who remain are either big operators with deep pockets or those who saw the writing on the wall.

Companies like Bitfury and Core Scientific opened licensed data centers in Nur-Sultan. They use AI to monitor energy use in real time. They’ve installed on-site solar panels and battery banks to reduce grid dependency. Some even sell excess heat to nearby greenhouses - turning waste into profit.

But for the average miner? It’s no longer a get-rich-quick scheme. The cost of compliance - licensing fees, mandatory sales, taxes, and equipment registration - eats into margins. One operator told reporters, “I used to make $800 a day. Now I make $400 - and I have to file paperwork every week.”

What About Illegal Mining? It’s Still Happening

Despite the crackdown, illegal mining hasn’t disappeared. It’s just gone underground - literally.

Miners now hide rigs in abandoned warehouses, basements of apartment buildings, and even refrigerated trucks. Some use modified power meters to bypass utility monitoring. Others bribe local officials to look the other way.

In July 2025, authorities dismantled a network in Karaganda that was siphoning power from a hospital’s backup generator. The miners were using the energy to run 200 rigs - while patients waited for ventilators to restart after power dips.

Enforcement is getting smarter. The FMA now uses blockchain analytics to trace crypto flows from mining pools to real estate purchases. They’ve built a national database that links mining licenses to bank accounts, vehicle registrations, and property deeds. If your wallet sends $500,000 to a luxury car dealer, they’ll know - and they’ll come.

Is Kazakhstan Still a Viable Place to Mine Crypto?

Yes - but only if you’re serious.

For small-scale miners, it’s no longer worth it. The barriers are too high. The profits too thin. The risk of getting caught too great.

For institutional players with legal teams, capital, and long-term planning? Kazakhstan still offers advantages: stable political environment, low humidity for cooling, and a government that wants you to succeed - as long as you follow the rules.

And if you’re thinking about investing in mining infrastructure? The 70/30 energy model is your best bet. The government is actively seeking foreign partners to build new power plants. The payoff isn’t just mining profits - it’s access to subsidized energy and a voice in shaping the future of digital asset regulation in Central Asia.

What’s Next? The Road to 2026

The government is already working on the next phase. Proposals include:

- Mandating that miners store 20% of their holdings on registered exchanges to increase market liquidity.

- Introducing a carbon footprint tax for mining operations using non-renewable energy.

- Creating a national digital wallet for miners to pay taxes and fees in real time.

- Launching a blockchain-based energy trading platform that lets miners sell surplus power back to the grid.

One legislator put it bluntly: “We don’t want to be the country that lost its lights for Bitcoin. We want to be the country that used Bitcoin to bring the lights back.”

That’s the new reality. Kazakhstan isn’t anti-crypto. It’s anti-chaos. And if you want to mine there in 2025, you better be ready to play by rules that are tougher than anywhere else on Earth.

Is crypto mining legal in Kazakhstan in 2025?

Yes, but only if you’re licensed. Unlicensed mining is illegal and punishable by fines, equipment seizure, or criminal charges. All miners must register with the National Association of Blockchain and Data Center Industry and buy electricity through the state-run platform.

How much electricity can a mining farm use in Kazakhstan?

Each licensed mining operation can purchase a maximum of one megawatt-hour per transaction through the state energy platform. There’s no daily or monthly cap, but each purchase requires approval and is tied to your registered equipment count.

Do I have to sell my crypto in Kazakhstan?

Yes. As of 2025, licensed miners must sell at least 75% of their mined cryptocurrency on AIFC-approved exchanges. This rule was increased from 50% in 2024 to improve transparency and tax compliance.

What’s the tax rate for crypto mining in Kazakhstan?

The tax rate is 15% on mining profits. This applies to all income from cryptocurrency sales, whether on local exchanges or international platforms. Failure to report can trigger audits by the Financial Monitoring Agency.

Can I still mine crypto illegally in Kazakhstan?

Technically, yes - but it’s extremely risky. Authorities have shut down over 36 illegal exchanges and confiscated 4,000 mining rigs since 2023. They now use blockchain analytics and utility data to track suspicious activity. Seizures of luxury property and vehicles linked to illegal mining are common.

Is Kazakhstan still a good place for crypto mining investment?

Only for large operators with legal resources and long-term plans. The regulatory environment is strict, but stable. The 70/30 energy partnership offers a path to subsidized power. For small miners, the costs and risks outweigh the rewards.

18 Comments